YCharts for Asset Management: Boosting Fund Sales and Strengthening Advisor Relationships

Asset managers, or wholesalers, play a critical role in pitching their funds to advisors. The primary goal of asset managers is to grow AUM (Assets Under Management) by convincing advisors to incorporate their funds into client portfolios. YCharts provides a comprehensive platform that enables asset managers to present compelling data and make informed decisions that ultimately drive sales and deepen relationships with advisors.

This blog will explore how asset managers use YCharts to enhance fund performance, streamline operations, and improve communication with advisors, leading to stronger partnerships and increased sales.

Enhancing Fund Sales and Performance

Advanced Fund Analytics

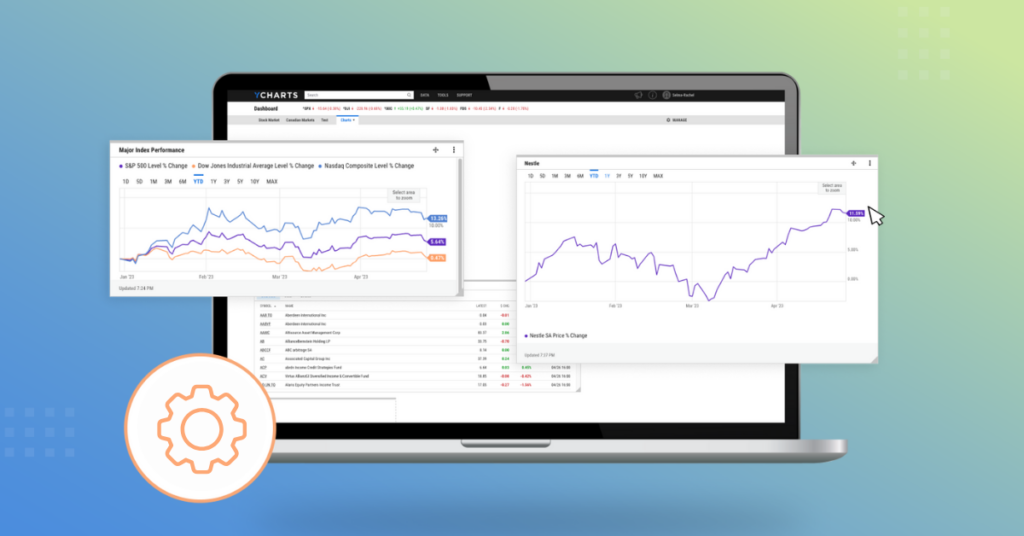

YCharts offers a suite of powerful analytics tools that help asset managers present the value of their funds to advisors. With tools like Fundamental Charts and Comp Tables, asset managers can effectively demonstrate how their funds perform against competitors and benchmarks.

Example: An asset manager pitching a fixed-income fund can use YCharts to compare its performance against peer funds and showcase how its risk-adjusted returns stand out.

Market and Economic Data Access

To effectively position their funds, asset managers need access to current market data. YCharts provides up-to-date insights on key metrics like interest rates, inflation, and market movements, enabling asset managers to create timely pitches based on the latest economic conditions.

Example: If market interest rates shift, an asset manager can use YCharts to highlight how their bond fund is positioned to benefit from the current economic environment, giving advisors a compelling reason to incorporate it into client portfolios.

Improving Advisor Communication

Customizable, Advisor-Focused Reports

YCharts enables asset managers to generate customized reports that speak directly to an advisor’s needs. These reports can highlight fund performance, peer comparisons, and risk metrics, tailored to the advisor’s clients and investment strategies.

Example: An asset manager can create a branded, custom report comparing their equity fund to an advisor’s current holdings, showing how the fund may offer better long-term growth opportunities or lower volatility.

Client-Friendly Visualizations

Presenting complex fund data in a clear, engaging format is key to winning advisors over. YCharts’ visual tools allow asset managers to present complex data through interactive charts and fundamental comparisons that resonate with advisors.

Example: During a meeting with an advisor, an asset manager can use YCharts to present a Fund Flow chart that shows increasing demand for their fund in the market, illustrating its potential to add value to client portfolios.

Streamlining Asset Management Operations

Automated Alerts and Monitoring for Fund Movement

YCharts makes it easy for asset managers to stay on top of their funds’ performance and positioning. With custom alerts, asset managers can monitor fund flows, performance changes, and market trends in real-time, ensuring they are always prepared for advisor conversations.

Example: An asset manager can set up alerts for significant movements in their fund’s risk metrics or shifts in the fund’s peer rankings, giving them real-time data to refine their sales pitches.

Portfolio Comparison Tools

YCharts’ Portfolio Comparison features enable asset managers to showcase the strengths of their funds compared to competitors, providing clear evidence of why advisors should choose their offerings.

Example: An asset manager pitching their active equity fund can use YCharts to compare it against passive ETFs in the same category, illustrating its potential for outperforming during certain market conditions.

Conclusion

YCharts equips asset managers with the tools they need to grow their funds’ AUM by strengthening advisor relationships and enhancing the overall sales process. By leveraging advanced analytics, customizable reports, and real-time data, asset managers can position their funds effectively in front of advisors, ensuring their value is recognized and incorporated into client portfolios. YCharts allows asset managers to streamline their operations, enabling them to focus on building deeper, more profitable relationships with advisors.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Download the Economic Summary Deck:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

The Best Performing Stocks of 2024Read More →