The 10 Best Performing Stocks in the Last 25 Years

Published: February 2, 2026 | Analysis by YCharts Research Team

Introduction

Understanding which companies have stood the test of time is invaluable for advisors guiding clients through uncertain markets. That’s why we used the YCharts Stock Screener to identify the best performing stocks across key lookback periods, including year-to-date, 1, 3, 5, 10, and 25 years, across the entire Russell 1000.

Rather than focus solely on recent winners, this analysis reveals which companies consistently rewarded investors over time, whether through capital appreciation, strong fundamentals, or dividend reinvestment. These insights help advisors put short-term volatility in context while positioning for long-term growth.

From 2025’s leaders to the stunning 25-year returns of household names like Monster Beverage and NVIDIA, here’s what advisors need to know about the stocks that delivered year after year.

Click to jump to a section:

- Best-Performing Stocks YTD

- Best-Performing Stocks in the Last Year

- Best-Performing Stocks in the Last 3 Years

- Best-Performing Stocks in the Last 5 Years

- Best-Performing Stocks in the Last 10 Years

- Best-Performing Stocks in the Last 25 Years

- What Was the Growth of $10,000 Over the Last 25 Years?

- How Would Making Regular Contributions Affect Overall Returns?

For a look at the best performers with a dividend focus, check out our analysis on the Best Performing Dividend Stocks.

Read YCharts’ Multi-Generational Planning Deck

Trillions are changing hands as the Great Wealth Transfer accelerates. Advisors who connect early with heirs stand to gain by bridging generations through clarity, values, and trust. Download the report to uncover strategies that turn transition into long-term growth.

View the Multi-Generational Planning Deck

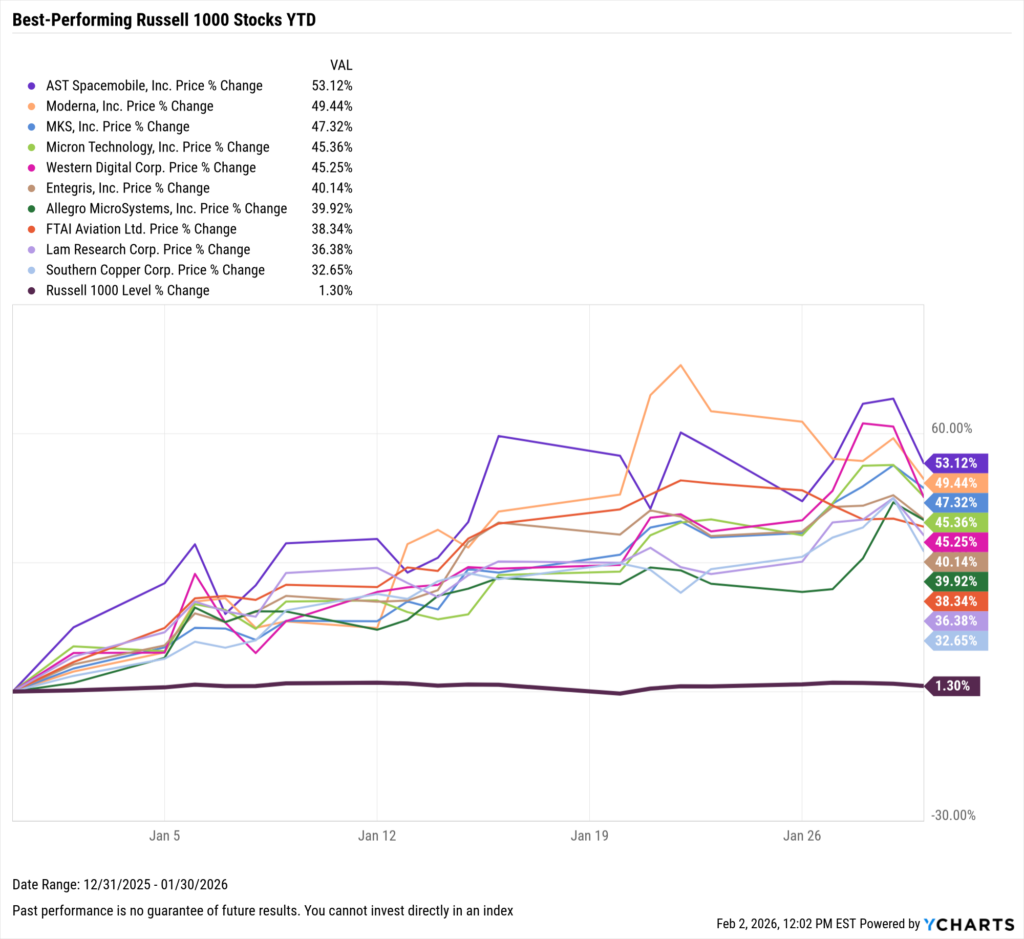

Best Performing Stocks YTD

These are the top-performing stocks year-to-date in 2026, as of January 31st, 2026.

