5 Conversations That Turn Summer Into a Planning Season

Summer is Slower. Smart Advisors Move First.

For financial advisors, the midyear mark is more than a date on the calendar; it’s a strategic window and a chance to reset expectations, reassess financial plans, and deepen client relationships. Clients are more relaxed, open to dialogue, and looking ahead.

To help you lead these conversations with confidence, we’ve created a Summer Planning Checklist, a structured guide designed to uncover opportunities, engage the entire household, and reinforce your value as a strategic partner.

From goal tracking to generational wealth planning, these five financial planning touchpoints will help you drive engagement and deliver value across households, even before the fall rush kicks in.

Table of Contents

1. “It’s Half-Time. How Are We Tracking?”

A summer check-in gives clients a clear view of how their portfolios and plans have performed through the first half of the year.

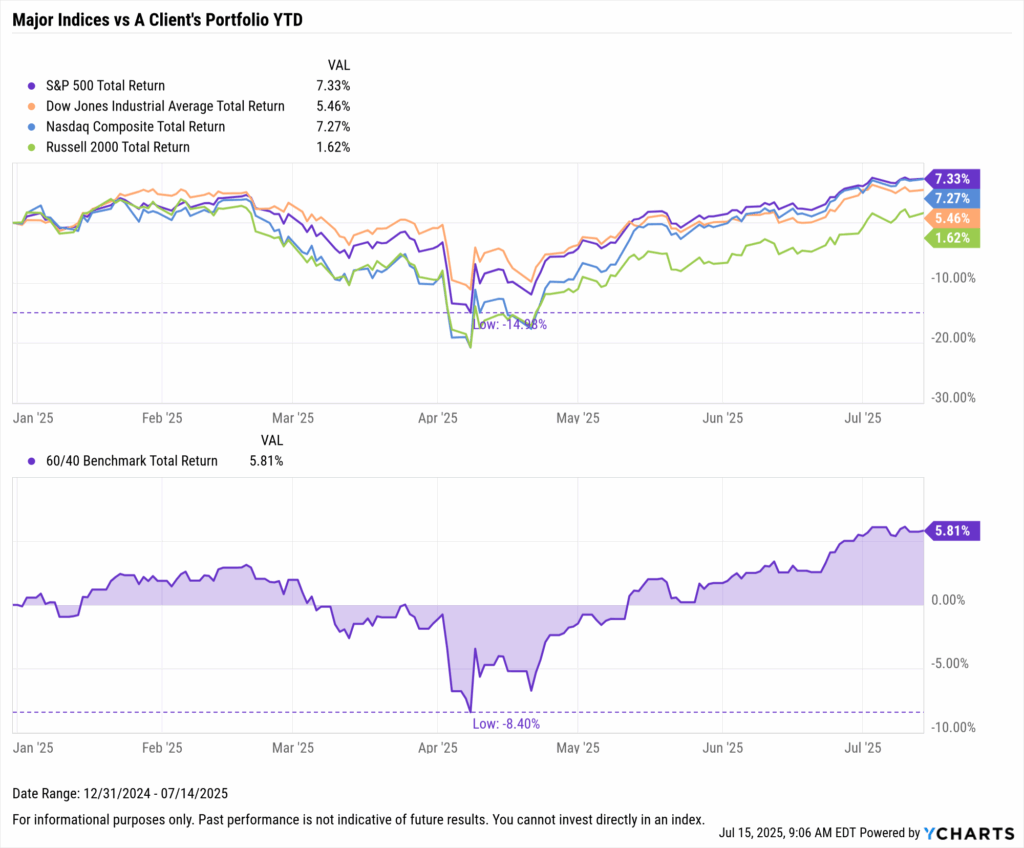

The start of 2025 brought a mix of market highs, pockets of volatility, and shifting sector leadership. While equities have gained ground overall, not all portfolios have moved in lockstep with the major benchmarks. Many clients are wondering how they stack up.

Download Visual | Modify in YCharts

Using Fundamental Charts, you can visually show clients how their portfolios have weathered market changes. You can overlay benchmark comparisons, highlight account-level returns, and guide the conversation with context instead of just numbers.

With a single click, generate a Performance Report or branded tearsheet to leave clients with something tangible that illustrates their progress.

Then pivot to planning

After discussing performance, advisors can pivot the conversation toward goals. Reviewing returns alone is a missed opportunity. The more valuable question is whether the client’s plan still supports their current direction.

