Helping Clients Navigate the “Big Beautiful Bill”

Major Policy Changes Ahead: What Advisors Need to Know

Less than six months into President Trump’s second term, a signature piece of legislation has already been passed by both houses and signed into law.

Though many of the provisions contained in The One Big Beautiful Bill Act (“OBBBA”) of 2025 don’t kick in until at least 2026, the second half of the year is a crucial time for advisors to start planning for how the nearly 1,000-page Congressional act will affect clients’ financial plans.

This blog examines upcoming changes to tax policy in the landmark legislation, analyzes the forecasted federal fiscal picture, and features talking points for advisors to consider using in client conversations.

For a visual breakdown of these planning opportunities and legislative shifts, consider our latest slide deck.

What is The One Big Beautiful Bill Act?

The One Big Beautiful Bill Act reshapes the landscape for high-net-worth individuals and business owners with lasting changes to estate exemptions, charitable deductions, business tax treatment, and more. Advisors have a timely opportunity to add value by helping clients interpret and act on these changes.

The bill delivers sweeping tax cuts, estate planning changes, and business tax reforms, creating both complexity and opportunity for HNW families and business owners.

While political shifts dominate headlines, advisors play a critical role in helping clients focus on fundamentals. Major policy shifts can feel disruptive, but they also open doors for thoughtful planning. Advisors who deliver personalized strategies and keep clients focused on long-term fundamentals rather than short-term headlines are best positioned to lead through change.

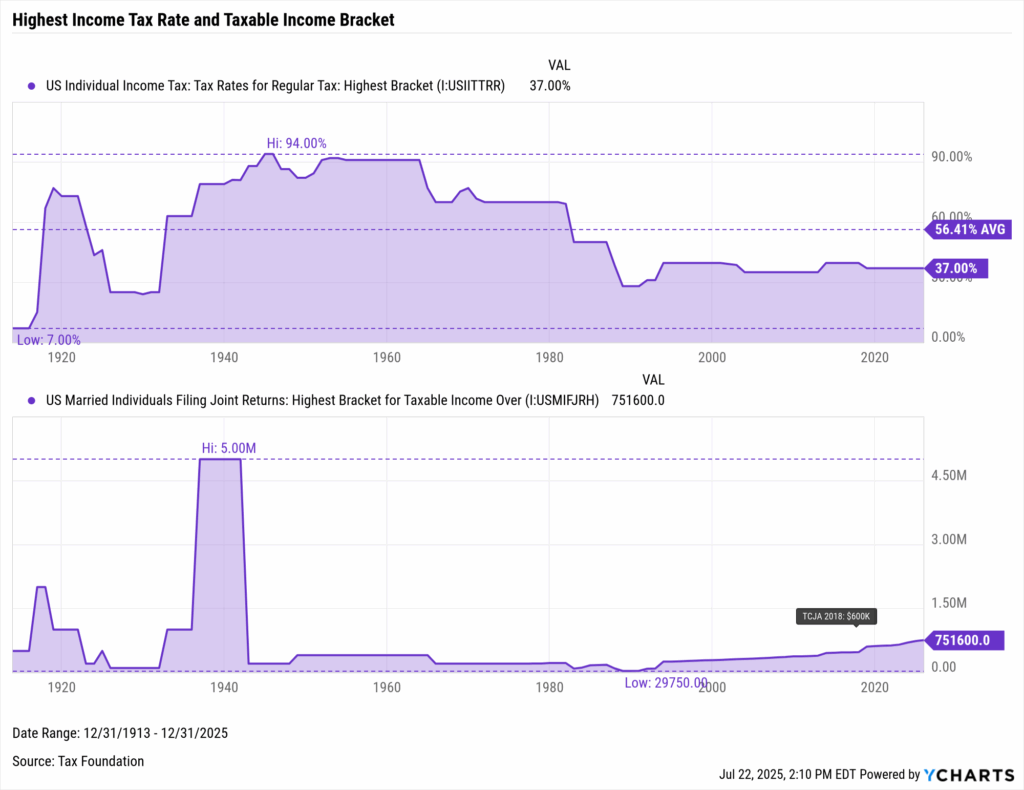

Tax Policy Changes

The Tax Cuts and Jobs Act of 2017 temporarily lowered the highest marginal tax bracket from 39.6% to 37% through 2025; the OBBBA permanently extends the 37% top income tax rate. For joint filers, the income required to fall into the highest tax bracket is now over $750,000, a 25% increase from the $600,000 threshold for fiscal year 2018.