| Ticker | Name | YTD Price Return | YTD Total Return | Market Cap |

|---|---|---|---|---|

| ASTS | AST Spacemobile, Inc. | 53.12% | 53.12% | $30.92B |

| MRNA | Moderna, Inc. | 49.44% | 49.44% | $17.22B |

| MKSI | MKS, Inc. | 47.32% | 47.32% | $15.81B |

| MU | Micron Technology, Inc. | 45.36% | 45.36% | $466.95B |

| WDC | Western Digital Corp. | 45.25% | 45.25% | $84.84B |

| ENTG | Entegris, Inc. | 40.14% | 40.26% | $17.90B |

| ALGM | Allegro MicroSystems, Inc. | 39.92% | 39.92% | $6.833B |

| FTAI | FTAI Aviation Ltd. | 38.34% | 38.34% | $27.93B |

| LRCX | Lam Research Corp. | 36.38% | 36.38% | $291.54B |

| SCCO | Southern Copper Corp. | 32.65% | 32.65% | $155.89B |

View in YCharts | Start a Free Trial to See Full Rankings

Download Visual | Modify in YCharts

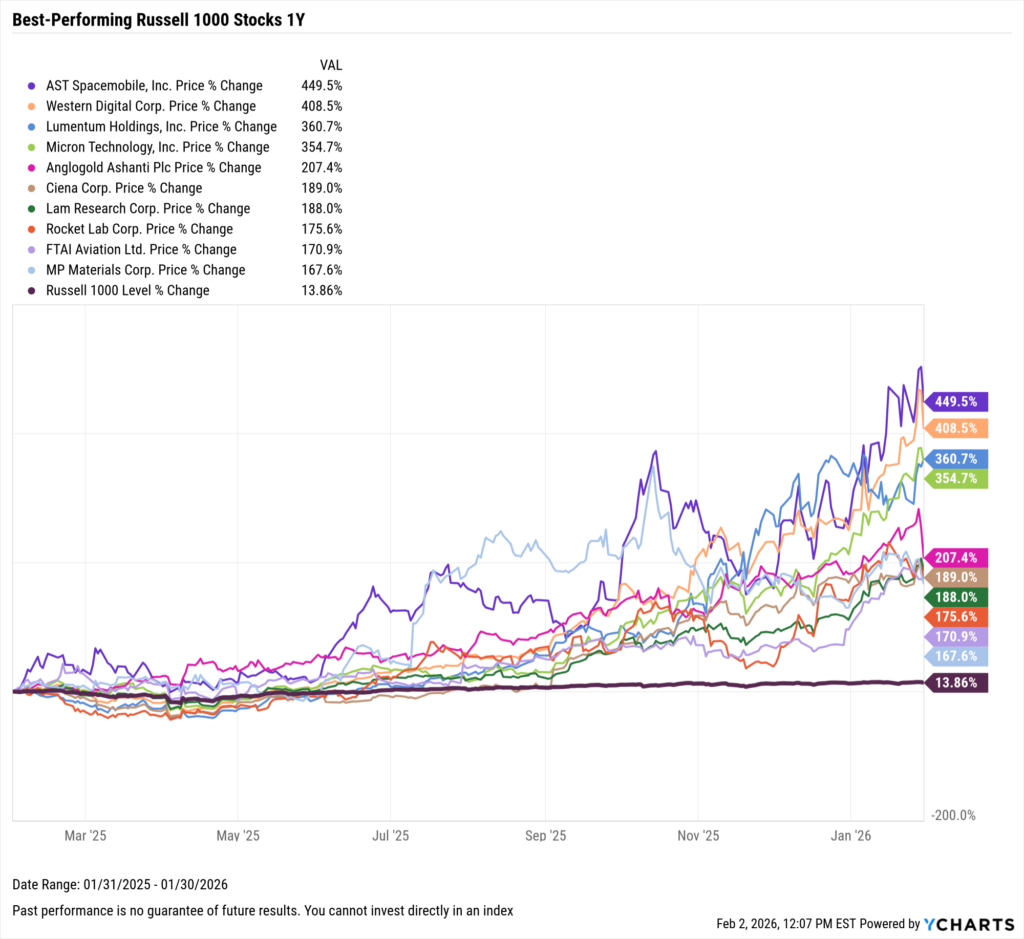

Best Performing Stocks in the Last Year

These are the top-performing stocks between February 1, 2025 and January 31, 2026.

