How to Use YCharts to Drive Advisor Interest in Your Alternatives

According to a 2023 study by WealthManagement IQ, 60% of financial professionals are looking to grow the alternative investment part of their business.

A 2023 iCapital report also found that 95% of survey respondents plan to maintain or increase allocations to alternative investments in the coming year, substantiating the growth prospects for these investment vehicles.

If you’re an asset manager, it is clear that demand for alternatives is here and growing fast. Whether it is a non-traded REIT, private credit, or private equity, it is imperative to get your alternative product in front of these advisors.

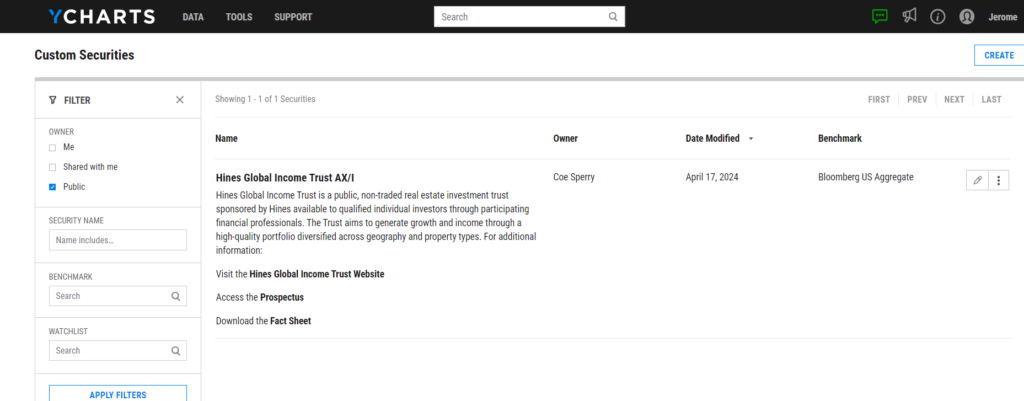

Luckily, with YCharts, you can now create Public Custom Securities so that the 7,100 advisors who use YCharts can view your offering and see how it might fit into their clients’ portfolios.

View Custom Security | Learn More About Adding Your Alternative Product to YCharts

Using YCharts to Educate Advisors on Your Alternative Investments

When building your Public Custom Security, you can link directly to a factsheet, prospectus, website, or any other educational content in the security description.

Not only will building a Public Custom Security in YCharts provide you with an awareness advantage, but it can also be used as an educational opportunity for advisors.

This is important because the iCapital survey found that only a quarter of advisors consider themselves “very knowledgeable” on alternatives. The WealthManagement IQ survey also found that 61% of respondents access alternative opportunities through independent research.

Advisors Can Build Model Portfolios with Alternative Investments

The iCapital survey found that 85% of respondents found tools that estimate the impact on a portfolio as valuable.

