Propose with Precision: Portfolio Recommendations at the Household Level

Building a smart, cohesive portfolio proposal for a client household is easier and faster than ever. Whether you’re onboarding a new client or reassessing an existing household, YCharts helps you work more efficiently and communicate more clearly.

With enhanced Household Portfolios and new Folder capabilities, YCharts streamlines your proposal workflow. You save time, improve collaboration, and can easily present tax-aware strategies that align with your clients’ goals. Here’s how YCharts helps you deliver proposals that stand out.

Work at the Household Level—Without the Spreadsheets

Picture this: a new client hands you three statements from three different custodians, covering five accounts across two family members. They ask, “What should we be doing differently?” Instead of flipping through PDFs or logging into multiple platforms, you build a Household Portfolio in YCharts.

Now, everything is in one place. You can:

- View performance and allocation at the household level

- Conduct attribution analysis to see which accounts or holdings are driving returns

- Drill into individual portfolios without losing sight of the full picture

That means no more reacting to scattered data. You can respond with a clear, cohesive strategy.

Dreading the idea of uploading statements one by one? Don’t fret, Quick Extract lets you upload client statements and automatically create portfolios. This eliminates manual entry and jumpstarts your proposal process.

Tax-Aware Transitions, Built In

Once you’ve assessed their current allocation, it’s time to guide the client toward your model. But transitioning appreciated positions, especially across a mix of qualified and non-qualified accounts, can be complex.

YCharts Transition Analysis does the heavy lifting. It evaluates cost basis across accounts to identify the most tax-efficient way to implement changes. No spreadsheets or third-party analysis required.

With just a few clicks, you can:

- Compare current and proposed allocations

- Estimate the tax impact of reallocation

- Create a clear, client-friendly proposal summary

Instead of presenting a generic model, you show a tailored, tax-aware plan backed by data.

Keep Everything in One Place with Folders

Let’s say your associate advisor drafts the plan, and your admin preps the report. Without a shared system, version control and miscommunication can slow everything down.

That’s where Folders come in. They make it easy to organize your proposal workflow. Store everything related to a household—draft portfolios, reports, custom securities, fund charts, and even Risk Profiles—in one place. With Public Items and Public Folders, your team can collaborate in real time and stay aligned.

The result? Faster turnaround, fewer errors, and a smoother experience for both your team and your clients.

Stronger Proposals Lead to Better Conversations

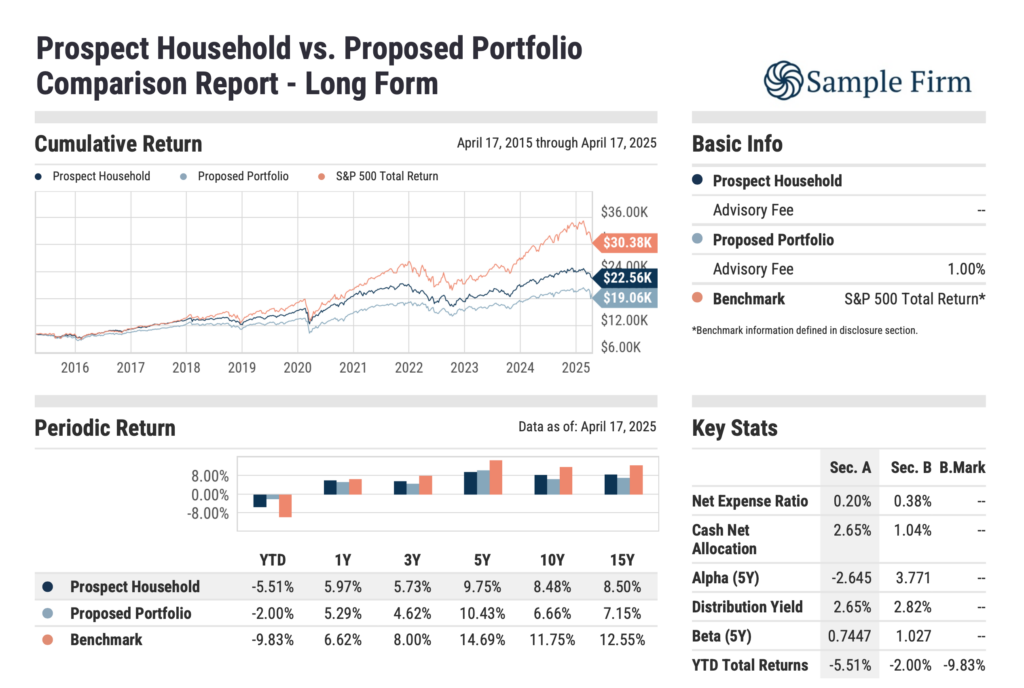

By the time you sit down with the client, you’re ready. YCharts helps you create clear, professional visuals that make complex strategies easy to understand, empowering clients and supporting more confident recommendations. Proposals can:

- Highlight household-level asset allocation

- Show alignment with your model or IPS

- Explain suggested changes with context and clarity

The conversation shifts from “What do we have?” to “What’s the best next step?” That clarity builds trust—and helps you win more business.

Better proposals help you move from information to insight. You go from prep mode to planning mode. If you’re looking to refine your process, explore how top advisors are speeding up proposal workflows and enhancing client presentations through more strategic, visual-forward communication.

Whenever you’re ready, here’s how YCharts can help you:

1. Want to know how much time you could save on proposals?

Calculate Your ROI with YCharts and see the impact for your business.

2. Looking to move on from your investment research and analytics platform?

3. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Canada’s Fastest-Growing ETFs: April 2025 Flow LeadersRead More →