What Did Market Concentration Really Mean in 2025?

Executive Summary: Market concentration was one of the most debated themes of 2025. This blog looks at what the data actually showed beneath the headlines and why managing concentration within a plan mattered more than reacting to it.

Interested in testing out YCharts for free?

Start 7-Day Free TrialTable of Contents

Diversification remains a foundational principle of portfolio construction, and 2025 provided several clear reminders of its importance. International and emerging markets outperformed US equities as gold advanced more than 60%.

At the same time, leadership within US large caps dominated headlines, pushing market structure into sharper focus and forcing advisors to further examine risk.

The Shape of Market Leadership

By December, just 2% of S&P 500 constituents accounted for close to 40% of total performance, an imbalance raising questions around the risk embedded in broad market exposure.

Explore in YCharts → Leadership throughout 2025

These concerns were central to YCharts’ recent webinar with Josh Brown, CEO of Ritholtz Wealth Management, focused on the Charts That Defined 2025.

The conversation examined how market leadership has evolved, how investors reacted, and what the data revealed beyond the headlines. As Brown summarized:

“Yes, it’s concentrated, no, it’s not only a tech market or a Mag Seven market, and there’s evidence of that everywhere you look.”

Strength Beyond the Largest Names

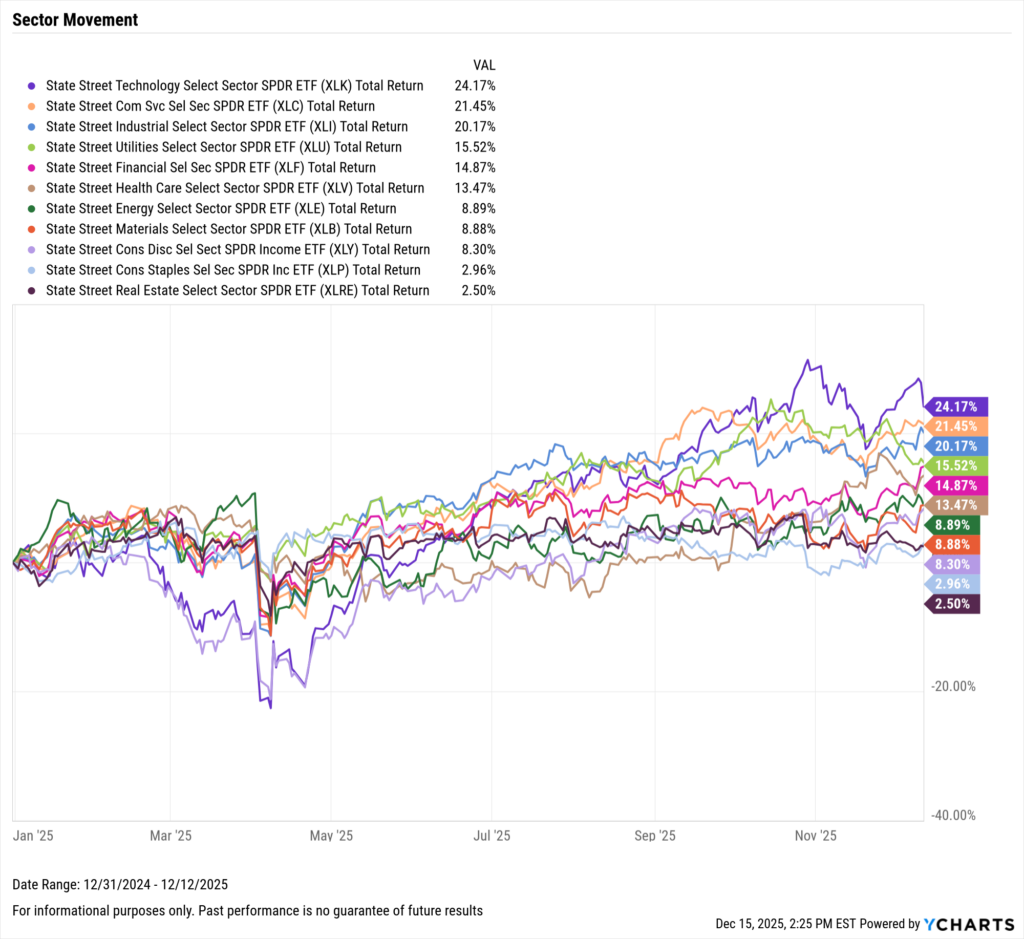

As the year progressed, the evidence became harder to ignore. While a small group of companies continued to drive a disproportionate share of returns, gains were not confined to one sector or style.