Consider using this conversation to:

- Confirm whether long-term goals are still relevant or achievable

- Ask about life events that may have shifted priorities, such as a job change or a growing family

- Reassess whether the existing strategy still matches their financial journey

Shifting the conversation from “How did the portfolio perform?” to “Where are we headed?” allows you to reinforce your role as a strategic partner, not just a money manager.

2. “Let’s Bring the Whole Family In”

Summer reunites families. For advisors, that’s a rare opportunity to open intergenerational conversations around wealth, roles, and responsibilities.However, many families don’t talk about money openly, and even fewer have a documented strategy.

Spouses may lack visibility into the plan. Adult children may be unaware of their future responsibilities. Aging parents may receive financial help informally, with no long-term plan in place.

Why this matters now

Advisors who engage the next generation early are far more likely to retain assets when wealth transfers.

Over the next two decades, an estimated $84 trillion in wealth will change hands in what’s being called The Great Wealth Transfer. This generational transition will define the future of many practices.

If advisors don’t engage the next generation now, they risk losing the relationship when assets transition. But when you include heirs, spouses, and extended family members early, you create long-term loyalty that spans decades.

Use this time to:

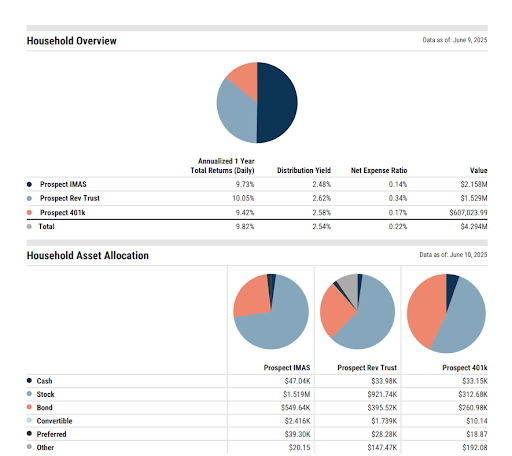

- Offer household-level reviews that bring all stakeholders into one conversation

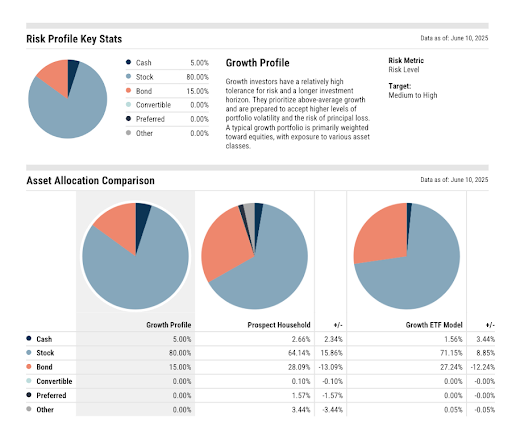

- Compare Risk Profiles between spouses or generations

- Identify gaps in estate plans or financial responsibilities

- Provide client-ready reports that can be shared across family members

With Householding and Proposal tools in YCharts, advisors can group individual accounts into one dashboard. Segment by household member, analyze asset overlap, and build proposals that speak to the entire family.

These conversations may be sensitive, but summer’s slower pace often makes them easier to start. As the advisor, you can reframe them around clarity and shared goals instead of conflict.

3. “How Are Rising Prices Affecting You?”