| Ticker | Name | 1Y Price Return | 1Y Total Return | Market Cap |

|---|---|---|---|---|

| ASTS | AST Spacemobile, Inc. | 449.46% | 449.46% | $30.92B |

| WDC | Western Digital Corp. | 408.45% | 410.35% | $84.84B |

| LITE | Lumentum Holdings, Inc. | 360.66% | 360.66% | $27.79B |

| MU | Micron Technology, Inc. | 354.71% | 356.21% | $466.95B |

| AU | Anglogold Ashanti Plc | 207.41% | 222.90% | $46.89B |

| CIEN | Ciena Corp. | 188.97% | 188.97% | $35.47B |

| LRCX | Lam Research Corp. | 188.04% | 190.66% | $291.54B |

| RKLB | Rocket Lab Corp. | 175.63% | 175.63% | $42.77B |

| FTAI | FTAI Aviation Ltd. | 170.88% | 173.51% | $27.93B |

| MP | MP Materials Corp. | 167.62% | 167.62% | $10.42B |

View in YCharts | Start a Free Trial to See Full Rankings

Download Visual | Modify in YCharts

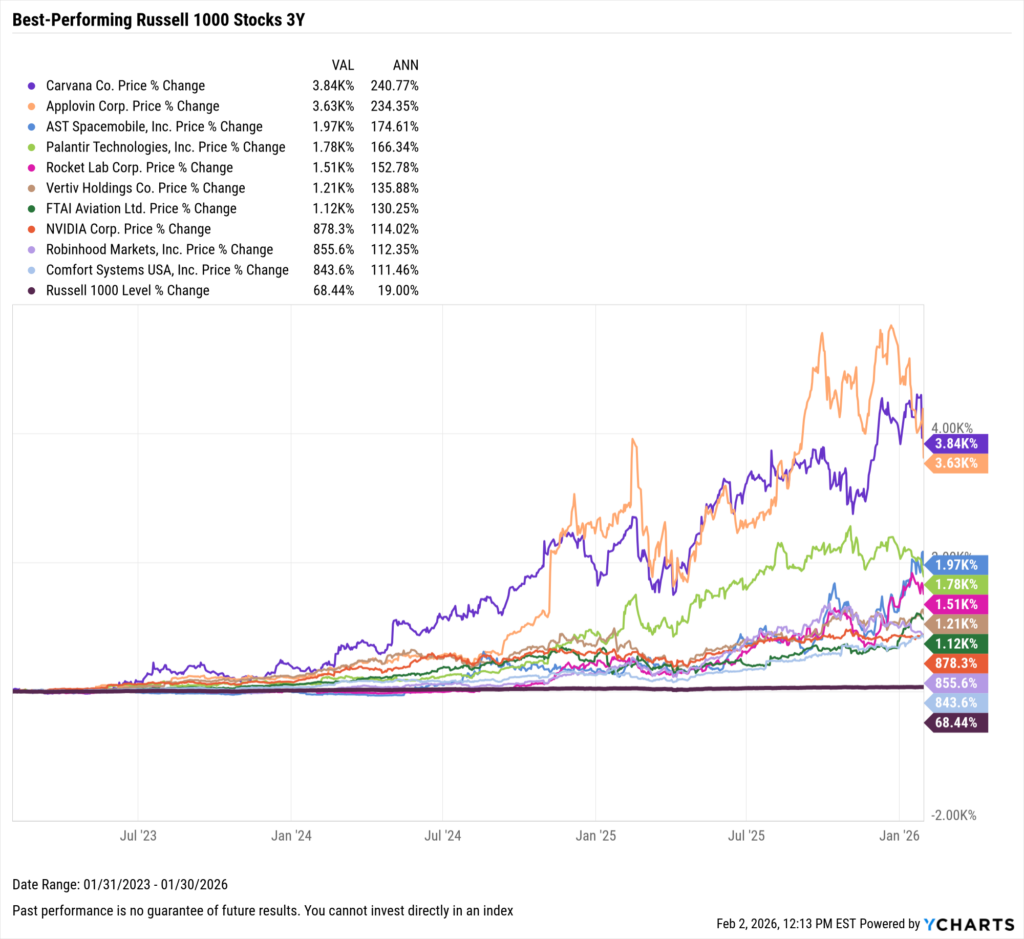

Best Performing Stocks in the Last 3 Years

These are the top-performing stocks between February 1, 2023 and January 31, 2026.

