Tech IPOs, Antitrust Shakeups & the 2025 Market: What Advisors Can’t Afford to Miss

Introduction

Tech initial public offerings (IPOs) are staging a comeback in 2025 against a backdrop of shifting antitrust winds. After the explosive IPO boom of 2021 and the drought that followed, we’re now seeing signs of a tentative revival.

Financial advisors are navigating a transformed landscape. New listings are once again hitting the market, but the environment, shaped by regulation, macro trends, and investor sentiment, looks very different from just a few years ago.

The regulatory climate set in motion by Lina Khan’s leadership at the Federal Trade Commission (FTC) in mid-2021 is evolving rapidly. Her antitrust agenda reshaped expectations for Big Tech, market consolidation, and startup exit routes.

Now, as policy shifts unfold, U.S.-based advisors, from RIAs and wealth managers to broker-dealers — must understand how this intersection of IPO resurgence and antitrust retreat affects client portfolios and investment strategy.

In this blog, we break down the key trends, recent developments, and actionable insights every advisor needs to navigate the 2025 IPO landscape.

Let’s set the stage with the market context behind these developments.

Table of Contents

Market Context: From Boom to Bust and Back Again

The journey of the U.S. IPO market since 2021 has been a rollercoaster mirroring broader market conditions. In 2021, pent-up demand, ultra-low interest rates, and the SPAC frenzy fueled a record-setting IPO boom. Tech startups rushed to market, culminating in what was (at the time) an all-time peak in IPO activity. But the euphoria was short-lived. By the first half of 2022, IPO volumes had collapsed to near-record lows, as inflation and rising rates chilled investor appetite. The post-pandemic darlings of 2020-21 were hit hard – only 11 of 2021’s 100 largest IPOs were even trading above water by mid-2022.

