Monthly Canada Market Wrap: October 2022

Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Starting December 1st, the Canadian Monthly Market Wrap will be offered exclusively as a Dashboard Template within YCharts. All data and visuals from the Canadian Monthly Market Wrap can be accessed from the YCharts Dashboard, by clicking Manage > Dashboard Templates > selecting the “Canadian Markets” template.

The US Market Wrap will continue to be published each month in its current form. Looking for the US Market Wrap? Click here.

Canada Market Summary for October 2022

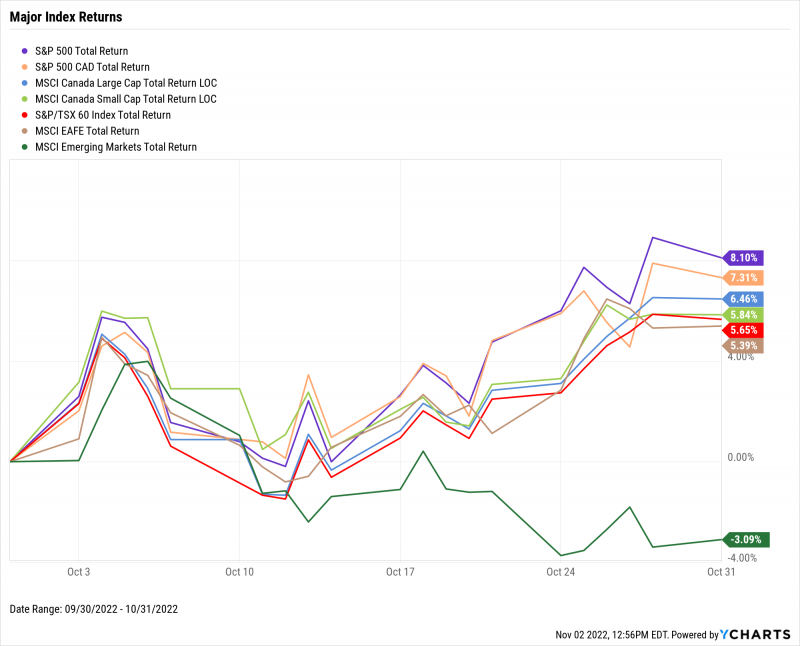

Equities rebounded in a significant way following a September that, for several indexes, was the worst month since March 2020. The S&P/TSX 60 index rose 5.7%, while Canadian Large Caps advanced 6.5% and Small Caps finished up 5.8%. In the US, the S&P 500 rose 8.1%. North American equity indexes appeared to benefit from better-than-expected Q3 earnings from many of their constituents.

