Wholesaler Perspective | Overcome the Challenges of Summer Advisor Meetings

Even before stepping foot into an advisor’s office, wholesalers face the uphill battle of securing time on their calendar. The summer months, in particular, pose an additional hurdle. Whether it’s family vacations with the kiddos or perfect conditions on the golf course, a wholesaler’s job is that much more difficult when everyone gets into Summer-mode.

Set Yourself Up For Success

Cold-calling an advisor’s office is a daunting task. But knowing exactly when and why to reach out can help yield significantly better results.

One tactic involves reaching out when asset outflows or poor performance are impacting the funds which an advisor leverages. These opportunities don’t happen every day, so timing is everything.

With the YCharts Fund Screener, you can identify prime replacement opportunities by screening for “Brokerage Availability”, “YTD Fund Share Class Flows”, “Total NAV Returns Category Rank”. More importantly, you can set alerts and track these funds on your Dashboard, so you can strike while the iron is hot.

By leading with impactful information, rather than a request or marketing materials, advisors know that your meeting will be worthwhile. YCharts’ Fundamental Charts and Comp Tables tools can help you build out your analysis to position your fund family in the best light and make a compelling case as to why advisors should learn more.

For internal wholesalers looking to book time with an advisor on their external’s behalf, this process ensures added efficiency. Even before making that first call, you’re confident of creating value for an advisor by knowing their current funds may not be living up to expectations.

Make the Most of Your Time

Let’s say you’ve earned a 30-minute appointment with an advisor. How can you use that time most effectively to highlight your fund family’s strengths?

Even before the meeting starts, YCharts arms you with an accurate portrayal of the advisor’s current models. To achieve this, internals can upload an advisor’s portfolio holdings matrix to understand the funds that drove performance and those that dragged the portfolio down. All of this is done in YCharts Model Portfolios, where alternative versions that hold your fund family offerings can also be created and compared.

When in the meeting room, wholesalers armed with YCharts can confidently answer questions about fund attributes or performance stats on-the-fly. Rather than waiting on a response from internal counterparts, navigate in YCharts to answer advisors’ questions and maintain momentum in the conversation. Here are a few key use cases and how YCharts can assist:

The risk vs. reward implication of your fund stacked up against comparables

Scatter Plots generate visual analyses that accurately depict the differences between your family of funds against competitor funds. Customize the X & Y-Axis using any combination of financial metrics, but most commonly Total NAV Return and Standard Deviation (performance and risk).

In addition, you can use scatter plots to take a microscopic look at an advisor’s portfolio to identify what’s weighing their portfolio down, and where your fund will best fit as a replacement.

Performance of your funds compared to advisor’s current holdings and the S&P 500

Use Fundamental Charts to illustrate fund performance in a flash. Better yet, add additional value for the advisor by exploring other metrics on the spot, such as risk, max drawdown, or even swapping in another index to see how it compares.

How your funds compare to an advisor’s current holdings across a laundry list of metrics

Comp Tables comes in handy here. Simply search for the funds & metrics of interest, and before you know it, all those funds will appear in a single view, ready to be sorted and compared across the selected metrics. From there, you can download a Comp Table either as a .CSV file for further analysis or as a PDF complete with custom branding and disclosures.

The bottom line: YCharts can do all of this in real-time to ensure that even a 30-minute meeting runs as frictionless as possible so that any questions are answered on the spot, leaving the advisor excited about your funds.

Prepare A Report for Advisors to Consider After Summer Vacation

But what happens if you don’t get that coveted summer meeting? Don’t sweat it, you can still give advisors something to ponder as they gear up for their next quarterly rebalance.

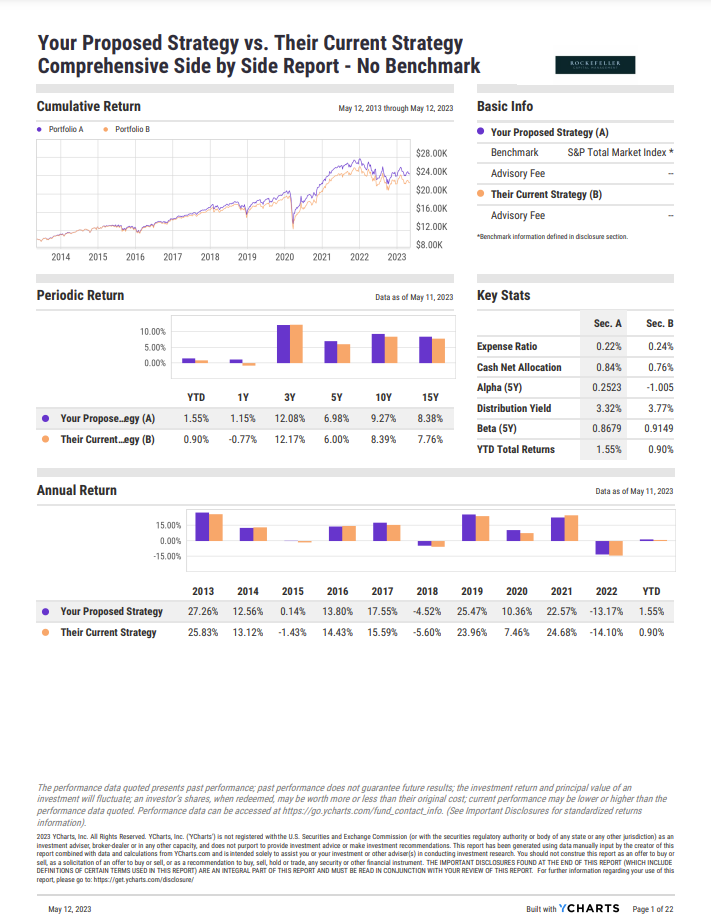

To help an advisor see the potential of adding your fund to their models, prepare a Comparison Report that will showcase the strengths of your fund family compared to their current holdings. The drag-and-drop Report Builder tool can be leveraged to generate reports fully customized to the advisor’s liking. To make the case for including your funds even more compelling, you can also include Scatter Plots, Fundamental Charts, and Comp Tables in the report to make the biggest impact all in one PDF. So, even if you can’t bask in the summer sun with advisors, there’s still a chance to make them fall for your funds as the leaves begin to change color.

Build a High Impact Tech Stack

While wholesalers strive to provide their clients and prospects with the best experience possible, they are sometimes limited by their tech stack’s capabilities. Traditionally, processes like analyzing an advisor’s portfolio or locating the correct performance stats would take hours, or even days, to turn around.

YCharts makes the entire process seamless, with an emphasis on answering questions the moment they arise. The biggest advantage YCharts provides to wholesalers is streamlined efficiency and effectiveness at every stage of the sales process, ensuring the best chance of winning new business.

Connect with YCharts

To learn more, schedule time to meet with an asset management specialist, call us at (773) 231-5986, or email hello@ycharts.com.

Want to add YCharts to your technology stack? Sign up for a 7-Day Free Trial to see YCharts for yourself.

Disclaimer

©2022 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer, or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold, or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Embracing Market Turmoil: Staying Invested vs. Exiting During Financial CrisesRead More →