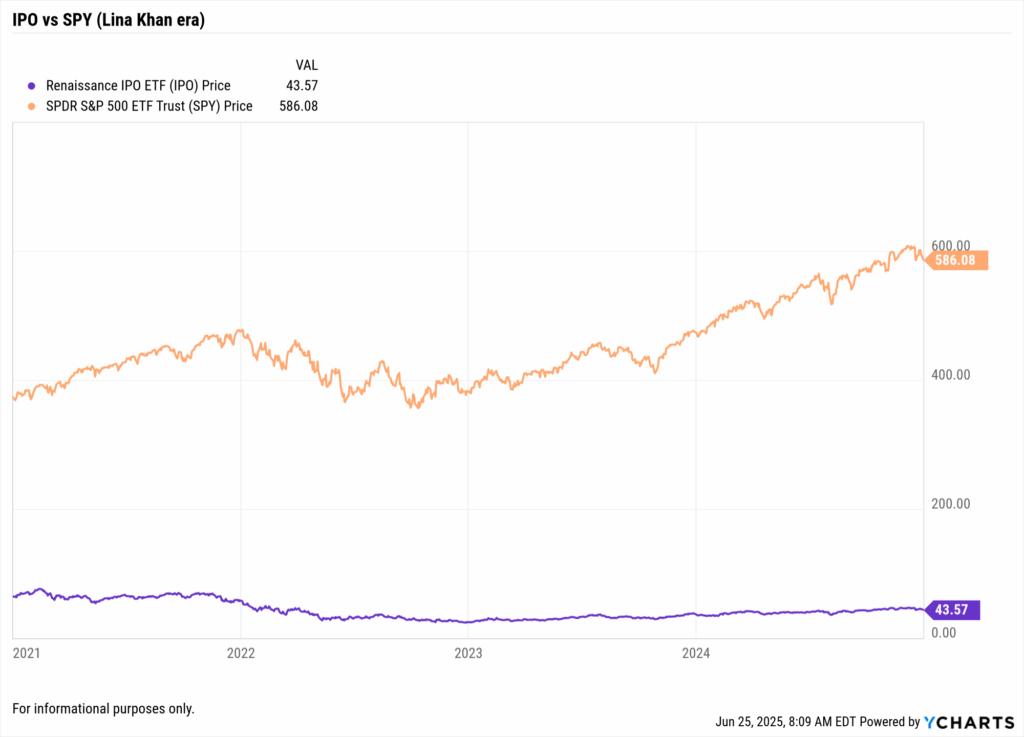

Lina Khan’s ascent to FTC Chair in mid-2021 coincided with this inflection point. Khan’s aggressive antitrust stance, particularly toward Big Tech, introduced new uncertainties. Mega-cap tech firms that once gobbled up promising startups faced tougher scrutiny on acquisitions. While macroeconomic factors were the primary driver of the IPO drought, the regulatory climate contributed to an environment where many late-stage tech companies stayed private longer, seeking alternate exits or waiting for clearer signals.

Fast forward to 2023-2024: the backdrop began to improve. Inflation showed signs of cooling and the Federal Reserve eventually paused its rate hikes, restoring some confidence. By late 2024, market sentiment had rebounded, aided by policy shifts. Following the 2024 U.S. elections, a more pro-business administration signaled easing regulatory pressures – President-elect Donald Trump even moved to replace Lina Khan as FTC chair with a more merger-friendly appointee. This anticipated deregulation, combined with lower corporate taxes, fueled optimism on Wall Street.