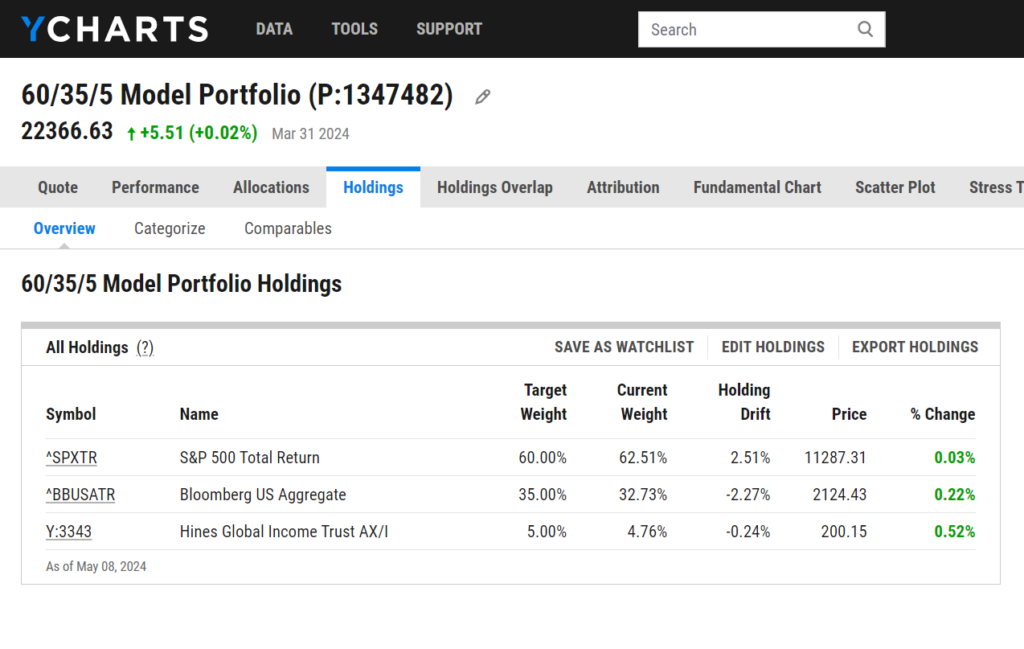

By uploading your alternative product as a Custom Security in YCharts, an advisor can glean insights like they could with any other security, including running it through stress tests, visualizing performance in fundamental charts, or modeling its impact in a portfolio.

Learn More About Adding Your Alternative Product to YCharts

Building Reports and Optimizing Portfolios with Alternative Investments

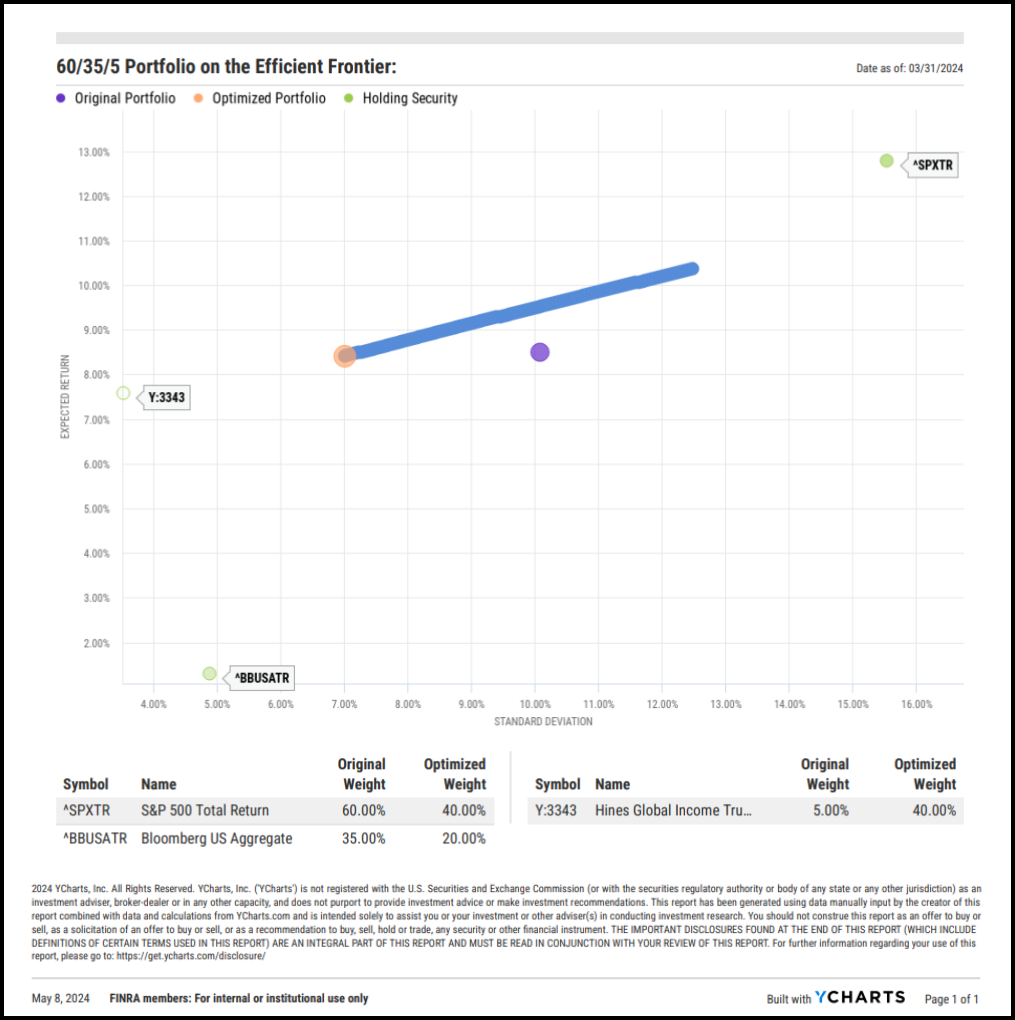

After building a model portfolio, an advisor can use Portfolio Optimizer to see a correlation matrix of their newly built portfolio or view it on an efficient frontier to find the optimal allocation for their client.