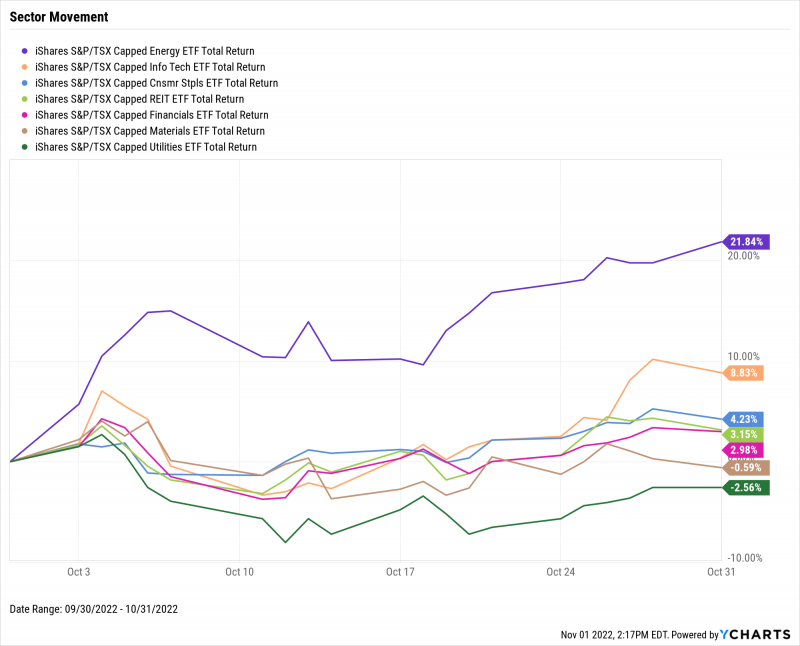

Five of the seven TSX sectors logged a positive October. Energy was the big winner with a 21.8% lift, due largely to rebounding oil prices, and Consumer Staples had the second-largest advance at 8.8%. Materials and Utilities were the two sectors that ended October in the red.

Manufacturing and Retail Sales stayed strong last month. The Canada Ivey PMI checked in at 59.5, and Monthly Canada Retail Sales grew by 0.7%. Inflation was kept at bay, too—the Canadian Inflation Rate declined for the third straight month to 6.86%. Finally, the Canada New Housing Price Index had its streak of 32 consecutive monthly increases snapped.

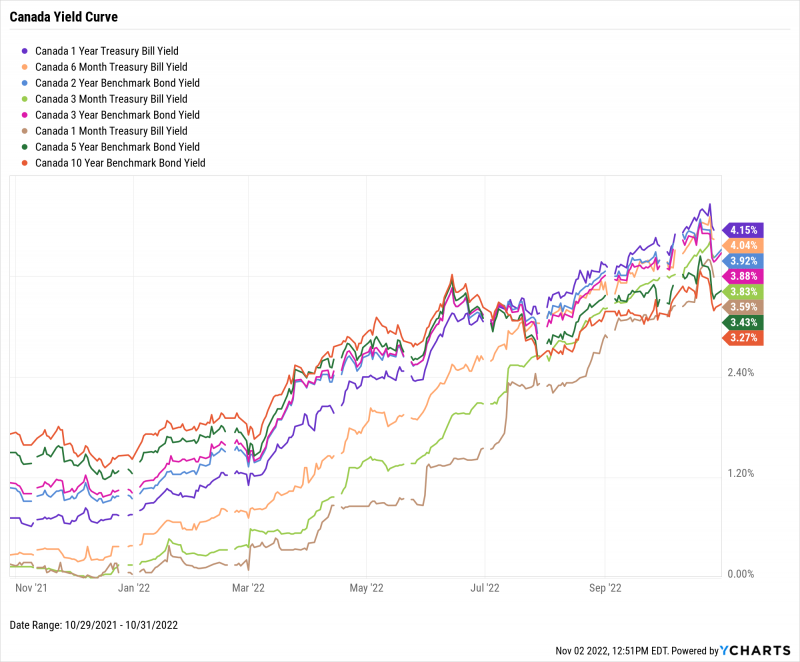

The 10 Year Benchmark Bond boasted the lowest yield among fixed-income instruments despite having the longest maturity. Yield on the 10-Year was 3.23% at October’s end, while the 1 Year Treasury Bill had the highest yield at 4.15%. Additionally, the 6 Month Bill was the only other instrument whose yield eclipsed 4%

