Safe Haven Surge Amid Tariff Turmoil: Gold (GLD) and Yen as Portfolio Shields

In the wake of intensifying tariff tensions, investors are rushing into traditional safe havens. Gold and the Japanese Yen are experiencing notable inflows as portfolio managers seek protection against escalating geopolitical uncertainty. The market’s reaction to the United States doubling tariffs on key imports, including steel and aluminum, has been swift, with many advisors asking the same question: How do I protect client portfolios amid rising global trade tensions?

This blog explores:

- • The macro environment surrounding new 2025 tariffs

- • Why gold (GLD) and the Yen are drawing attention as defensive assets

- • How advisors can incorporate safe havens into client portfolios

- • YCharts tools to help monitor and allocate effectively in this environment

Global Macro Shake-Up: Tariffs Amplify Volatility

On June 3rd, the U.S. administration doubled down on its trade war stance by raising tariffs on key imports. This move, part of a broader protectionist campaign, has introduced renewed volatility across global markets. The “tariffs” now impact over $200B in goods, with retaliatory threats already surfacing from major trading partners like the EU and China.

For advisors and asset managers, the return of protectionist policy brings elevated uncertainty. Industrial producers, exporters, and multinational equities are facing renewed pressure. As the market recalibrates, capital is flowing into historically defensive assets.

Related read: Trade War Escalation in 2025: Portfolio Moves Amid New Tariff Threats

