Stock Screeners 101: How to Analyze Thousands of Equities with YCharts

The Power of Stock Screeners

In today’s fast-paced financial environment, manually analyzing individual equities can be both time-consuming and inefficient. Stock screeners have emerged as an essential tool for financial professionals, helping investors sift through thousands of stocks and find potential opportunities that meet specific investment criteria.

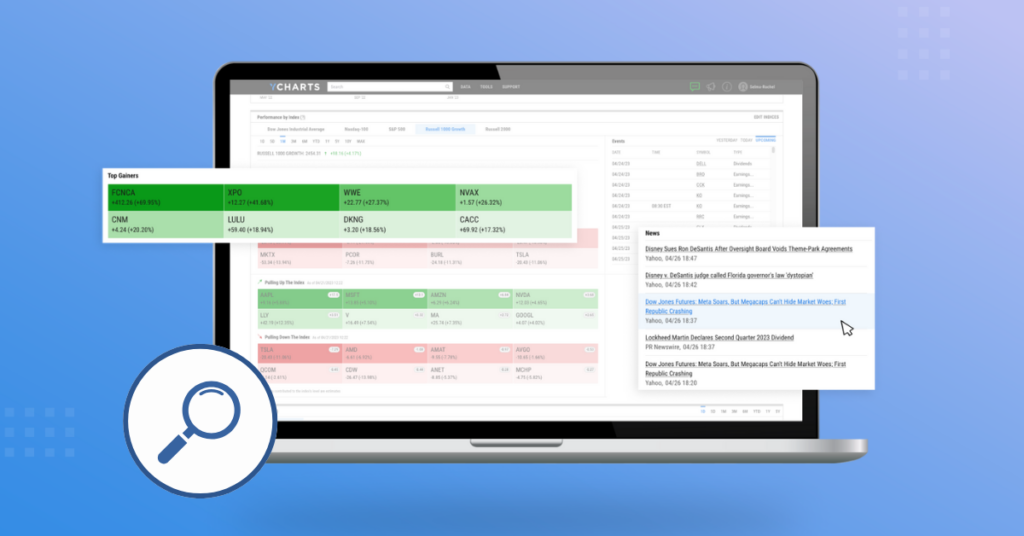

With YCharts’ advanced Stock Screener, financial advisors and asset managers can access a powerful set of filters and tools that simplifies the process of researching, analyzing, and comparing equities. This blog will explore the basics of stock screening, highlight key features of YCharts’ Stock Screener, and demonstrate how financial professionals can use it to their advantage.

The Basics of Stock Screening

A stock screener helps investors filter stocks based on customizable criteria such as valuation ratios, performance metrics, sector classifications, and more. This allows investors to quickly identify companies that align with their investment strategies, without the need to manually sort through endless stock lists.

Key Features of a Stock Screener:

- Filter by Fundamental Data: Investors can filter stocks based on earnings, revenue, P/E ratios, and other key metrics.

- Customizable Filters: Tailor searches for specific stock types such as growth, value, or dividend-paying equities.

- Real-time Data: Get up-to-the-minute information, enabling timely and informed decisions.

In YCharts, the Stock Screener allows users to analyze over 4,500 financial metrics for 20,000+ equities, offering multiple data points and charting options to visualize equity performance.

Getting Started with the YCharts Stock Screener

Accessing the Screener

To begin using the YCharts Stock Screener, navigate to the Stocks section within the platform. From there, you can access the Stock Screener tool. Users are presented with thousands of global equities that can be filtered based on fundamentals, technical indicators, and sector-specific metrics.

Setting Filters: How to Narrow Down Your Search

The YCharts Stock Screener offers hundreds of customizable metrics, enabling financial professionals to tailor their searches to their unique investment strategies. Here’s how to use it:

1. Fundamental Metrics

YCharts provides a comprehensive set of fundamental metrics to filter equities, including:

- Price-to-Earnings (P/E) Ratio

- Earnings-per-Share (EPS)

- Dividend Yield

By using these metrics, you can quickly screen for undervalued stocks or those with strong dividend potential, perfect for both growth and income-focused investors.

2. Performance Filters

For investors focused on stock momentum or performance, YCharts allows you to screen based on:

- Year-to-Date (YTD) Performance

- 1-Month/3-Month Return

- 52-Week High/Low

This makes it easy to identify equities that are poised for further growth or exhibiting momentum.

3. Industry and Sector Filters

Diversification is a key aspect of portfolio management. With YCharts, users can filter equities by sector, such as:

- Technology

- Healthcare

- Energy

This feature helps investors gain exposure to specific sectors or align investments with broader economic trends.

Pre-Built Templates

YCharts offers a powerful suite of pre-built templates designed to streamline the creation of investment reports and client presentations. These templates simplify the reporting process while ensuring professional-grade quality and customization options for branding. Whether generating portfolio summaries, proposals, or market updates, YCharts’ pre-built templates save valuable time and elevate client communication.

Creating Watchlists and Custom Reports

One of the standout features of YCharts is the ability to create custom watchlists. After narrowing down your stock selections, you can save them to a watchlist for ongoing analysis. In addition, YCharts enables users to generate custom-branded reports for client presentations, perfect for showcasing insights.

Visualizing Results: Turning Data Into Insights

YCharts allows you to transform your stock screening results into stunning visuals, helping to present complex data in a client-friendly format. Below are some of the visualization options:

1. Performance Charts

Compare multiple stocks side-by-side using customizable performance charts to evaluate how they measure up across various key metrics.

2. Comparison Tables

Load several securities from screener results or a watchlist along into a Comp Table. Analyze securities head-to-head by utilizing over 4,000 financial metrics including tax cost ratio, max drawdown, beta, ESG scores, and more to power better, more insightful analysis.

3. Financial Tear Sheets

Generate firm-branded tear sheets summarizing a stock’s financial health, providing a comprehensive overview of performance for clients and stakeholders.

Why Use Stock Screeners? The Importance of Streamlined Equity Analysis

Stock screeners offer financial professionals a strategic advantage by cutting down research time. Instead of manually reviewing financial reports, screeners help investors find stocks that meet their specific criteria in minutes. This leads to more informed decisions, optimized portfolio management, and better client engagement.

With YCharts, you get:

- Real-time, accurate data to stay ahead of the market.

- Comprehensive filters for deep analysis.

- Advanced visuals that simplify complex equity data for clients.

Conclusion: Master Stock Screening with YCharts

Whether you’re a seasoned financial advisor or just starting out, YCharts’ Stock Screener simplifies the equity analysis process, enabling you to make data-driven decisions faster. By mastering this tool, you can uncover investment opportunities, enhance client communication, and optimize your overall strategy. Start your free trial today to see how YCharts’ Stock Screener can transform your equity analysis workflow.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Download the Economic Summary Deck:Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

These 5 Equity Income ETFs are Winning Assets in 2024Read More →