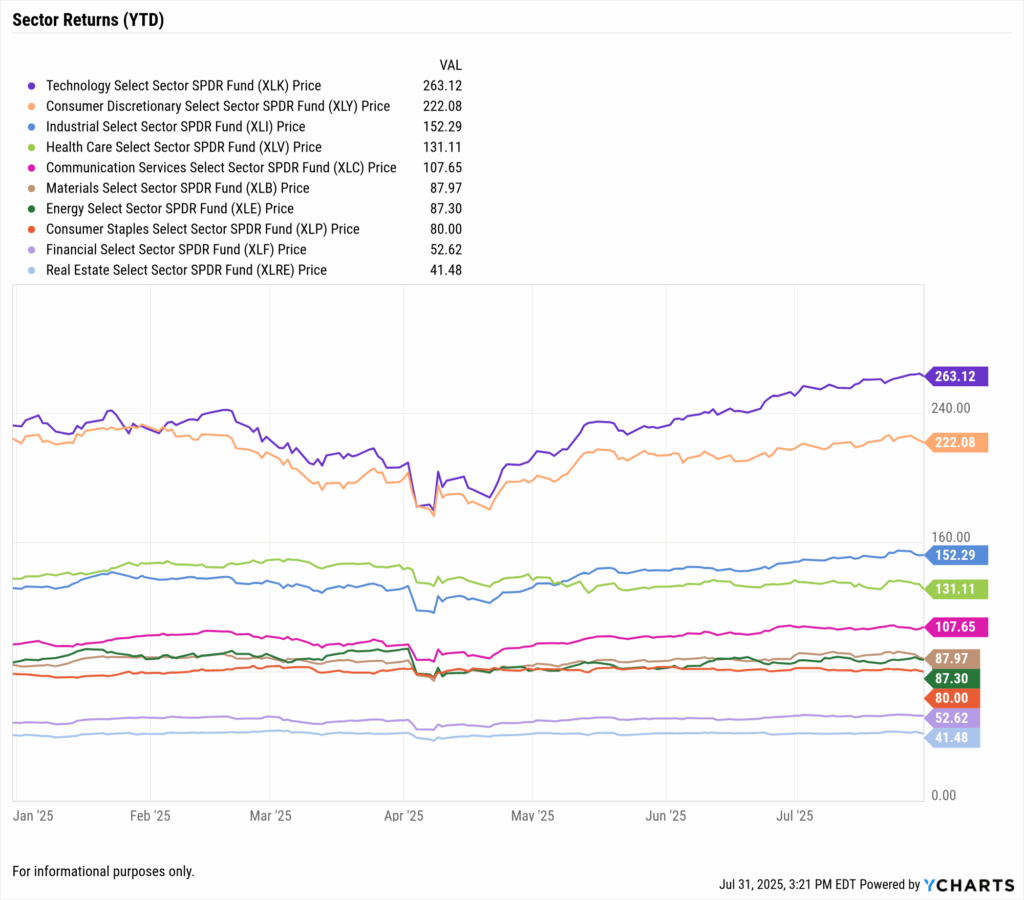

Equity markets responded in force. In the first half of 2025, U.S. stocks surged, led by the tech-heavy Nasdaq and growth names. In fact, May 2025 was the best month for equities since 2023, with the Nasdaq Composite up nearly 9.7% and the S&P 500 up 6.3%. The “Magnificent 7” mega-cap tech stocks (Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, and NVIDIA) roared back, posting outsized gains amid renewed risk-on sentiment. Advisors watched as technology and consumer discretionary sectors jumped ~8–10% in a single month, vastly outpacing defensives like health care. This rally has brought the S&P 500 to fresh multi-year highs, buoyed by strong earnings (Q1 2025 saw 12.9% blended earnings growth year-over-year) and improved investor confidence.

However, it hasn’t been all smooth sailing. In April 2025, abrupt tariff escalations by the Trump administration jolted markets, reminding advisors that policy can cut both ways. A mid-spring threat to double tariffs on key imports sparked volatility and briefly “shackled” IPO activity. The episode highlighted how trade policy and antitrust policy together shape market conditions. Fortunately, by early June 2025, tariff tensions eased with temporary agreements, and the IPO window swung back open.

The net result? As of mid-2025, the U.S. IPO market is in revival mode. Through June 11, U.S. IPOs have raised about $25.4 billion year-to-date – a sharp rise from ~$9.5 billion in the same period of 2023. Recent weeks have seen a flurry of high-profile listings and “eye-popping debuts”. The Renaissance IPO Index (which tracks newly listed stocks) lagged the broader market during the tariff scare, but by June it staged a comeback, now roughly in line with the S&P 500’s gains. In other words, investors’ appetite for new offerings is returning, supported by a favorable stock market and the prospect of friendlier regulatory oversight.

For advisors, this broad market context, a resurgent bull market, easing inflation, and policy shifts toward deregulation, sets the stage for the opportunities and risks discussed below. With the wind at the market’s back, many companies that hunkered down during the 2022–2023 dry spell are seizing their moment to go public. Next, we’ll dive into the tech IPO landscape since Khan’s tenure and what lies ahead.

Asset Focus: Tech IPOs and Antitrust – A New Era Unfolding

What happened to tech IPOs during Lina Khan’s era?

Her strict antitrust approach delayed M&A and IPOs. Many companies, like Stripe and Reddit sat out, fearing scrutiny. The market called this period “IPO Zombieland.”

What’s changed in 2025?