| Ticker | Name | 3Y Price Return | 3Y Total Return | Market Cap |

|---|---|---|---|---|

| CVNA | Carvana Co. | 3844.05% | 3844.05% | $56.73B |

| APP | Applovin Corp. | 3625.28% | 3625.28% | $159.89B |

| ASTS | AST Spacemobile, Inc. | 1965.18% | 1965.18% | $30.92B |

| PLTR | Palantir Technologies, Inc. | 1784.19% | 1784.19% | $349.39B |

| RKLB | Rocket Lab Corp. | 1511.07% | 1511.07% | $42.77B |

| VRT | Vertiv Holdings Co. | 1209.28% | 1213.37% | $71.18B |

| FTAI | FTAI Aviation Ltd. | 1117.89% | 1195.84% | $27.93B |

| NVDA | NVIDIA Corp. | 878.30% | 879.28% | $4.645T |

| HOOD | Robinhood Markets, Inc. | 855.62% | 855.62% | $89.45B |

| FIX | Comfort Systems USA, Inc. | 843.57% | 855.04% | $40.28B |

View in YCharts | Start a Free Trial to See Full Rankings

Download Visual | Modify in YCharts

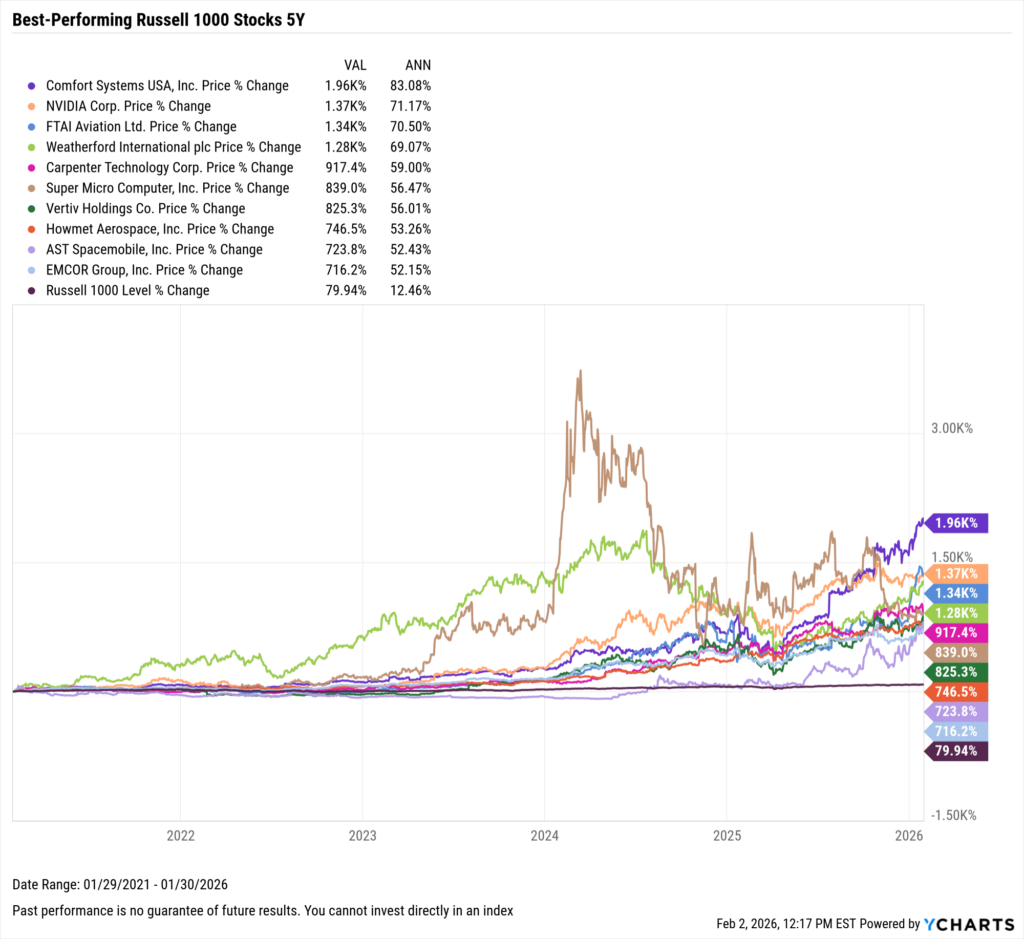

Best Performing Stocks in the Last 5 Years

These are the top-performing stocks between February 1, 2021 and January 31, 2026.