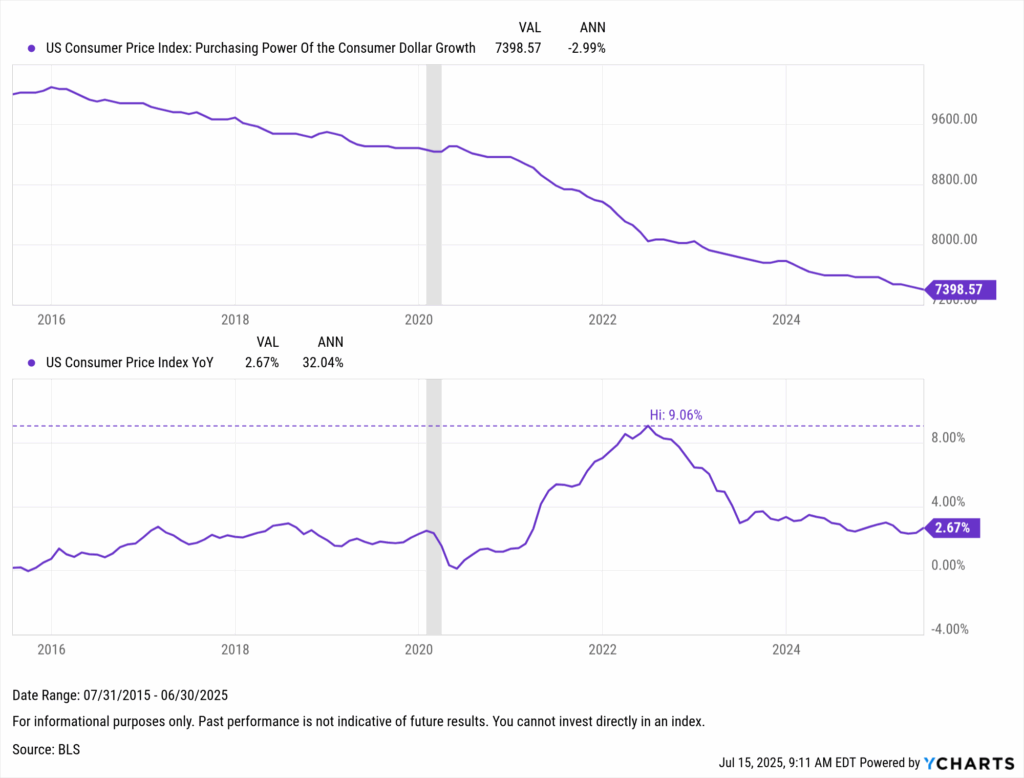

Inflation isn’t a headline; it’s personal. Clients feel it in grocery bills, tuition, travel. You can use those everyday moments to start bigger conversations. Even with inflation cooling compared to last year, today’s dollar doesn’t stretch as far as it used to.

While CPI data might look better on paper, clients want to talk about what they’re seeing in their daily lives.

Download Visual | Modify in YCharts

Use a visual, such as the purchasing power of a dollar, to illustrate how inflation has eroded value over time. These tools create an entry point for meaningful conversation.

Ask your clients:

- Where are you feeling financial pressure right now?

- Have you adjusted your budget or savings strategy?

- Are rising costs impacting retirement expectations or timelines?

- Do you feel comfortable with your current emergency reserves?

Then, turn what you learn into action. Depending on the answers, you may recommend:

- Adjusting drawdown strategies to account for increased expenses

- Rebalancing into inflation-protected securities

- Increasing savings contributions while wages remain stable

- Reassessing how much cash is held for short-term needs

Small updates can lead to greater peace of mind. More importantly, they show clients that your advice goes beyond the market; it connects directly to their lives.

4. “Is Your Plan Still Built for What’s Ahead?”

Markets shift. So do client dreams. Whether they’re eyeing a home purchase, business exit, or early retirement, summer is the time to recheck assumptions.

At the same time, clients are paying attention to headlines and wondering how broader events might affect their future.

Help clients navigate market uncertainty

So far in 2025, the financial planning environment has been shaped by:

- U.S. political uncertainty and the potential for tax policy changes

- Geopolitical tension in Europe and the Pacific

- A Federal Reserve that has held rates steady while markets shift expectations

- Sticky inflation in housing, healthcare, and education

Even if clients don’t bring these topics up directly, they’re thinking about them. This is your opportunity to address their concerns, reframe the conversation around their plan, and provide reassurance.

Use this time to:

- Revisit timelines for major goals such as retirement, home purchases, or education

- Evaluate whether projected spending still aligns with new interest rate assumptions

- Run stress tests to see how the plan holds up under different inflation or market scenarios