- Antitrust enforcement has softened

- Corporate taxes were lowered

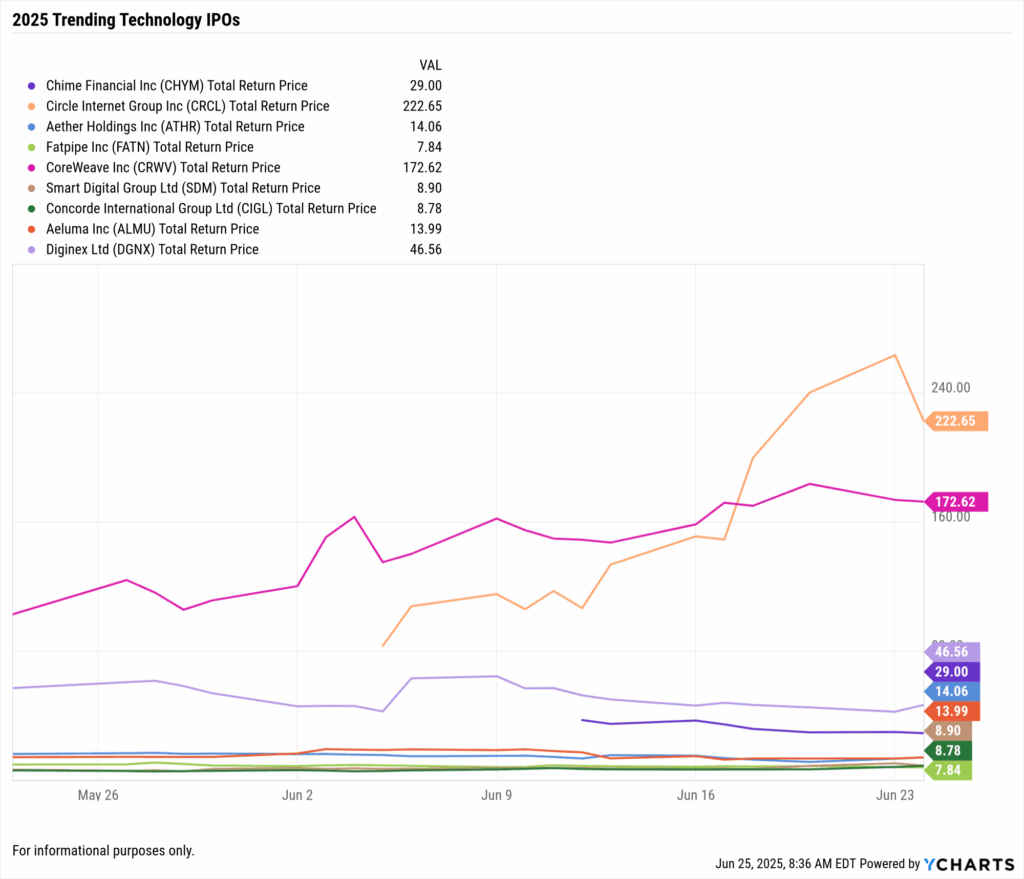

- Chime and Circle IPOs soared (Chime gained 59% on day one)

- M&A projections: up to $700B in tech deals expected this year

What tech IPOs are trending now?

- Chime (CHYM) and Circle (CRCL) – recent winners

- Instacart (CART) – rocky start, but recovered 40% YTD

- Stripe – long-anticipated

- Klarna and Gemini – likely late-2025 IPOs

How does antitrust affect sectors?

- Big Tech: fewer barriers = more deals = stock rallies

- Small/mid-tech: IPO becomes the main exit route

- Fintech & Crypto: regulation lightening = IPO doors opening

- Financials: regional banks and fintechs expected to consolidate

Now, as we reach mid-2025, the pendulum is swinging back. Under the current administration, antitrust rhetoric has softened. (Notably, Morgan Stanley projects tech M&A volume could rebound to $700B in 2025, the highest since 2021.) This easing of regulatory pressure has two significant implications for tech assets:

- More Tech IPOs Hitting the Market: With acquisitive Big Tech less constrained than during Khan’s peak, some startups might indeed get bought out. But a larger effect we’re seeing is renewed confidence to go public. The logic is straightforward: when market valuations are high and the threat of being blocked or undercut by a dominant competitor wanes, the IPO route looks more attractive. Case in point – fintech and crypto-related IPOs have surged this year, showing that even industries once wary of regulatory backlash are stepping forward. In just the past month, digital payments firm Circle (NYSE: CRCL) and neobank Chime (NASDAQ: CHYM) pulled off successful IPOs, each soaring on debut. Chime’s stock jumped 59% on its first day of trading in June, a clear indicator of pent-up demand for fresh growth names.

- Sector Rotation and Competitive Dynamics: A friendlier antitrust environment tends to favor the largest tech incumbents, as they can pursue strategic deals more freely. Indeed, investors have reacted by piling back into the mega-cap “Magnificent 7” stocks – which collectively gained over 13% in May alone – on the expectation that these giants will face fewer constraints. This dynamic can concentrate market performance in Big Tech, as we saw in the first half of 2025 with the S&P 500’s gains heavily driven by its top constituents. Advisors should note that

- Big Tech’s regained M&A flexibility could further entrench their dominance, potentially boosting sectors like Technology and Communication Services in the equity markets. On the other hand, smaller tech firms may benefit indirectly: if they’re no longer easily acquired by the FAANGs, they must sink or swim on their own merits – and going public to raise capital for growth becomes appealing. The downstream effect is a richer opportunity set in the mid-cap tech space and sector diversification. For example, the IPO revival isn’t confined to Silicon Valley software – we’re also seeing activity in sectors like biotech, clean energy, and industrial tech that had been dormant.