| Ticker | Name | 5Y Price Return | 5Y Total Return | Market Cap |

|---|---|---|---|---|

| FIX | Comfort Systems USA, Inc. | 1960.44% | 2009.52% | $40.28B |

| NVDA | NVIDIA Corp. | 1371.39% | 1375.46% | $4.645T |

| FTAI | FTAI Aviation Ltd. | 1343.02% | 1621.75% | $27.93B |

| WFRD | Weatherford International plc | 1283.53% | 1315.21% | $6.748B |

| CRS | Carpenter Technology Corp. | 917.38% | 995.86% | $15.83B |

| SMCI | Super Micro Computer, Inc. | 839.03% | 839.03% | $17.38B |

| VRT | Vertiv Holdings Co. | 825.35% | 829.30% | $71.18B |

| HWM | Howmet Aerospace, Inc. | 746.54% | 758.11% | $83.75B |

| ASTS | AST Spacemobile, Inc. | 723.78% | 723.78% | $30.92B |

| EME | EMCOR Group, Inc. | 716.23% | 730.37% | $32.26B |

View in YCharts | Start a Free Trial to See Full Rankings

Download Visual | Modify in YCharts

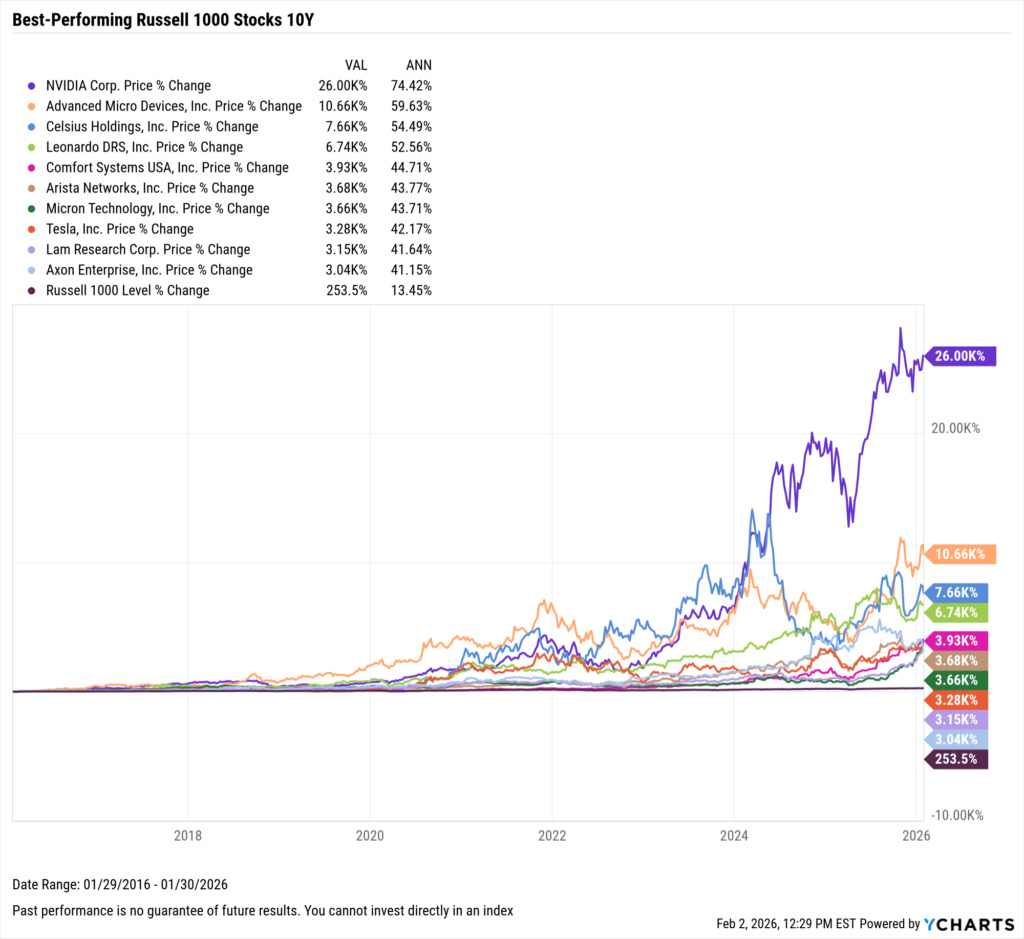

Best Performing Stocks in the Last 10 Years

These are the top-performing stocks between February 1, 2016 and January 31, 2026.