While tax brackets are adjusted for inflation annually, a permanent cap on the highest tax rate affords advisors the stability to help high earners plan ahead for the long term.

Download Visual | Modify in YCharts

The OBBBA contains many additional tax considerations for HNW/UHNW individuals and business owners. Below are seven prominent policies that are changing as a result of the OBBBA and tips for advisors to navigate the changes:

Estate, Gift, and Generation-Skipping Transfer Tax Exemptions

HNW clients will benefit from a larger exemption limit to transfer wealth tax-free. The current estate, gift, and GST tax exemption of $13.99 million per person was set to be reduced by half in 2026, but the OBBBA increases the base exemption to $15 million per person ($30 million per couple) beginning next year.

Takeaway: Though the new tax exemption limits are indefinite, they aren’t immune to changes made by future administrations. Advisors should consult with clients to evaluate gifting and trust strategies both going into next year when the higher exemption limit kicks in, as well as future election cycles in case of a changed political environment that advocates for lower thresholds.

Itemized Deduction Cap

Financial planning strategies that rely heavily on deductions, such as writing off investment interest or advisory fees, will become less valuable. This is because the overall limitation on itemized deductions has been replaced with a new limitation that effectively caps the benefit of each itemized deduction at 35%.

Takeaway: Advisors may need to re-evaluate planning for tax-sensitive clients who historically benefited from broad itemization.

Charitable Giving

The new 0.5% Adjusted Gross Income floor means fewer clients will benefit from itemizing charitable gifts. Charitable write-offs won’t kick in until itemizers have donated at least 0.5% of their AGI.

Example: a client with $1M in AGI donates $7.5K in a calendar year.

- In 2025, the full $7.5K donation is deductible.

- In 2026, only $2.5K is deductible, as the first $5K (0.5% of $1M) is excluded.

- Result: A $5K drop in tax-deductible giving without any changes to income or donation amount.

Takeaway: Advisors may want to reassess the use of donation vehicles like donor-advised funds or Charitable Remainder Trusts to maintain clients’ tax efficiency and philanthropic goals. Advisors should also help clients evaluate the timing of charitable gifts, especially large planned contributions, to preserve deductibility benefits.

Explore this example and more using YChart’s Scenarios Tool.

SALT Deduction Cap

Middle-income clients will see temporary relief with the State and Local Tax (SALT) deduction cap raised to $40,000 through 2029, but high earners still face the existing $10K limit.

Takeaway: This may limit the benefits of a tax provision leveraged by residents living in a high-tax state, making location-based planning and income smoothing more relevant.

QSBS Expansion

Enhanced Qualified Small Business Stock (QSBS) rules will allow founders and early employees a lifetime exclusion of up to $15M in capital gains, a 50% increase from the existing threshold of $10M. Taxpayers can exclude capital gains on a tiered basis starting after three years, and become eligible for full 100% exclusion after five years.

Takeaway: Advisors working with business owners may want to revisit equity structures and exit timing to maximize these benefits.

Bonus Depreciation & R&D Expensing

Clients running private businesses can now fully expense qualifying purchases and R&D indefinitely, offering new flexibility to manage taxable income and reinvest in growth.

Takeaway: Advisors can consider collaborating with their clients’ CPAs to evaluate how these changes could support near-term capital expenditures, innovation initiatives, or broader tax planning objectives.

Opportunity Zones

The new, permanent Opportunity Zones program, which will start in 2027, opens new opportunities for deferring and reducing capital gains.

