What’s the S&P 500 Without Its FAANGs?

Given the sheer size of “mega cap stocks”—being Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG & GOOGL), Meta Platforms (FB), Tesla (TSLA), NVIDIA (NVDA), and formerly Netflix (NFLX)—most portfolios carry noteworthy exposure to these companies.

And so it’s worth asking: how would the S&P 500, and most of our portfolios, have performed without these Mega Cap Stocks?

In our latest white paper, The Impact of Mega Cap Stocks on Portfolios and the Market, we estimated the leading index’s performance without its star constituents to answer that question.

Download the white paper to read our full findings:

The Effects Excluding Mega Caps Would Have Had on the S&P 500’s Historical Performance & Risk Profile

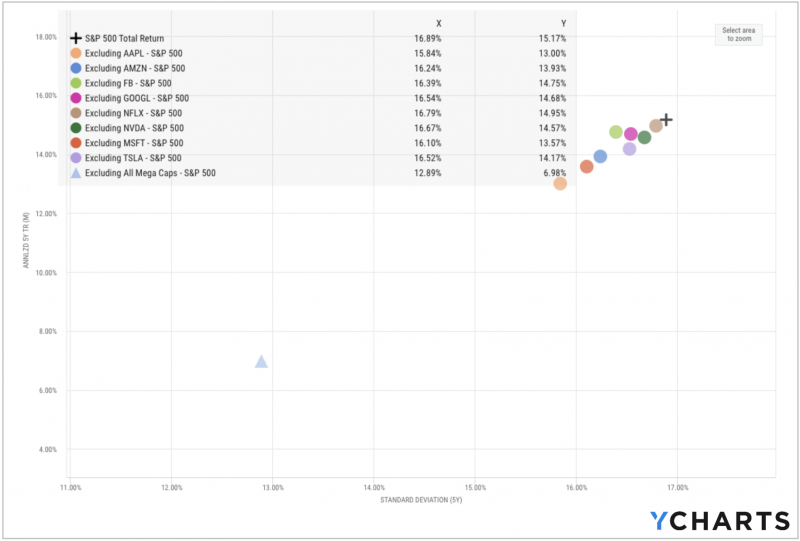

When stripping out the entire cohort of Mega Cap Stocks, the S&P 500’s annualized performance in the five-year period ending February 28, 2022 would have fallen to 6.98% from 15.17% annually—a reduction of more than half. The index’s standard deviation would have seen an improvement of 4 percentage points, but the lost returns seem to sting more than the reduced volatility.

Individually, excluding any of the nine Mega Cap Stocks (but only eight companies due to Google’s two share classes) would have reduced both the performance and volatility of the S&P 500. That said, Netflix (NFLX), Meta Platforms (FB), and Alphabet (GOOGL) would have been missed the least in terms of performance contributed to the overall index. (Note that performance and standard deviation for Alphabet’s GOOG share class are identical to GOOGL and are not shown in the scatter plot below.)

Download the Full Report to Learn More

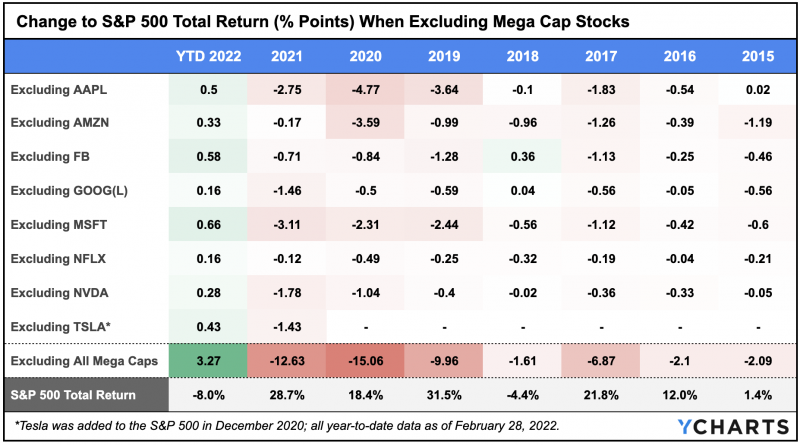

The pattern persists in each full calendar year since 2015. When each Mega Cap Stock is hypothetically excluded from the S&P 500’s total return, the index suffers. Notably, 2020’s 18.4% total return for the S&P 500 would have been a mere 3.3% had the eight Mega Cap Stocks been excluded, by our calculations.

Only in 2022 (year-to-date, through February 28, 2022) would removing the Mega Cap Stocks have actually boosted the S&P’s growth.

Download the Full Report to Learn More

So what does this all mean for typical portfolios? How much of an investor’s wealth would have been erased had any of these Mega Caps crashed? To what degree do Mega Caps play a role in a portfolio’s overall performance and risk?

For answers to these questions and more about Mega Cap Stocks, download the FREE white paper:

Connect with YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2022 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

The Risks & Rewards of Leaning into Mega CapsRead More →