| Ticker | Name | 10Y Price Return | 10Y Total Return | Market Cap |

|---|---|---|---|---|

| NVDA | NVIDIA Corp. | 26001.74% | 26648.82% | $4.645T |

| AMD | Advanced Micro Devices, Inc. | 10660.45% | 10660.45% | $385.41B |

| CELH | Celsius Holdings, Inc. | 7655.66% | 7655.66% | $13.53B |

| DRS | Leonardo DRS, Inc. | 6736.50% | 6804.57% | $10.92B |

| FIX | Comfort Systems USA, Inc. | 3929.99% | 4205.76% | $40.28B |

| ANET | Arista Networks, Inc. | 3677.84% | 3677.84% | $178.49B |

| MU | Micron Technology, Inc. | 3661.38% | 3755.54% | $466.95B |

| TSLA | Tesla, Inc. | 3276.65% | 3276.65% | $1.615T |

| LRCX | Lam Research Corp. | 3151.99% | 3639.55% | $291.54B |

| AXON | Axon Enterprise, Inc. | 3042.17% | 3042.17% | $38.16B |

View in YCharts | Start a Free Trial to See Full Rankings

Download Visual | Modify in YCharts

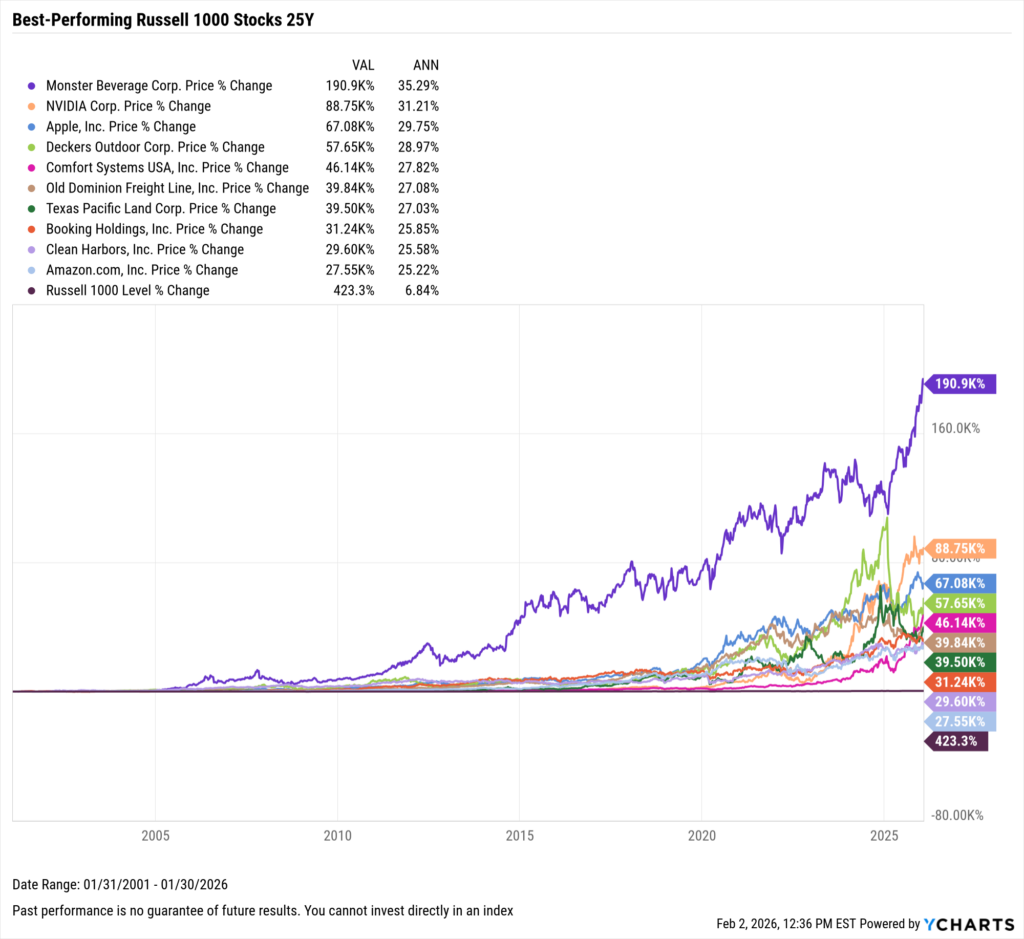

Best Performing Stocks in the Last 25 Years

These are the top-performing stocks between February 1, 2001 and January 31, 2026.