Download the Top 10 Visuals Deck for Clients & Prospects

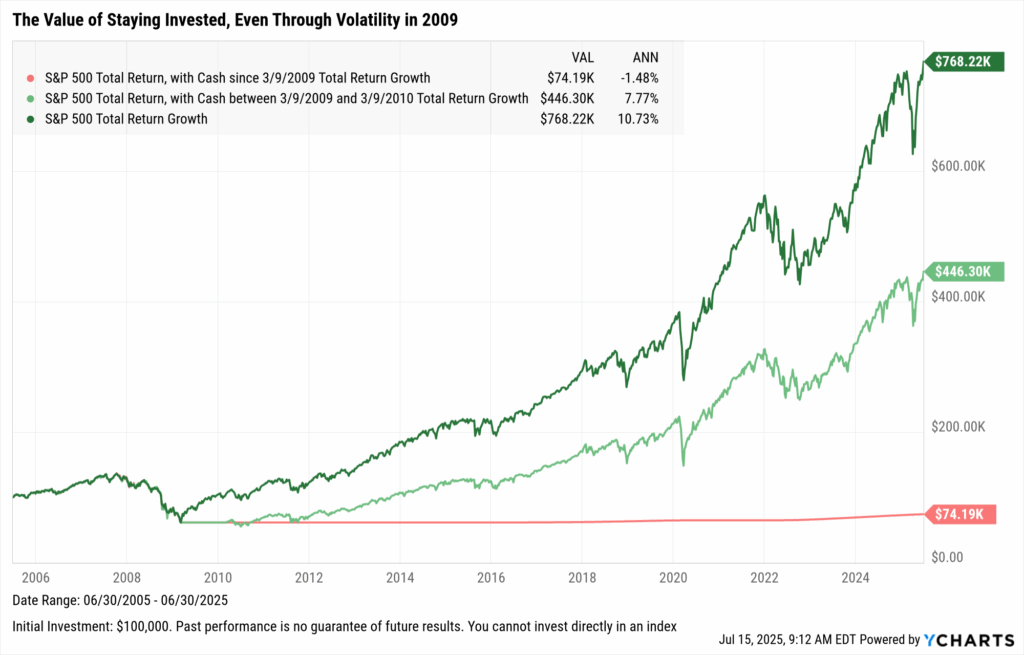

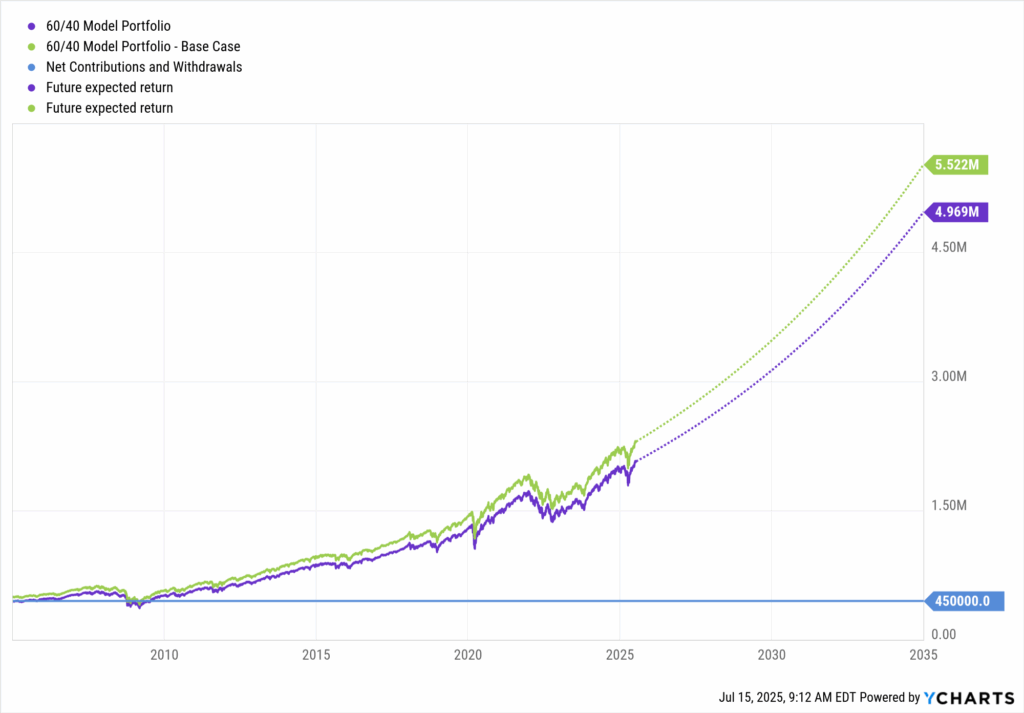

The Scenarios Tool in YCharts allows you to model real-world tradeoffs. If a client is considering pulling back from the market, making a large purchase, or pausing contributions, you can show the long-term implications in just a few clicks.

Download Visual | Modify in YCharts

In one scenario, a $50,000 withdrawal today might not seem significant. But when projected over 30 years, it could reduce future value by more than $500,000. Clients often need to see these numbers visually to fully understand the impact.

It’s not speculation. It’s visual, data-backed advice clients trust.

5. “What Needs to Change Before the Year Does?”

Most year-end planning fails because it starts in October. Summer is often the most effective time to prepare for year-end. Clients are less rushed and more open to in-depth planning conversations. Framing this now as a preemptive touchpoint reduces stress and ensures key strategies are in motion.

Start with tax planning

Tax strategies are most effective when implemented midyear. This includes:

- Estimating taxable income to forecast bracket movement

- Exploring Roth conversions while income is lower

- Identifying opportunities for tax-loss harvesting

With Cap Gains Valet and the Transition Analysis tool in YCharts, you can surface capital gains exposure and identify portfolio adjustments without spending hours on manual research.