Takeaway: Advisors may want to start preparing clients with liquidity events, concentrated positions, or exit planning needs tied to multigenerational wealth goals to take advantage of the new rules when they go live.

Some of these changes create up to a two-year planning window, while others will take effect as early as January 1st, 2026. Smart advisors will use it to reposition clients ahead of the tax policy shift that begins in 2026, taking advantage of the stability in today’s tax code while preparing for changes coming in the near future.

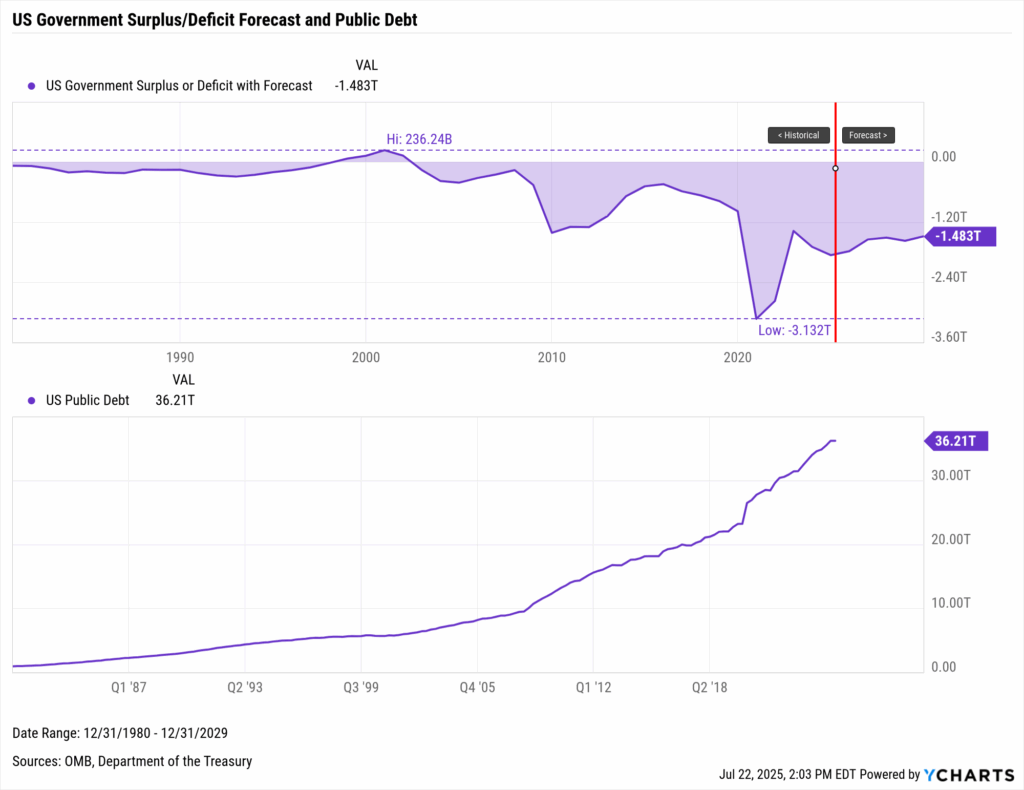

The Fiscal Picture

One of the most contested aspects of the OBBBA was its projected impact on the federal deficit, prompting some Republican lawmakers to oppose the final version of the legislation. According to the Congressional Budget Office, the bill is expected to increase projected deficits by $2.8 to $3.4 trillion, raising the risk of a U.S. credit outlook downgrade.