Gold (GLD): A Resurgent Hedge Against Policy Shock

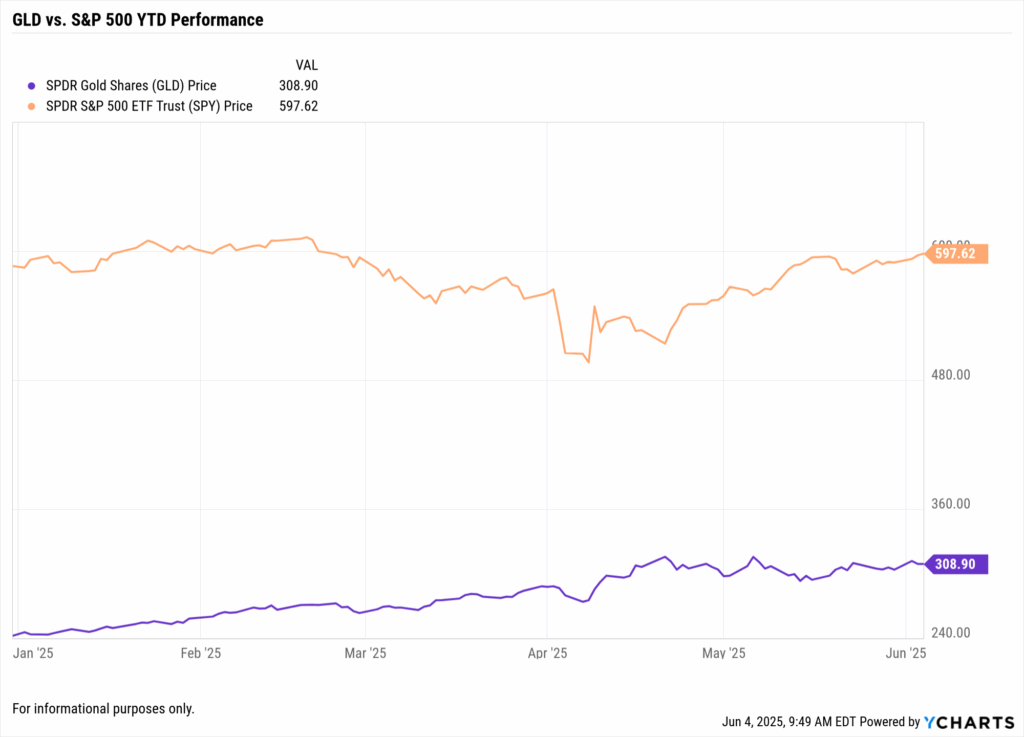

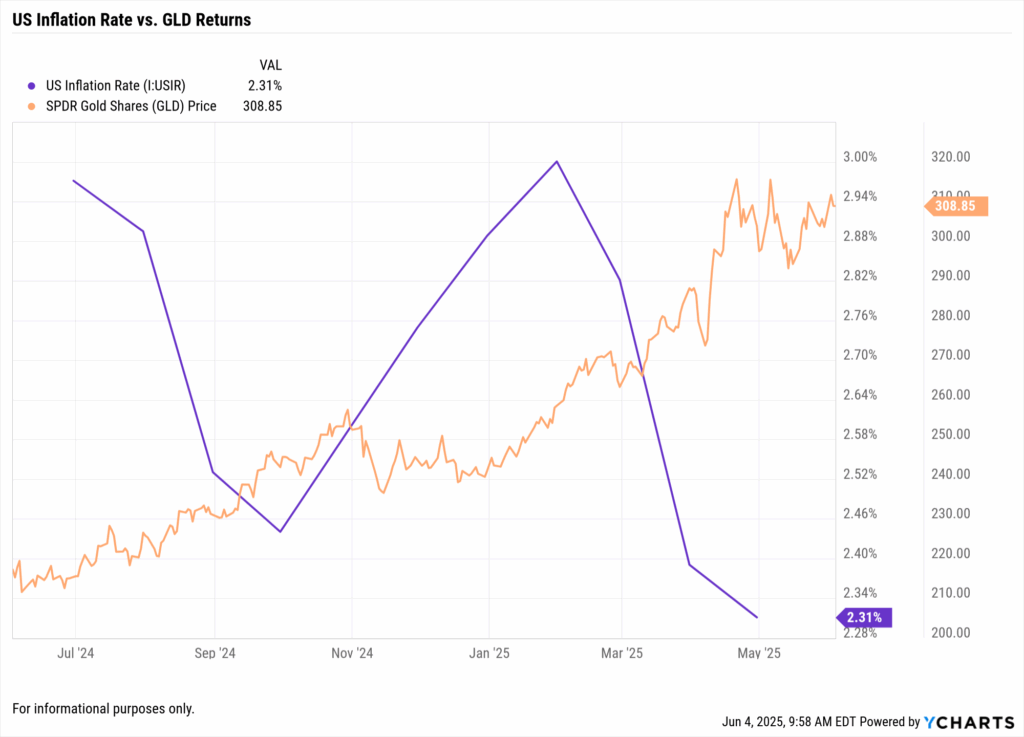

Gold has long served as a portfolio hedge during geopolitical or inflationary episodes. With inflation expectations ticking up due to supply chain cost-push pressures, demand for gold is accelerating. The SPDR Gold Shares ETF (GLD), the most liquid gold-backed ETF, has seen increased volume and positive inflows since the tariff announcement.

Why advisors are rotating into gold:

- • Inflation Hedge: Tariffs can spark inflation via higher import costs; gold historically outperforms in such environments.

- • Market Volatility: GLD has an inverse correlation with equity risk-off periods, helping to balance portfolios.

- • Dollar Hedge: If U.S. trade isolation leads to dollar weakness, gold gains an additional tailwind.

Advisors seeking to manage inflation-sensitive allocations can track the US Consumer Price Index MoM and overlay GLD’s performance to assess correlation.

