Are ESG Funds Too Expensive?

The SEC proposed new rules in 2022 to implement stricter reporting guidelines for environmental, social, and governance (ESG) strategies, as well as aggregated greenhouse gas (GHG) emissions. See the SEC’s Fact Sheet for more details.

If adopted, the SEC’s new rule would require registered firms to include ESG factors in fund prospectuses, annual summaries, and brochures. Additionally, the rules would establish three new fund classifications: Integration Funds, ESG-Focused Funds, and ESG Impact Funds.

To equip advisors and asset managers with data and talking points in advance of the proposed rule’s implementation, YCharts used qualitative and quantitative data (specifically, fund prospectuses and ESG Scores from MSCI) to better ascertain these funds’ impact on investor portfolios.

Download the free White Paper Is It Easy Being Green? to see our full findings:

Fee Comparison: ESG Marketing & ESG Scores

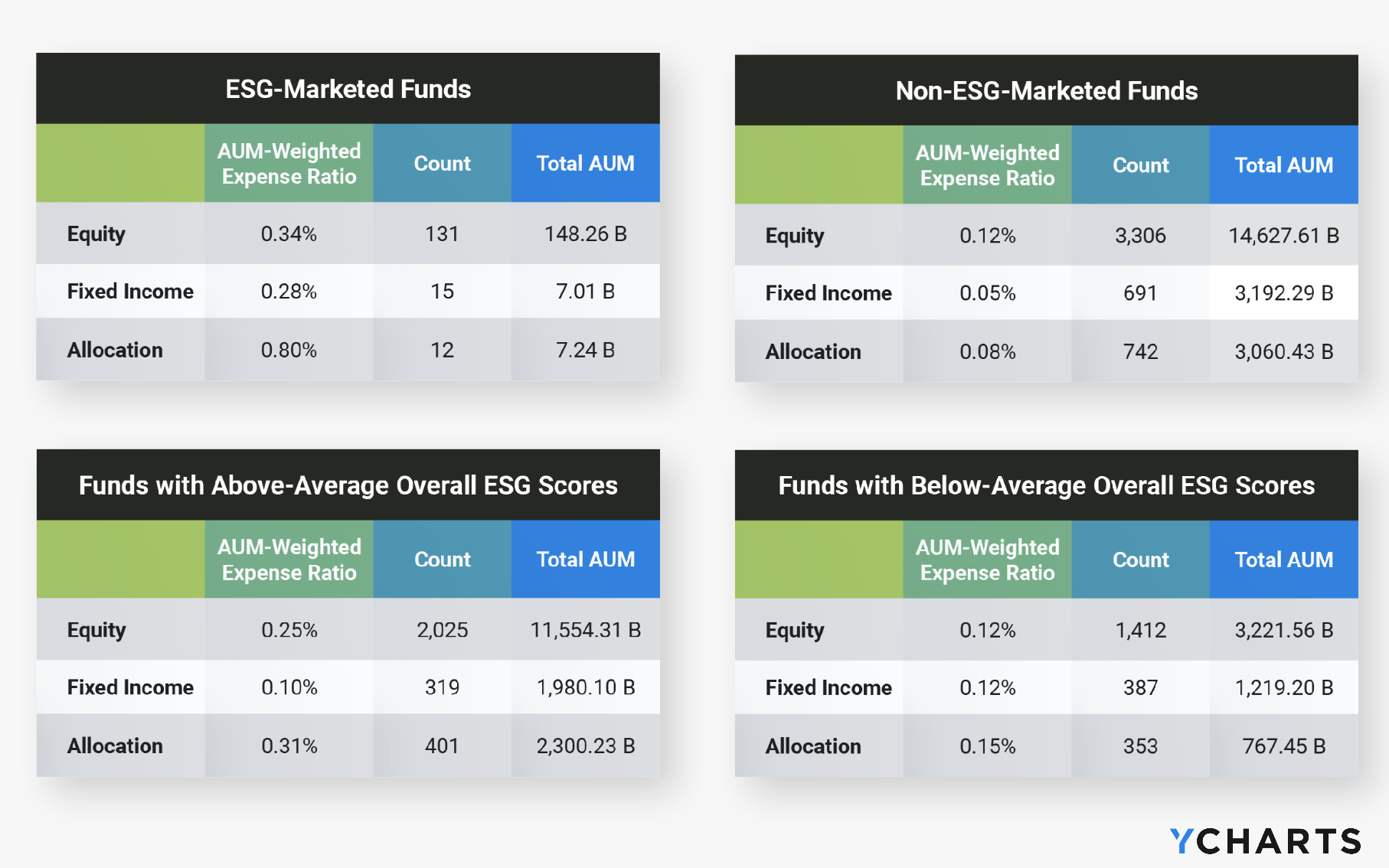

Across the board, ESG strategies tend to be more expensive than their non-ESG counterparts. When pitting ESG-marketed funds against non-ESG-marketed funds, and also comparing funds with above-average ESG Scores to below-average ones, it appears that investors pay higher fees for ESG.

Download the Is It Easy Being Green? White Paper

While many funds in the ESG groups are also index funds, the size and quantity of low-cost index funds in the non-ESG-marketed grouping are likely driving the cost gap, at least in part. Most ESG investments are a breed of actively managed strategies, after all.

The AUM-weighted average expense ratios for ESG-marketed funds were between three to ten times higher than non-ESG-marketed funds, with the largest gap appearing in the Allocation fund category.

For equity and allocation funds with above-average ESG Scores, investors pay about twice the fee they would for a fund with below-average ESG merits. That difference is a 0.25% expense ratio, on average, versus 0.12% for funds with subpar ESG Scores. Fixed Income funds were the exception, however, as funds that scored poorly on the ESG front were actually more expensive on the basis of an AUM-weighted average.

Fees, Performance & Transparency

The SEC’s proposed rules aim to improve transparency around how ESG funds are constructed and marketed to advisors and their clients. However, the jury is out on whether transparency will lead to more AUM.

Critics cite “greenwashing” as a driver of asset flows into ESG-marketed funds with little to no ESG merit. But as our white paper found, the highest-scoring ESG funds out there don’t actually have “ESG” written on the box.

Could the realization that ESG-marketed funds are not so ESG-friendly hurt the efforts, by association, of asset managers with legitimate “double bottom-line” aspirations?

Download the free White Paper Is It Easy Being Green? to see our full findings:

Connect with YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2022 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Do ESG Funds Strengthen Investor Portfolios?Read More →