Healthcare, for example, a laggard for long periods in 2025, became a meaningful contributor as conditions improved. With roughly two weeks left in the year, every major sector has posted positive year-to-date performances, despite a difficult first half.

Explore in YCharts → Strong sector performance

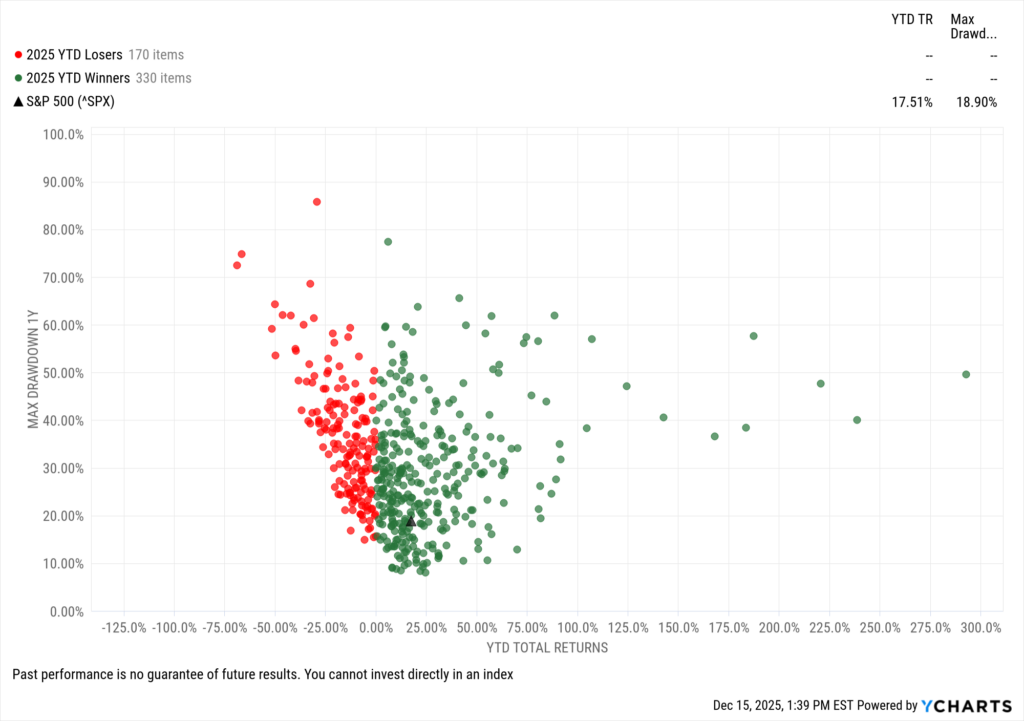

At the individual stock level, strength has also been widespread. As of mid-December in the S&P 500:

- 99 non-tech companies are up more than 25% YTD

- 313 constituents are trading above their 200-day moving average

- 66% of the index is positive on the year

Together, these signals point to a market that was more balanced and resilient than headline narratives have suggested. In Brown’s words, “the concentration is not as severe as you’ve been led to believe.”

| Symbol | Name | YTD Total Returns | Sector | % Index Weight |

|---|---|---|---|---|

| SNDK | Sandisk Corp. | 460.80% | Technology | 0.05% |

| WDC | Western Digital Corp. | 283.20% | Technology | 0.10% |

| STX | Seagate Technology Holdings Plc | 236.30% | Technology | 0.10% |

| HOOD | Robinhood Markets, Inc. | 209.30% | Financial Services | 0.15% |

| MU | Micron Technology, Inc. | 183.00% | Technology | 0.46% |

| WBD | Warner Bros. Discovery, Inc. | 181.10% | Communication Services | 0.13% |

| NEM | Newmont Corp. | 172.30% | Basic Materials | 0.19% |

| PLTR | Palantir Technologies, Inc. | 142.30% | Technology | 0.71% |

| LRCX | Lam Research Corp. | 129.50% | Technology | 0.36% |

| APP | Applovin Corp. | 108.50% | Communication Services | 0.31% |

Download the Charts That Defined 2025 deck and watch the full webinar replay with Josh Brown for a closer look at this year’s biggest winners outside US markets and the themes that shaped investor sentiment.