Let’s talk concrete examples of recent and upcoming IPOs and what they signal:

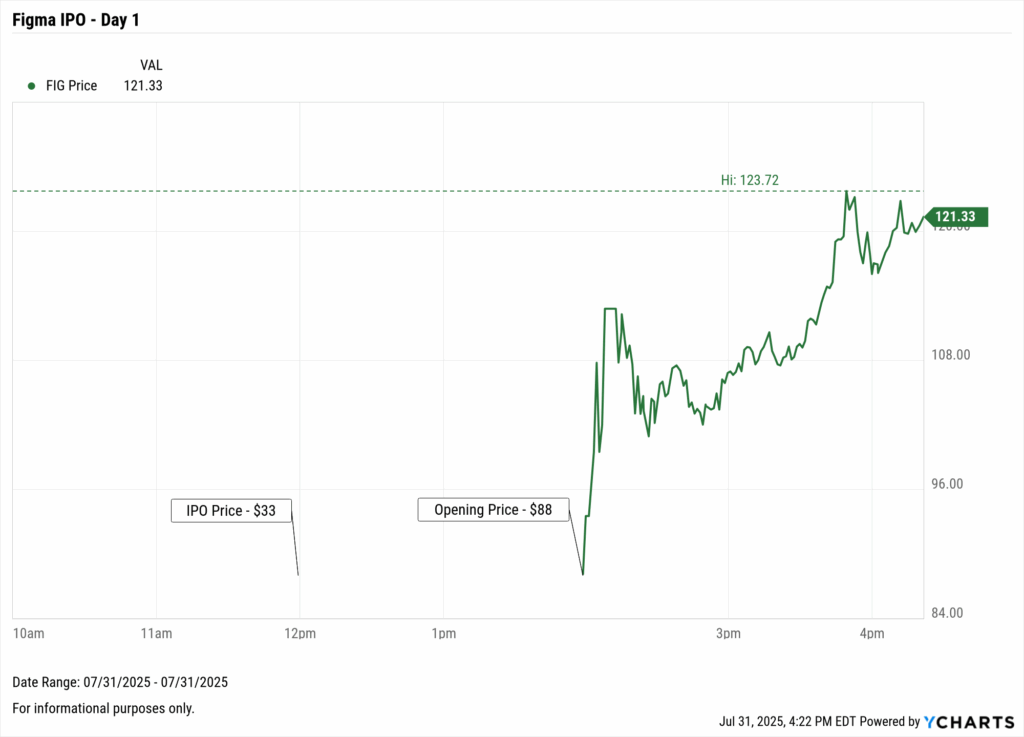

- Newest Winner: Figma (FIG): This has been one of the most highly anticipated tech IPOs of the year, following the collapse of Adobe’s proposed $20 billion acquisition in late 2023 due to regulatory pushback. On the final day of July, Figma officially hit the public markets, pricing at $33 per share and opening above $88. In what became a nearly 40× oversubscribed offering, the stock has posted intra‑day gains as high as 250%. While it remains to be seen where the stock settles, one thing is clear: the successful return of blockbuster tech IPOs is reigniting enthusiasm across the broader market.

- Biggest Comeback: Instacart (CART): The grocery delivery app’s IPO in September 2023 was one of the first big tech offerings after the drought. It priced at $30/share and initially surged to $42, but soon fell below its IPO price as investors reassessed valuations. Instacart’s rollercoaster – ending 2023 around $25 (down 17% from its IPO price) exemplified the market’s cautious attitude last year. Fast forward to mid-2025, and CART has recovered into the high $40s, now trading nearly 60% above its IPO price after a broader tech rally. This turnaround reflects improved sentiment for growth stocks and shows that even if IPOs were tepid at launch, the rising tide of 2025 is lifting many boats. Advisors eyeing recent IPOs should separate short-term pops from long-term potential, as Instacart’s case illustrates: initial underperformance can reverse once fundamentals catch up and macro conditions improve.