Check in on charitable giving goals

If done strategically, charitable contributions can reduce taxable income while reinforcing a client’s values. Use this moment to align planned donations with broader financial goals and ensure execution well before year-end deadlines.

Review Required Minimum Distributions (RMDs)

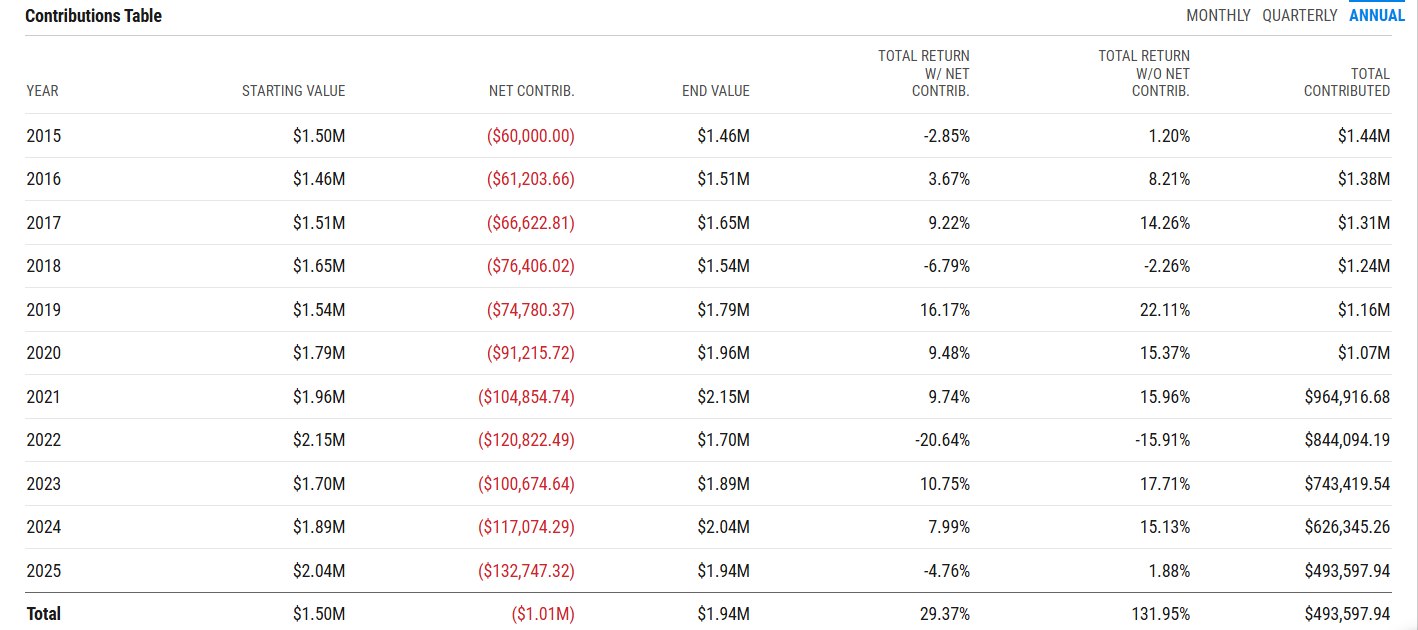

For clients age 73 and older, the IRS requires minimum annual withdrawals from traditional IRAs and 401(k)s. These distributions are calculated using a rising percentage based on age. YCharts allows you to model this using a 5% annual increase, which aligns with the IRS schedule from ages 75 to 85.

Build a Scenario in YCharts to demonstrate how RMDs will affect income, taxes, and total portfolio value. For clients not yet drawing from their retirement accounts, this insight helps prevent surprises and supports better drawdown strategies.

Put Summer Conversations to Work

Looking to turn these summer conversations into year-end action? Check out our latest YCharts University, where we share high-impact workflows to help advisors shift into Q4 with confidence.

Learn how to bring timely planning topics into client meetings, from education funding and tax payments to re-engagement strategies that drive meaningful year-end progress.

YCharts is the platform behind it all equipping you to:

- Deliver custom visuals in minutes

- Turn raw data into strategic insight

- Engage families, not just individuals

- Scale planning without sacrificing personalization

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Want to reduce time spent researching stocks, funds, or macro trends?

Explore how advisors are using AI in YCharts to accelerate their workflows.

2. Wondering how an efficient, compliant, and personalized proposal process could transform your business?

Check out how Alan Cohen used YCharts Proposals to double his business, and how you can too.

3. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

The Berkshire Breakdown: Why Buffett's Succession Sparked an Alarming 11-Point Performance GapRead More →