Jump to Fixed Income Performance

Equity Performance

Major Indexes

Download Visual | Modify in YCharts | View Below Table in YCharts

Canadian Sector Movement

Download Visual | Modify in YCharts | View Below Table in YCharts

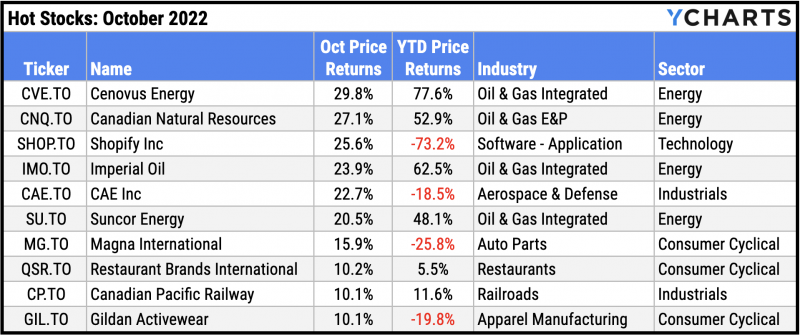

Hot Stocks: Top 10 TSX 60 Performers of October 2022

Cenovus Energy (CVE.TO): 29.8% gain in October

Canadian Natural Resources (CNQ.TO): 27.1%

Shopify Inc (SHOP.TO): 25.6%

Imperial Oil (IMO.TO): 23.9%

CAE Inc (CAE.TO): 22.7%

Suncor Energy (SU.TO): 20.5%

Magna International (MG.TO): 15.9%

Restaurant Brands International (QSR.TO): 10.2%

Canadian Pacific Railway (CP.TO): 10.1%

Gildan Activewear (GIL.TO): 10.1%

Download Visual | Modify in YCharts

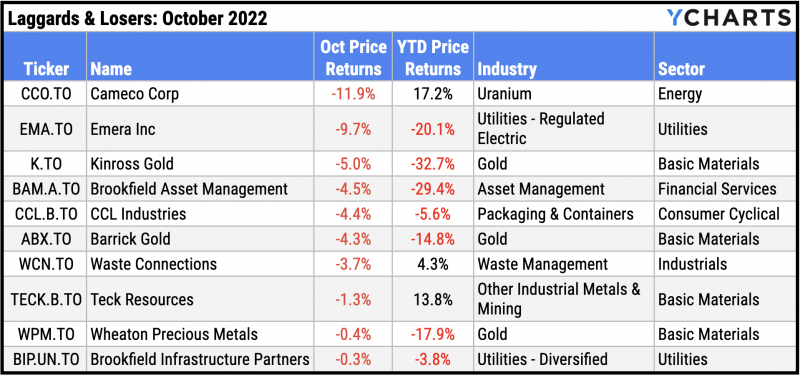

Laggards & Losers: 10 Worst TSX 60 Performers of October 2022

Cameco Corp (CCO.TO): -11.9% decline in October

Emera Inc (EMA.TO): -9.7%

Kinross Gold (K.TO): -5.0%

Brookfield Asset Management (BAM.A.TO): -4.5%

CCL Industries (CCL.B.TO): -4.4%

Barrick Gold (ABX.TO): -4.3%

Waste Connections (WCN.TO): -3.7%

Teck Resources (TECK.B.TO): -1.3%

Wheaton Precious Metals (WPM.TO): -0.4%

Brookfield Infrastructure Partners (BIP.UN.TO): -0.3%

Download Visual | Modify in YCharts

Featured Market & Advisor News

Rate surprise risks engulfing Bank of Canada in political storm (BNN)

Economic Update — Reviewing Q3 2022 (YCharts)

Flat Q3 leaves pension returns down big in 2022: RBC (Advisor’s Edge)

Do ESG Funds Strengthen Investor Portfolios? (YCharts)

Canada boosts immigration targets to record amid labour crunch (Financial Post)

Q3 2022 Fund Flows: Investors Sound the Recession Alarm, Move into Money Markets, Flee Fixed Income (YCharts)

Economic Data

Employment

The Canadian unemployment rate declined in September to 5.2%. Canada also logged a gain of 16,000 part-time workers in the month. However, the Canada Ivey Employment index shrunk from 66.3 to 62.5, or -5.73% MoM.

Production and Sales

The Canada Ivey PMI slipped 1.4 points in September to 59.5 but stayed firmly in “expansion territory” following a July where the index reported its first contractionary reading since December 2021. Canada Retail Sales growth of 0.7% affirmed the positive state of manufacturing, and Canada Real GDP rose 0.14% higher.

Housing

Canadian home prices declined by 0.08% in September, following growth of 0.08% in August. September’s decline snapped a 32-month consecutive growth streak in the Canada New Housing Price Index.

Consumers and Inflation

The Canadian Inflation Rate cooled off for the third month in a row, down to 6.86%. However, Canada’s Consumer Price Index rose by 0.39% in September.