- Upcoming: Klarna, Gemini, Cerebras (anticipated 2025): A “packed IPO calendar” for late 2025 is taking shape. Klarna, the Swedish buy-now-pay-later fintech, made headlines by filing an F-1 for a U.S. listing, aiming for a $15B valuation. It briefly paused plans amid tariff jitters, but with trade tensions easing, Klarna may resume its march to market. Gemini, the crypto exchange run by the Winklevoss twins, confidentially filed for a U.S. IPO in June, notable because crypto firms have long been regulatory targets, and their willingness to list indicates a perceived thaw (the Trump administration’s lighter-touch oversight is explicitly “welcomed by digital asset firms”, accelerating such plans). Cerebras, an AI chipmaker, and Medline, a medical supplier, are also cited as marquee IPO hopefuls for 2025. The diversity of these names – fintech, crypto, AI, healthcare – shows the breadth of the IPO rebound. Unlike the narrow SPAC boom of 2021, 2025’s IPO wave spans multiple sectors, hinting at a broadening opportunity set for investors.

What about antitrust shakeups specifically? It’s important for advisors to recognize how regulatory shifts are reverberating across sectors:

- Big Tech and Communications: These were the primary focus of Khan’s crackdown. Lawsuits and blocked deals (e.g. the attempted NVIDIA-Arm merger was scuttled under heavy regulatory pressure) created uncertainty. Now, with leadership change at the FTC, Big Tech stocks have rallied hard – a relief rally on the idea that breakups or strict limits are off the table for now. For instance, an FTC case against a major tech firm that might have loomed over markets has likely been deprioritized. This translates into lower perceived risk premiums for tech sector equities, contributing to their outperformance. Advisors should watch for any signs that this regulatory pendulum could swing back in the future (for example, if political winds change or if Big Tech abuses rekindle calls for action). For 2025, though, the trend is clear: a deal-friendly antitrust environment is boosting not just the tech giants, but also the entire ecosystem of suppliers, partners, and would-be disruptors around them.

- Financials and Fintech: The fintech space provides a useful parallel. It thrived on innovation but faced a regulatory maze (from banking regulators and antitrust enforcers alike). Post-Khan, there’s an expectation of deregulation in financial services too, which may spur more fintech IPOs and M&A. The case of Chime’s blockbuster IPO is instructive, a fintech once considered a disruptor to big banks found a warm reception from public investors. Within financials, advisors might see increased consolidation (regional banks merging, fintechs being acquired by larger institutions) if regulators remain accommodative. A note of caution: while antitrust enforcement is easing federally, some state-level watchdogs or the EU abroad continue to keep Big Tech and Big Finance in check. Thus, global companies still face a patchwork of regimes.

In summary, the asset class implications of tech IPOs and antitrust shifts are multi-fold. We are entering a period where newly public tech stocks are becoming a bigger part of the investable universe (increasing the weight of growth/tech in indices), Big Tech is extending its reach (potentially buoying large-cap indexes further), and certain previously underrepresented sectors (like crypto or specialized tech) are getting their moment in the sun. The next section discusses how advisors can position portfolios amid these changes.

Portfolio Strategy: Positioning Client Portfolios for IPO Resurgence and Policy Shifts

Q: Should advisors chase new IPOs in 2025?

Not blindly. The 2021 cycle showed the risks. Instead:

- Use diversified IPO ETFs like IPO and FPX

- Wait 1–2 quarters after debut to reassess fundamentalsInstacart’s rebound proves patience pays off

Q: What’s the best way to rebalance tech exposure?