The Cost of Neutralizing Leadership

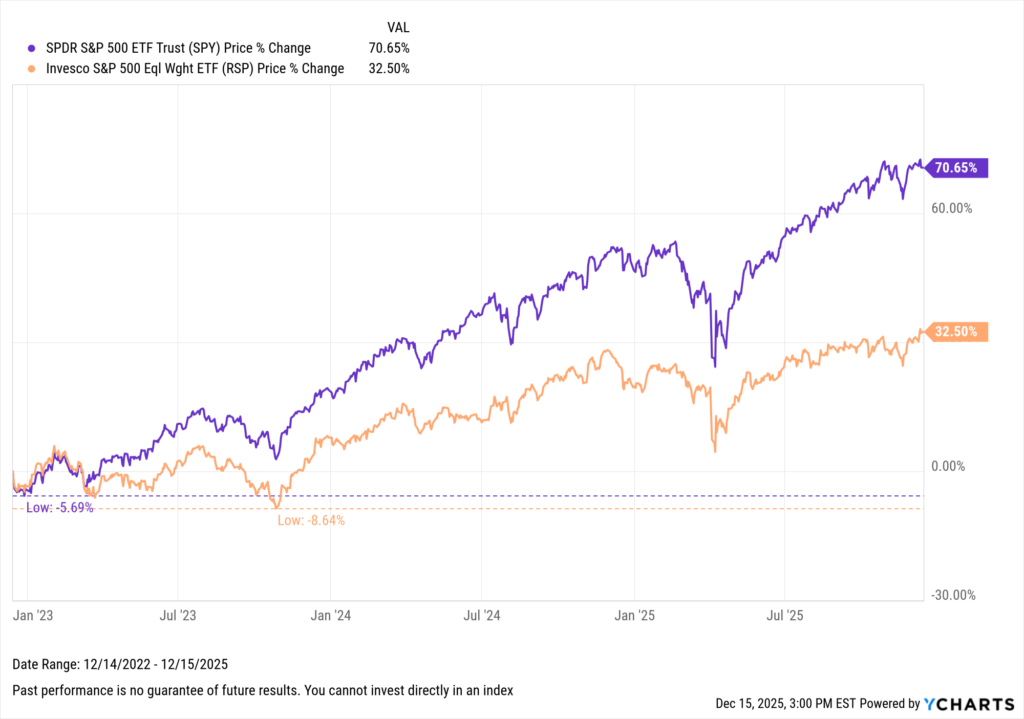

For advisors, the growing influence of a small group of stocks meant concentration was no longer just something to observe; it was something to respond to. Some reduced positions while others waited for leadership to broaden, all while the S&P 500 continued to behave exactly as designed.

As the strongest companies continued to expand earnings, scale, and market value, they accounted for an increasingly larger share of the index.

This was the tradeoff advisors had to navigate. Reducing exposure to concentration may have felt like the responsible action, but it also meant stepping away from the engines driving overall performance.

“If you avoided the Mag Seven because of market concentration,” Brown noted, “you missed one of the greatest bull markets of all time, and you can’t get those years back.”

Explore in YCharts → Three-year total return comparison between the S&P 500 cap-weighted index and its equal-weighted counterpart.

The Advisor Behavior

The takeaway is not that diversification is unnecessary. In fact, the opposite is true. Diversification works best when it is part of a deliberate plan, not a reaction to discomfort.

Periods of strong, concentrated leadership test discipline. They require advisors to balance risk awareness with participation, and to help clients stay invested without overcorrecting in ways that limit long-term outcomes.

For advisors who remained disciplined, diversification meant managing risk without abandoning the drivers of returns. For those who waited for conditions to feel more comfortable, the cost was time, and time out of the market cannot be recovered.

Strong cycles reward patience and preparation. Avoiding them entirely in the name of caution often proves more damaging than navigating them with intention.

Ready to Move On From Your Investment Research and Analytics Platform?

Follow YCharts Social Media to Unlock More Content!

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

6 Answers to Pressing Questions with Talley Léger of The Wealth Consulting GroupRead More →