Commodities

The price of gold in Canadian Dollars slipped 2.4% in September to C$2,243.20 per ounce. In the oil patch, crude prices rebounded in October. The spot price for a barrel of WTI crude bounced between $77.17 USD and $93.07 USD in October before settling at $86.12 USD at month’s end. Monthly Retail Sales among Canadian Gasoline Stations grew to C$6.99 billion in August, according to the latest data available.

Cryptocurrencies

Major cryptocurrencies fled the “crypto winter” for a month in the sun in October. The price of Ethereum rallied 19.1% to settle at $1,591 USD. Bitcoin rose 5.4% to $20,624 USD, and Binance Coin advanced 10.5% to $313.60 USD, its third consecutive month of gains. Year-to date performance remains firmly in the red with Binance Coin 39.5% lower YTD, Bitcoin down 56.3%, and Ethereum off 57.2%.

Fixed Income

Canadian Treasury Yield Curve

Canada 1 Month Treasury Bill Yield: 3.59%

Canada 3 Month Treasury Bill Yield: 3.83%

Canada 6 Month Treasury Bill Yield: 4.04%

Canada 1 Year Treasury Bill Yield: 4.15%

Canada 2 Year Benchmark Bond Yield: 3.92%

Canada 3 Year Benchmark Bond Yield: 3.88%

Canada 5 Year Benchmark Bond Yield: 3.43%

Canada 10 Year Benchmark Bond Yield: 3.27%

Download Visual | Modify in YCharts

Global Bonds

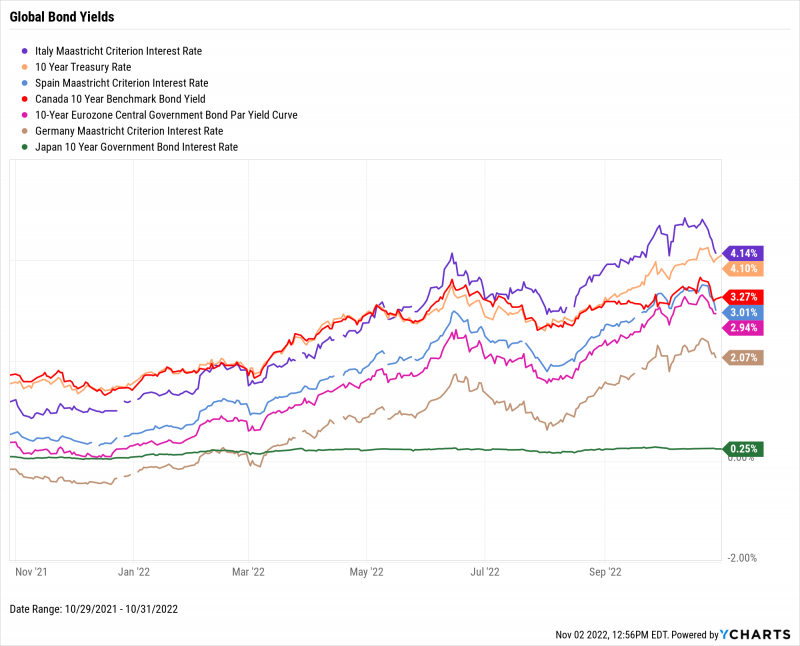

Italy Long Term Bond Interest Rate: 4.14%

10 Year Treasury Rate: 4.10%

Spain Long Term Bond Interest Rate: 3.01%

Canada 10 Year Benchmark Bond Yield: 3.27%

10-Year Eurozone Central Government Bond Par Yield: 2.94%

Germany Long Term Bond Interest Rate: 2.07%

Japan 10 Year Government Bond Interest Rate: 0.25%

Download Visual | Modify in YCharts

Have a great November! 📈

Next Article

Q3 2022 Fund Flows: Investors Sound the Recession Alarm, Move into Money Markets, Flee Fixed IncomeRead More →