| Ticker | Name | 25Y Price Return | 25Y Total Return | Market Cap |

|---|---|---|---|---|

| MNST | Monster Beverage Corp. | 190858.10% | 190858.10% | $78.79B |

| NVDA | NVIDIA Corp. | 88746.02% | 96790.91% | $4.598T |

| AAPL | Apple, Inc. | 67079.29% | 79900.70% | $3.878T |

| DECK | Deckers Outdoor Corp. | 57645.07% | 57645.07% | $16.72B |

| FIX | Comfort Systems USA, Inc. | 46138.87% | 57598.53% | $41.13B |

| ODFL | Old Dominion Freight Line, Inc. | 39836.36% | 41441.85% | $38.13B |

| TPL | Texas Pacific Land Corp. | 39496.35% | 50359.83% | $23.52B |

| BKNG | Booking Holdings, Inc. | 31239.91% | 31749.99% | $165.07B |

| CLH | Clean Harbors, Inc. | 29604.00% | 29604.00% | $13.94B |

| AMZN | Amazon.com, Inc. | 27548.76% | 27548.76% | $2.620T |

View in YCharts | Start a Free Trial to See Full Rankings

Download Visual | Modify in YCharts

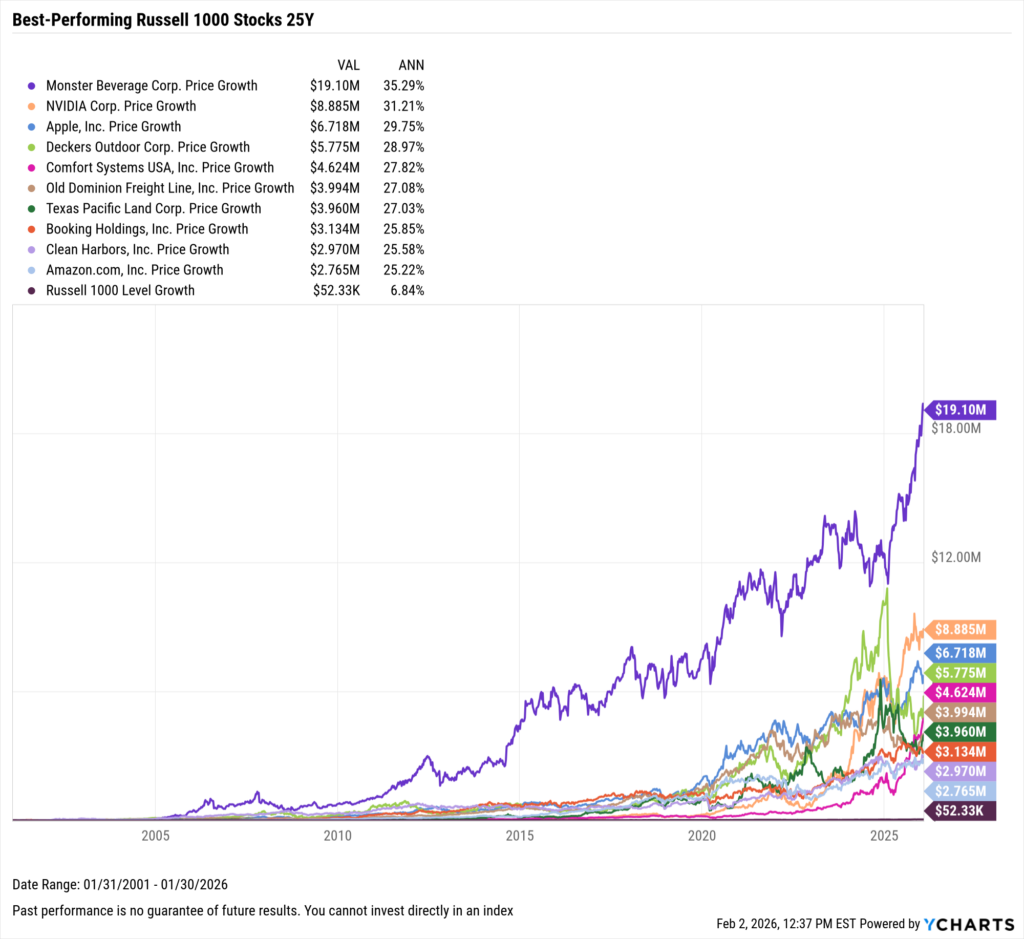

What Was the Growth of $10,000 Over the Last 25 Years?

If you invested $10,000 25 years ago into any of the ten best-performing stocks over the last 25 years, your balance today would be in the millions of dollars.