Download Visual | Modify in YCharts

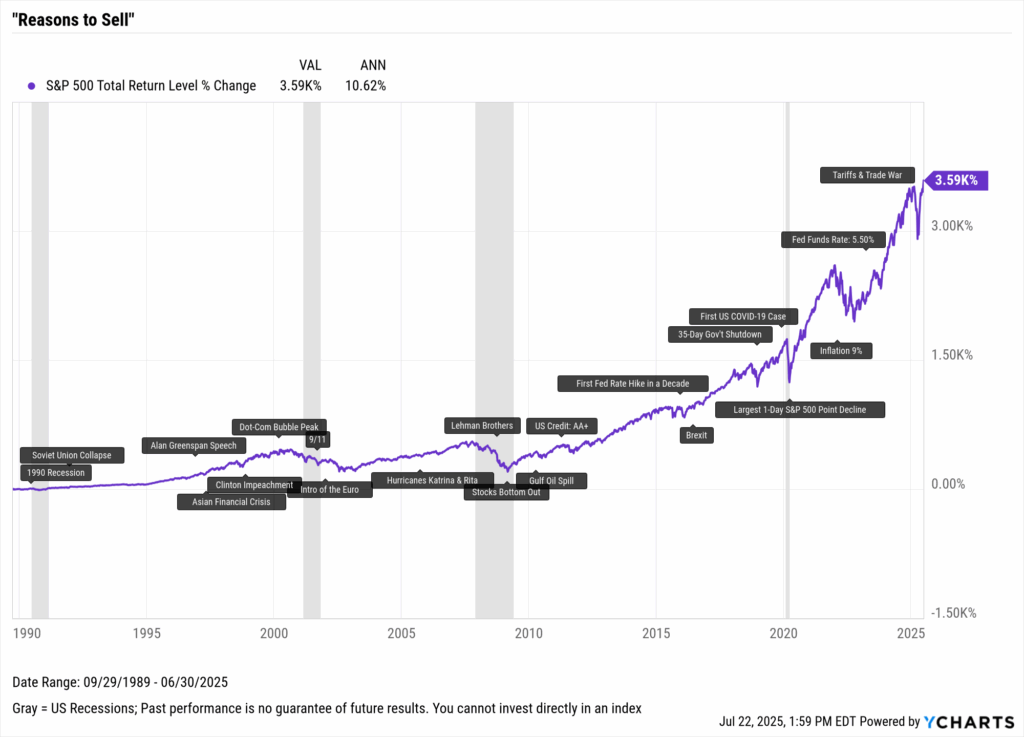

Markets have endured a wide range of fiscal, legislative, and economic policy shifts, from record deficits to surpluses, and wartime spending to tax overhauls. Through it all, long-term investors who stayed the course were rewarded.

Despite volatile government policy and political change, equities have delivered strong long-term growth. Helping clients focus on long-term trends and avoid reactionary decisions remains one of the most impactful ways advisors can add value.

Download Visual | Modify in YCharts

Advisors should help clients stay focused on their financial plans. While news about deficits can trigger short-term market volatility, long-term portfolio performance depends on fundamentals, not headlines.

Craft A Politically Aligned Strategy

For advisors with worried or uncertain clients asking about what effects the OBBBA will have on their financial plan, here are some points to consider in the months ahead:

- Create Planning Windows. Before changes take effect, the OBBBA opens opportunities to engage HNW and business owner clients on estate strategy, income planning, and entity structure.

- Act on Timing. From charitable giving to harvesting gains and estate restructuring, timing is critical. Advisors should help clients act or reevaluate in 2025 to lock in tax efficiency.

- Stay the Course. As headlines heat up, long-term discipline becomes a differentiator. Advisors are key in keeping clients focused on strategy, not noise.

- Tailor Every Strategy. The OBBBA’s complexity makes broad guidance insufficient. Advisors who tailor strategies to clients’ unique income, entity structure, and legacy goals will drive deeper value.

- Cut Through the Noise. In a volatile landscape, clarity wins. Advisors who simplify the complex and lead decisively will keep clients aligned with long-term objectives.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Want to reduce time spent researching stocks, funds, or macro trends?

Explore how advisors are using AI in YCharts to accelerate their workflows.

2. Wondering how an efficient, compliant, and personalized proposal process could transform your business?

Check out how Alan Cohen used YCharts Proposals to double his business, and how you can too.

3. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Trade War Winners: Who Benefits from Tariffs as Deadline LoomsRead More →