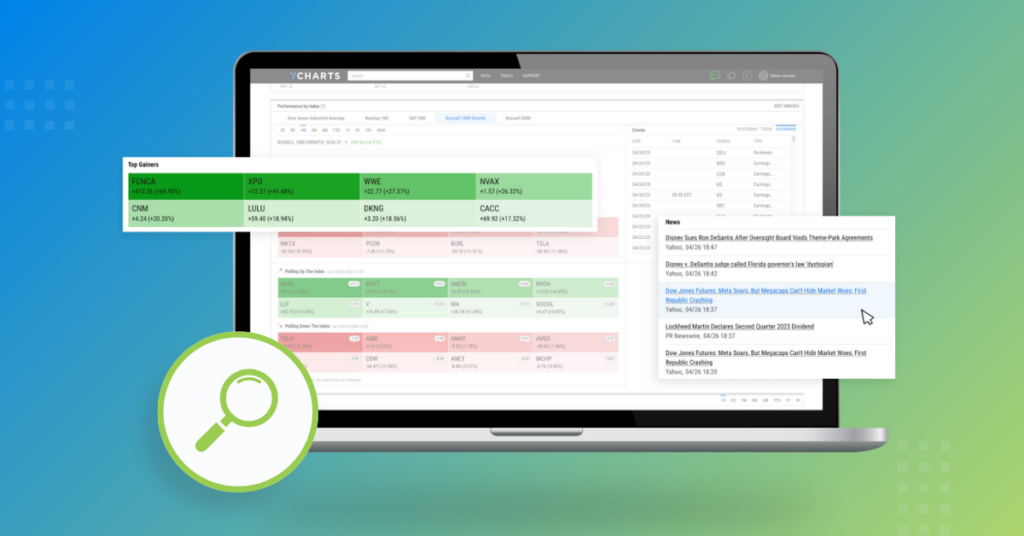

YCharts Features: In-Depth Look at the Tools That Empower Financial Advisors

YCharts is a comprehensive platform designed to empower financial advisors with a suite of tools for investment research, portfolio management, and proposal generation. Whether you’re an advisor managing multiple client portfolios or an investment researcher seeking advanced analytics, YCharts offers the tools you need to succeed. This blog provides an in-depth look at YCharts features, illustrating how they can be utilized to enhance your financial advisory practice.

Data and Research Tools

Comprehensive Financial Data:

YCharts provides access to a vast database of financial data, covering over 29,000 stocks, 75,000 funds & ETFs, economic indicators, and more. This data is crucial for making informed investment decisions and staying ahead of market trends.

Security Screeners:

The Security Screener tools allow you to filter through thousands of stocks or funds based on custom criteria. Use them to identify investment opportunities that meet your specific parameters, such as P/E ratios, dividend yields, expense ratios, or market cap.

Example: An advisor can use the screener to find undervalued stocks within the technology sector that fit a client’s growth-oriented strategy.

Economic Indicators:

YCharts also offers a robust library of economic indicators, including GDP, unemployment rates, and inflation data. These indicators can be integrated into your analysis to provide context and inform your investment strategies.

Example: An advisor can overlay unemployment data on a chart of consumer discretionary stocks to identify potential investment opportunities during economic downturns.

Portfolio Management Tools

Portfolio Optimizer:

YCharts’ Portfolio Optimizer helps you identify the optimal asset allocation for a given level of risk. Leveraging the principles of the efficient frontier and insights from the correlation matrix, the tool suggests adjustments to enhance portfolio performance while managing risk.

Model Portfolios:

Model Portfolios enable you to standardize investment strategies across multiple client accounts. These portfolios can be shared with clients or used as a benchmark to guide individual portfolio construction.

Client Communication and Reporting

Report Builder:

YCharts’ Report Builder is a flexible tool that showcases key YCharts features by enabling you to create customized, client-friendly reports. Include performance summaries, risk metrics, and visualizations in your reports, and brand them with your firm’s logo and colors.

Example: An advisor preparing for a quarterly review meeting can generate a detailed report that highlights the client’s portfolio performance, compares it to benchmarks, and provides actionable insights.

Download YCharts Client Communication Survey here:

Presentation Tools:

Use YCharts’ presentation tools to create compelling visuals and summaries for client meetings. These tools help simplify complex financial data, making it more accessible and understandable for clients.

Real-Time Alerts:

Stay informed with YCharts’ real-time alerts. Set up custom alerts for significant market movements, portfolio performance changes, or updates on specific securities. This feature ensures that you can respond quickly to market developments.

Advanced Analytics

Fundamental Charts:

YCharts offers advanced charting capabilities that allow you to visualize data trends over time. These charts are fully customizable, enabling you to add indicators, annotations, and recession overlays. Fundamental Charts are particularly valuable for charting a client’s portfolio performance over time and comparing it to other strategies or benchmarks. This feature helps advisors illustrate how different investments stack up, providing clients with a clear visual representation of their portfolio’s relative performance and assisting in making informed decisions.

Time-Series Analysis:

Conduct detailed historical analyses with YCharts’ Timeseries Analysis tool. Import multiple data points and analyze trends across custom time periods. Data can be exported for further analysis in YCharts’ Excel Add-in or other platforms.

Comp Tables:

Comparative Tables (Comp Tables) allow you to compare multiple securities, funds, or portfolios side by side. This tool is particularly useful for evaluating investment options and printing them onto a PDF to make informed decisions.

Conclusion:

YCharts is a powerful platform equipped with a wide array of features designed to empower financial advisors. From comprehensive data and research tools to advanced portfolio management and proposal generation capabilities, YCharts features provide everything you need to deliver exceptional service to your clients. By leveraging these tools, advisors can enhance their practice, streamline their workflows, and achieve better outcomes for their clients.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Download the Economic Summary Deck:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Best Performing Fixed Income ETFs of 2024: Total Returns, Income Potential & VolatilityRead More →