The best-performing stock in the last 25 years was Monster Beverage (MNST). A $10,000 investment into Monster Beverage 25 years ago would be worth $19.10 million today. Right behind it is NVIDIA (NVDA); $10,000 invested into NVIDIA in 2001 would’ve turned into $8.89 million today, or $9.69 million after dividend reinvestment.

| Ticker | Name | 25Y Price Growth | 25Y Total Return |

|---|---|---|---|

| MNST | Monster Beverage Corp. | $19.10 million | $19.10 million |

| NVDA | NVIDIA Corp. | $8.885 million | $9.689 million |

| AAPL | Apple, Inc. | $6.718 million | $8.000 million |

| DECK | Deckers Outdoor Corp. | $5.775 million | $5.775 million |

| FIX | Comfort Systems USA, Inc. | $4.624 million | $5.770 million |

| ODFL | Old Dominion Freight Line, Inc. | $3.994 million | $4.154 million |

| TPL | Texas Pacific Land Corp. | $3.960 million | $5.046 million |

| BKNG | Booking Holdings, Inc. | $3.134 million | $3.185 million |

| CLH | Clean Harbors, Inc. | $2.970 million | $2.970 million |

| AMZN | Amazon.com, Inc. | $2.765 million | $2.765 million |

Start a Free Trial to See Full Rankings

Download Visual | Modify in YCharts

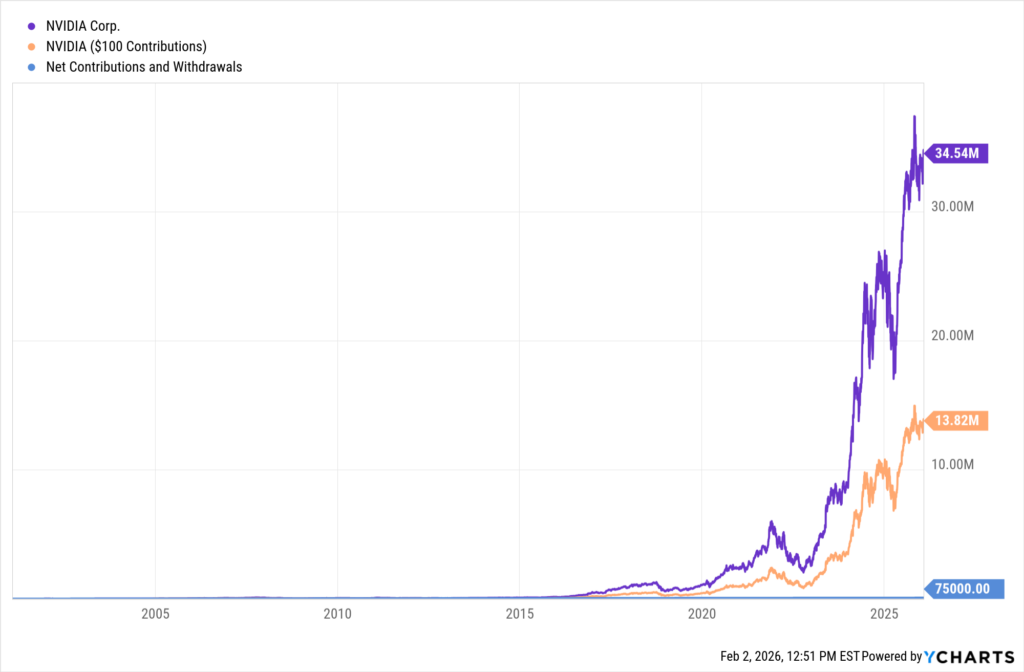

How Would Making Regular Contributions Affect Overall Returns?

Using NVIDIA (NVDA)–one of the world’s most valuable companies and second-best performer over the last 25 years–as an example, contributing $100 each month since February 2001 would’ve equaled a net total contribution of $30,000, with a total return of $13.82 million.

If the monthly contribution was $250 each month ($75,000 total), the net balance after those 25 years would be $34.54 million today.

Download Visual | Create Your Own Scenarios

Though total returns achieved via monthly contributions over the 25 year time horizon wouldn’t have been as large as an upfront lump-sum investment, tools like Scenarios illustrate the importance of “staying the course” as an equity investment strategy to clients.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a best-in-class data & visualization tool?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of The Top 10 Visuals for Client and Prospect Meetings slide deck:

Disclaimer

©2026 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

7 Categories Where Advisors Chose ETFs Over Mutual Funds in 2025Read More →