Proactively Address Client Concerns During a Volatile Market Environment

The charts used in this post are from The Top 10 Visuals for Prospect & Client Meetings slide deck. We’re sharing the deck for free for you to use in your practice.

Download the free Slide Deck for more insights:The market has seen its fair share of ups and downs in just the last couple of years. How do advisors quell client concerns while ensuring they “stay the course” amid volatility?

During volatile markets, clients turn to their advisors for clarity and guidance. To help advisors navigate these conversations, we put together The Top 10 Visuals for Clients & Prospects, a free slide deck filled with informative visuals that explain key investing concepts.

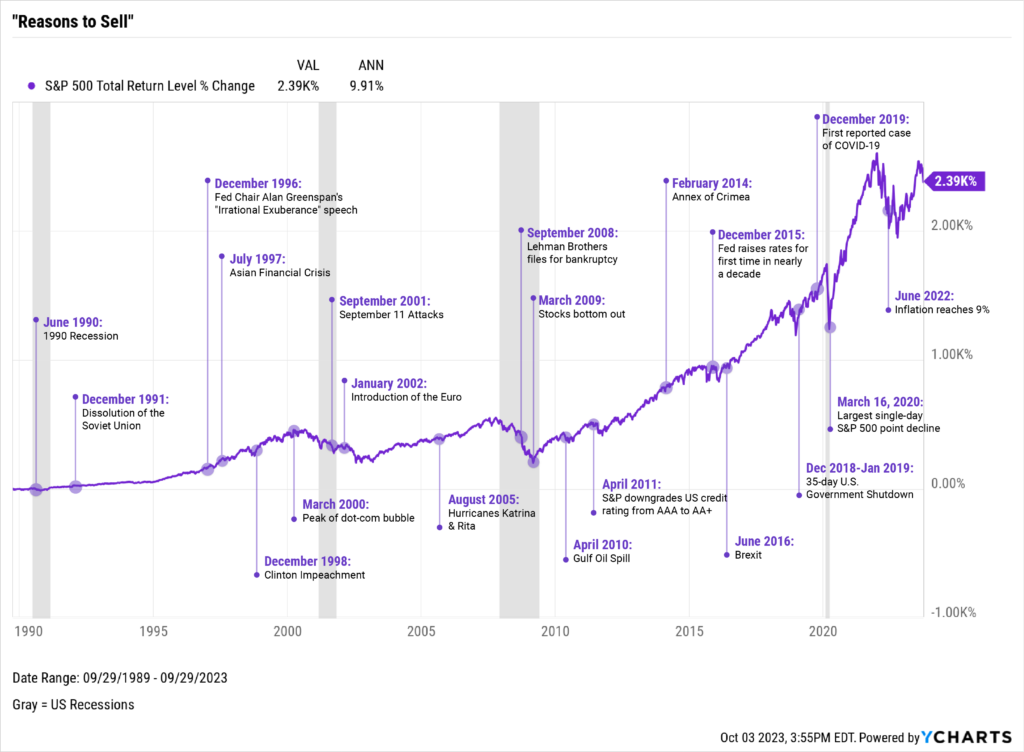

There’s Always a “Reason to Sell”. But Should You?

Since October 1989, the S&P 500 has posted a 2,100% total return (including dividends). Put differently, the index has grown an average of 9.73% each year for over 30 years. While there have been a number of events that have led to significant declines, the market continued to climb higher over time.

Download: The Top 10 Visuals for Clients and Prospects

Since October 1989, the S&P 500 has posted a 2,390% total return (including dividends). Put differently, the index has grown an average of 9.91% each year for over 30 years. While several events led to significant short-term declines, the market climbed higher.

During steep drawdowns, investors are thinking of one thing: capital preservation. Client emotions will run high with their life savings or retirement at stake. In these moments, advisors are in a unique position to address their clients’ concerns over the short term while reassuring them that they’re still on track to meet their long-term financial goals.

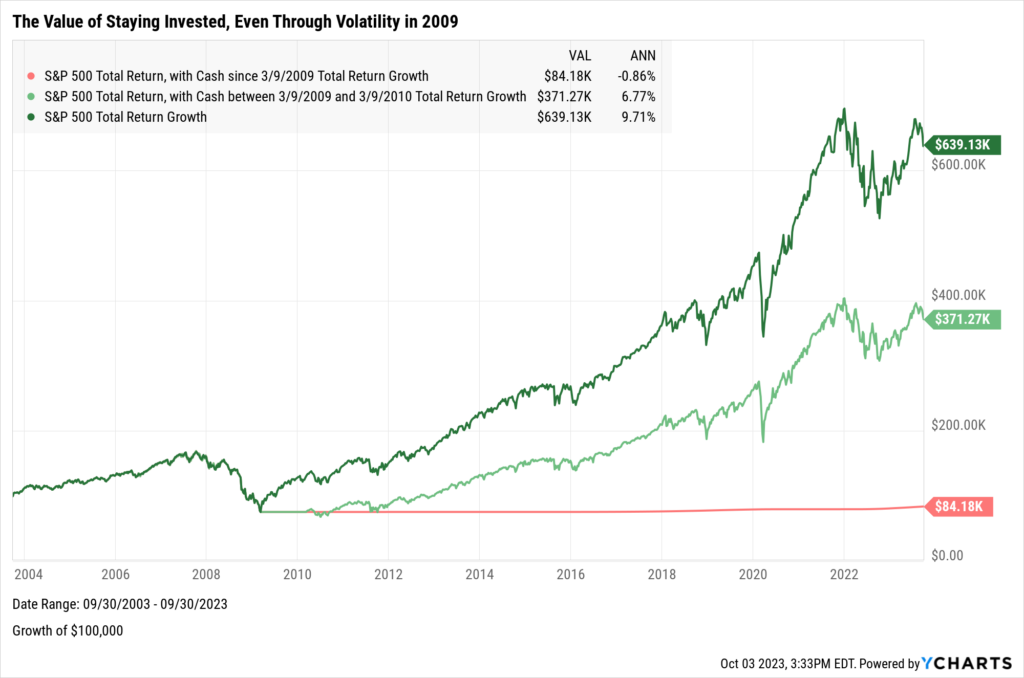

The Power of Staying Invested

Download: The Top 10 Visuals for Clients and Prospects

Using an initial investment of $100K in the S&P 500 since 2003 as an example, individuals who kept their money invested for 20 years saw a 9.71% annual rate of return compared to just 6.77% had they moved to cash for a year at the bottom of the 2008 Financial Crisis. Those who stayed in cash the whole time saw a negative return on their initial investment.

While investors may have felt good about the move, in retrospect, staying invested would have brought them closer to their long-term goals.

It’s natural for clients to want to minimize short-term losses. Volatile markets often spark challenging conversations for advisors. We built YCharts with powerful features like Scenario Builder and the beautiful visuals we used to create the charts in this post to help you exceed client expectations during volatile markets.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Have questions about how YCharts can help you prepare for client meetings?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a free copy of The Top 10 Visuals for Prospect & Client Meetings:

Disclaimer

©2023 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer, or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Monthly Market Wrap: September 2023Read More →