Japanese Yen: The Currency Safe Harbor

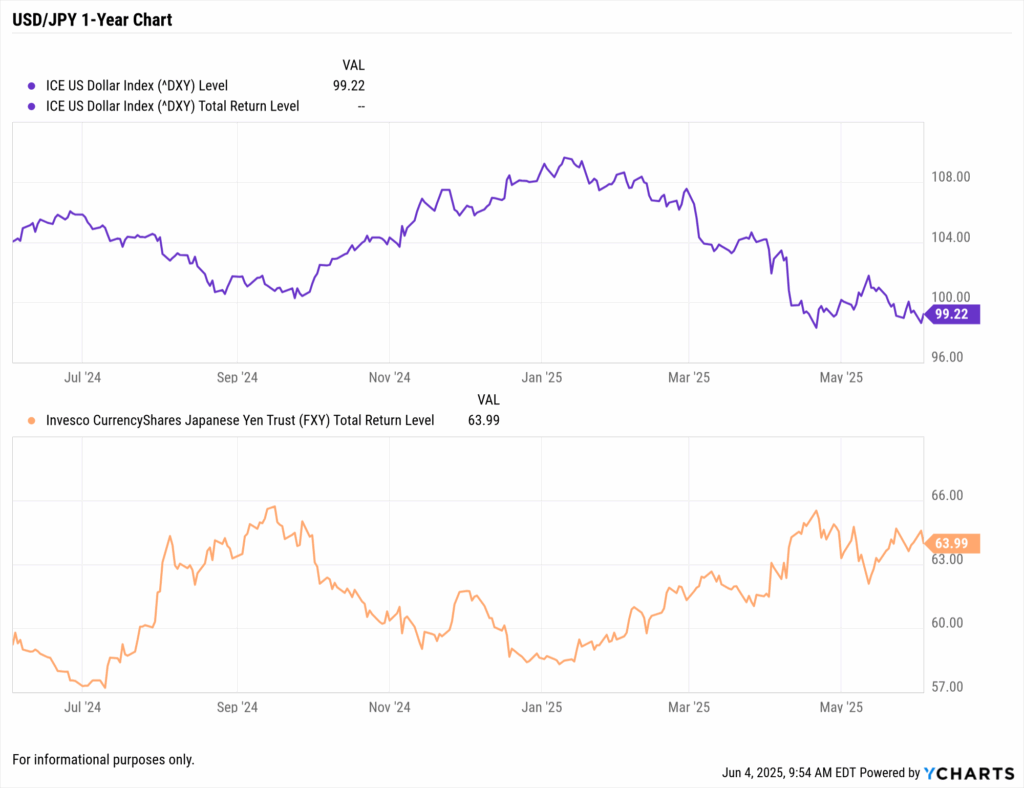

The Japanese Yen (JPY) remains one of the most consistent currency safe havens. When geopolitical risk rises, traders typically unwind carry trades, and the Yen strengthens. Over the last two weeks, the Yen has appreciated against the U.S. Dollar and Euro, coinciding with the tariff escalation and broader market uncertainty.

Why the Yen matters now:

- • Flight to Safety: The Yen’s deep liquidity and Japan’s net creditor status reinforce its safe haven status.

- • Currency Diversification: Allocating to Yen-denominated assets can reduce correlation with USD-driven volatility.

- • FX Volatility Hedge: Currency-linked ETFs or managed currency strategies can soften portfolio shocks from dollar volatility.

Portfolio Strategy: Allocating to Resilience

Given the current climate, advisors may consider the following tactics:

1. Increase Exposure to Safe Haven Assets

Tactically allocate to gold and Yen ETFs. For example, the iShares Currency Hedged MSCI Japan ETF (HEWJ) can offer FX exposure while remaining equities-neutral.

2. Reduce Tariff-Sensitive Equity Positions

Industrials, materials, and multinational discretionary companies are exposed to margin compression. Review your portfolio allocations using the YCharts Holdings Analysis Tool to assess sector overexposure.

Related read: Sector Rotation Strategy: Where to Allocate Capital in a Volatile Market

3. Watch Treasury and Inflation Indicators

Inflation from tariffs can pressure the Fed to remain hawkish. Monitor Treasury yield spreads and breakeven inflation rates to better understand bond market expectations.

Related read: Why Treasury Yields Are Spiking and What It Means for Your Portfolio

How YCharts Helps You Respond Strategically

YCharts gives you the tools to stay ahead of market events like these:

Charting GLD and FXY (Yen ETF) vs. S&P 500 to visualize safe haven performance

Overlay key asset classes and benchmark indices in a single view to show clients how gold and the yen have historically performed during market stress.

Economic Indicators to track inflation trends. YCharts provides a rich set of macroeconomic indicators—like CPI, PPI, 5-Year Breakeven Inflation, and Fed Funds Futures—that can be charted together to monitor inflation pressure and monetary policy sentiment.

Alerts for new trade policy announcements or shifts in Treasury yields. Stay ahead of macro events by creating real-time alerts for economic data releases, yield curve movements, or tariff-sensitive equity sectors.

Scenario Analysis to simulate portfolio resilience under tariff-induced inflation. Model different market conditions—rising input costs, currency devaluation, or commodity price shocks—to see how portfolios hold up under pressure.

Related read: How Financial Advisors Use YCharts to Optimize Investment Strategies

Conclusion: Seeking Shelter in a Shifting Global Landscape

As tariffs disrupt global trade flows and inject new volatility into markets, the traditional principles of portfolio diversification gain renewed relevance. The recent strength of gold and the Japanese yen serves as a signal to advisors: when uncertainty spikes, clients look to you for calm, clarity, and protection.

Whether shielding client portfolios from inflationary shocks or finding performance consistency amid choppy equity markets, safe haven assets like GLD and FXY deserve renewed attention. But identifying the opportunity is just the start—measuring it, contextualizing it, and acting on it are where YCharts helps you shine.

By leveraging real-time economic data, powerful visual tools, and client-friendly reporting, YCharts ensures that your tariff-era strategies aren’t just reactive, they’re resilient.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Trade War Escalation in 2025: Portfolio Moves Amid Trump's Tariff ThreatsRead More →