- Trim overweight FAANG allocations if overextended

- Rotate into mid-cap innovators (fintech, clean tech, AI)

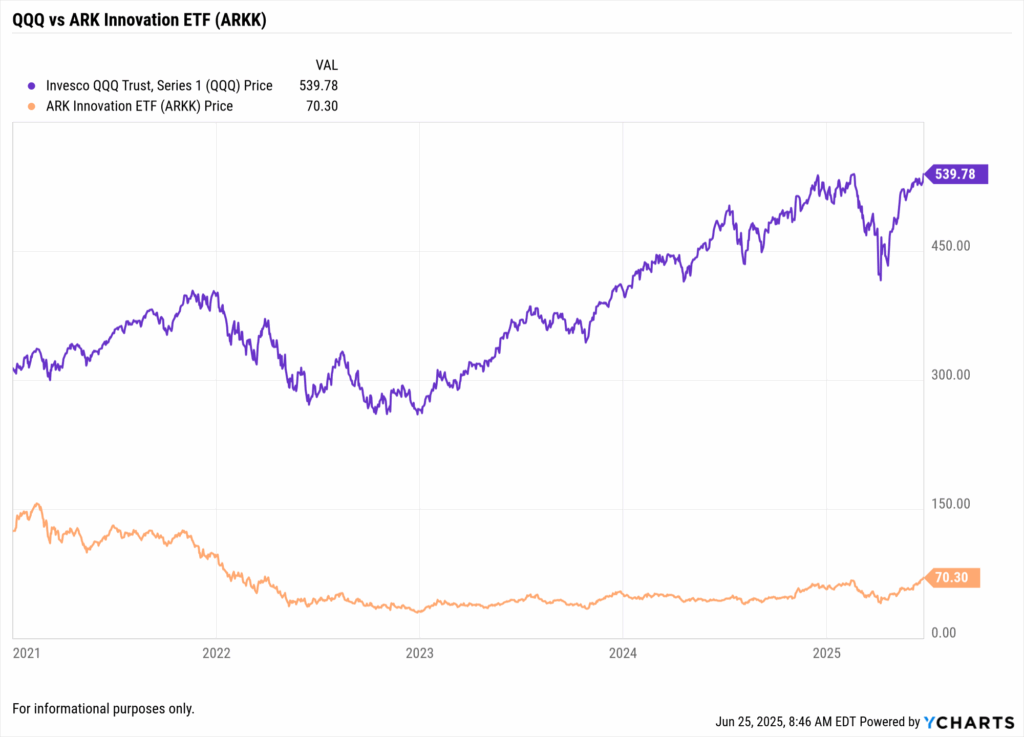

- Use ETFs like ARKK or IWO for small/mid-cap exposure

- Consider sectors likely to benefit from M&A: healthcare, telecom

Q: What macro factors should advisors watch?

- A “policy trilemma”: rate cuts vs. tariffs vs. fiscal expansion

- Maintain defensives: dividend payers, healthcare, cash

- Prepare for pullbacks: use covered calls or tactical bond ladders

Q: How should advisors talk about IPOs with clients?

Be transparent:

- “The IPO window is reopening, not exploding.”

- “Some IPOs outperform, many don’t. Due diligence is key.”

- “Regulation may change again in 2026, don’t over-index on Big Tech.”

Q: How can advisors use this moment to de-risk Big Tech?

Discuss options like:

- Gifting appreciated stock

- Protective puts

- Gradual trimming via tax-efficient rebalancing

YCharts Tools in Action: Turning Insights into Strategy

Stay Macro-Aware

Use the Dashboard to track inflation, sentiment, and rates. Plot IPO Index vs. Fed Funds rate to identify pressure points.

Evaluate Sector Rotation

The Comparison Table reveals how Tech (+10%) outpaced Healthcare (–5%) YTD. Visualize sector P/E and forward growth for informed trims or tilts.

Screen for IPOs with Fundamentals

Use the Stock Screener to filter by IPO date, revenue growth, or valuation. Use the ETF Screener to assess IPO-themed funds or thematic tech funds.

Conclusion: Navigating 2025’s New Frontiers

IPOs are back. Antitrust enforcement is easing. Market conditions are improving. But none of it guarantees success. The 2025 IPO market outlook offers both opportunity and volatility, and clients need advisors to help distinguish between the two.

Financial advisors who:

- Stay macro-aware

- Embrace diversified tools

- Educate on risk and reward

…are the ones who will lead with confidence and clarity.

YCharts provides the macro dashboards, sector visuals, and ETF screeners that make this analysis easy and client-ready.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

RIAs are Embracing these Active Bond ETFs in 2025Read More →