Puru Saxena’s State of the Markets: How Will 2022 End?

Inflation, a bear market, the Fed, rising rates… For many, 2022 has been a year of getting back out into the world, but these topics have remained front of mind. The question everyone is asking: when will things turn back around?

Puru Saxena joined YCharts to dissect the current economic climate and what’s in store for markets next. Puru is a retired money manager based in Hong Kong who specializes in individual stock analysis, with an emphasis on growth names.

Watch the full discussion here, or read some of Puru’s key takeaways below (originally aired September 27th, 2022):

Puru’s Take on US Markets and the Economy

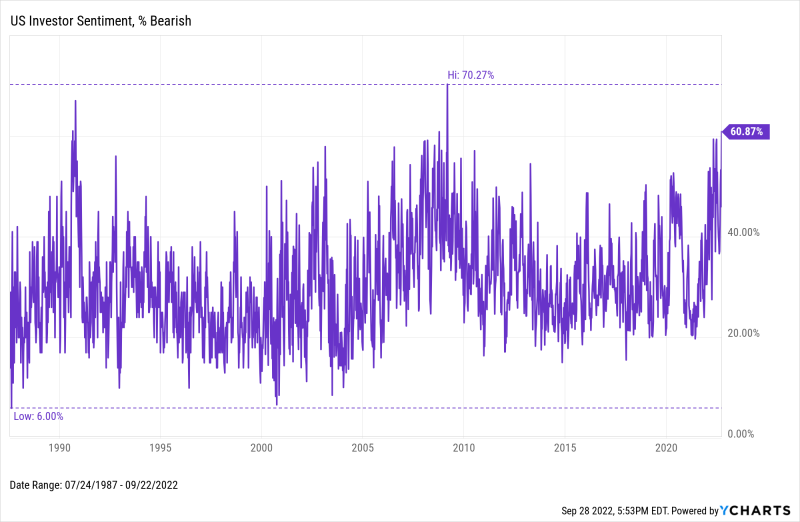

Puru is currently bearish on US stocks. And he’s not alone—the percentage of US Investors who are market Bearish on stocks currently sits at 60.9%, the highest level since March 2009.

Puru attributes his bearish position to actions taken by the Federal Reserve. He believes rates were kept too low for too long, and the Fed is swinging harshly in the other direction to correct course with policies that are “driving the economy into the ground.” Puru notes that the effects of monetary policy decisions typically don’t show up until four or five months later—the stock market has discounted a lot of those negative economic events as a result.

Unprecedented growth in the US money supply has been a primary driver of inflation, according to Puru. He cites the over 20% increase in M2 Money Supply between 2020 and 2021 as the key culprit of domestic inflation. Coupled with the Fed’s “hawkish” rate hikes that have moved all interest rates higher, future cash flows have become less valuable and growth stocks have suffered disproportionately in turn.

Download Visual | Modify in YCharts

What Puru is Watching Next

Puru is paying attention to a slew of economic indicators, including the US Unemployment Rate, US CPI/Core CPI, commodity prices (namely copper and crude oil), freight container rates, US Mortgage Rates, treasury yields, and the US Dollar. He cites the “imploding” commodity and freight prices as potentially early signs that deflation is coming. Puru also suggests the Fed should put greater emphasis on forward–looking indicators when making policy decisions.

As for stocks, Puru is a long-term bull in the software, e-commerce, and payment spaces. His highest-conviction play “for the next 7-10 years” is Snowflake (SNOW). He also favors cybersecurity players such as Datadog (DDOG) and SentinelOne (S), to name a couple. Most are software companies with robust enterprise contracts.

Overall, Puru believes share prices of companies in these spaces have been battered down so much that multiples have compressed in a meaningful way. With an expectation that CPI will fall and the risk-free rate potentially doing the same, Puru believes the “sticky” revenues of certain high-growth software-as-a-service (SaaS) companies will prevail in the long run.

Though the bears have cornered 2022 in many ways, Puru notes that businesses have historically outperformed every other asset class “bar none.” He believes “human ingenuity will win the day,” and much like Warren Buffett, Puru says “the time to buy is when everyone is despondently selling. The time to sell is when everyone is despondently buying.”

Connect With YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2022 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

What 5 Measures of Market Valuation Are Saying Right NowRead More →