Learn More About Adding Your Alternative Product to YCharts

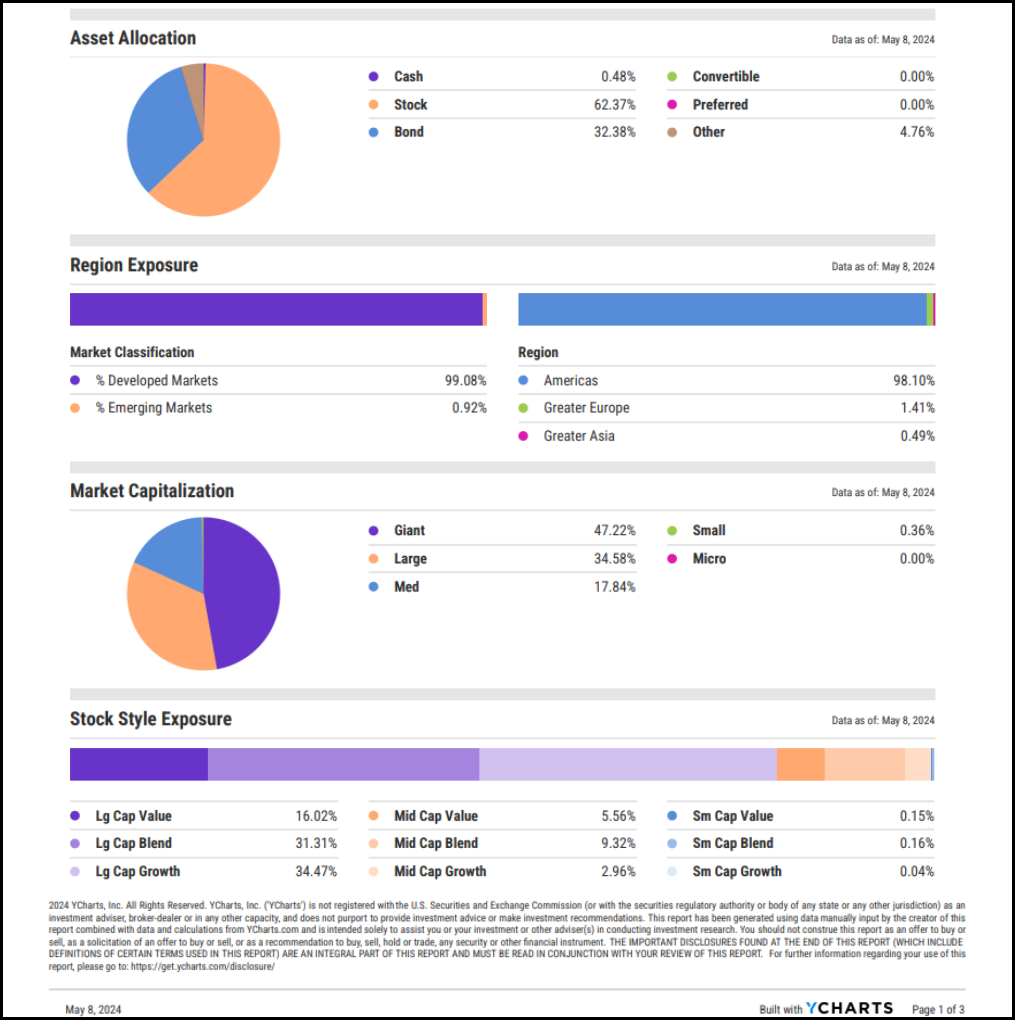

When presenting how an alternative investment fits into a portfolio, an asset manager or advisor can use Report Builder to highlight the diversification or performance benefits that may come with including an alternative product in a client’s portfolio.

Learn More About Adding Your Alternative Product to YCharts

By leveraging YCharts to create Public Custom Securities, asset managers can seamlessly showcase their alternative offerings to the growing pool of advisors seeking to expand into alternative investments. With tools like Portfolio Optimizer and Report Builder, YCharts empowers asset managers to highlight diversification and performance benefits and position their products to maximize AUM growth.

Whenever you’re ready, there are three ways YCharts can help you:

Have questions about how to leverage YCharts to create Public Custom Securities and grow AUM?

Email us at hello@ycharts.com or call (866) 965-7552. You’ll get a response from one of our Chicago-based team members.

Try out creating your own Custom Security.

Dive into YCharts with a no-obligation 7-Day Free Trial now.

Talk to a member of our Asset Management team to see how YCharts can get your alternative strategy in front of 7,100 advisors:

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Inflation Surprises in April 2024: How U.S. Treasury Rates ReactedRead More →