Monthly Canada Market Wrap: April 2022

Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Looking for the US Market Wrap? Click here.

Canada Market Summary for April 2022

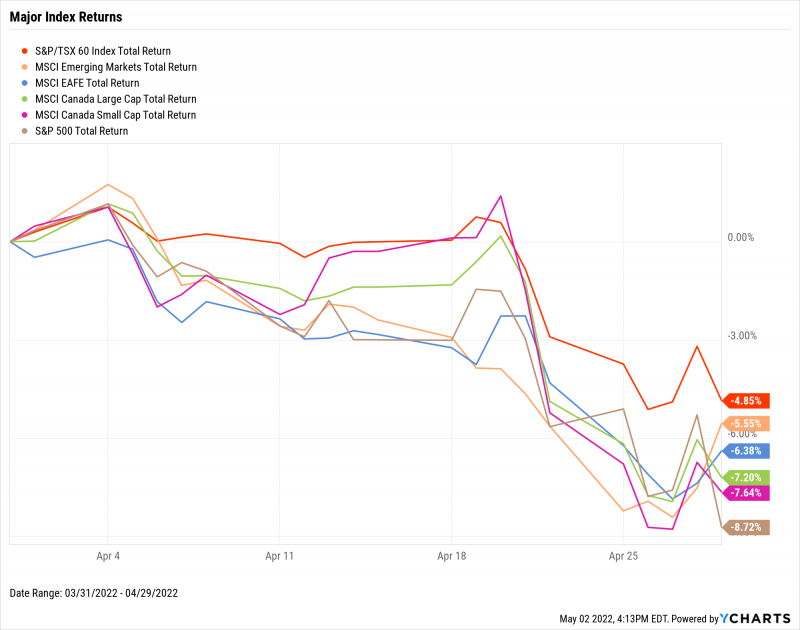

Equities gave up last month’s rebound, as the S&P/TSX 60 index fell 4.9% in April. US markets were worse off—the S&P 500 declined 8.7%, and the NASDAQ tumbled 13.2%. Both Canadian Small Caps and Large Caps posted larger losses than the TSX overall, though large caps declined 44 fewer basis points than small caps did.

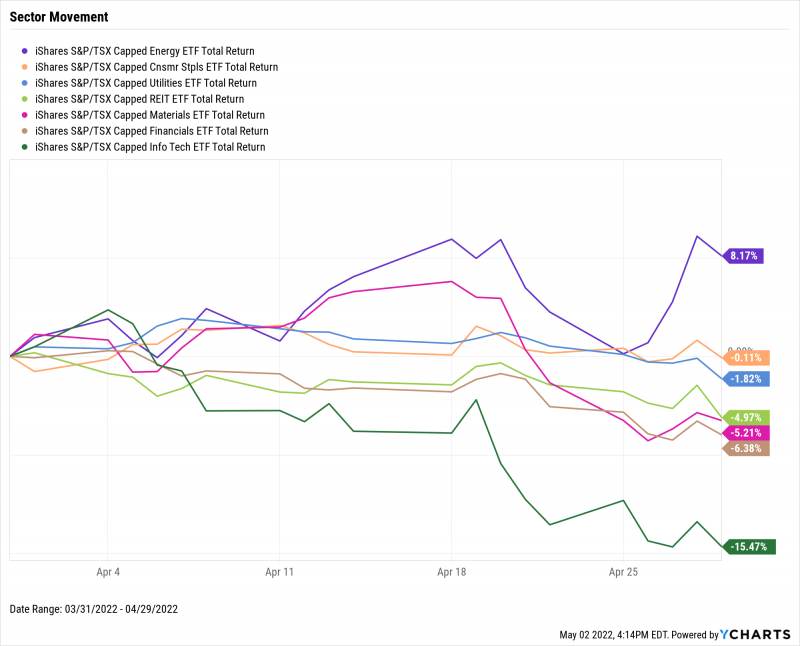

Energy was the only sector to finish April in the black, up 8.2%. Defensive sectors such as Consumer Staples and Utilities posted relatively smaller losses in April, but the biggest decliner was the rate-sensitive Info Tech sector, plunging 15.5%.

Key economic data includes the Canadian unemployment rate tying its record low of 5.3%, previously reached in October 2007. Canadian inflation climbed for the ninth consecutive month to 6.66%, and Canada’s Consumer Price Index rose by a relatively significant 0.89% in April. Manufacturing logged another strong month—the Canada Ivey PMI stood at 74.2 as of April’s end, just two months after the index was on the border of contraction territory.

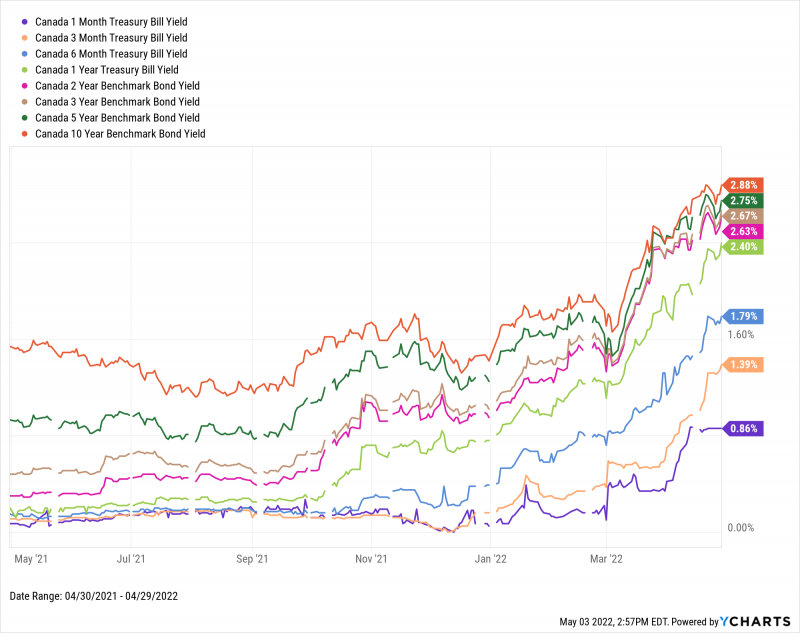

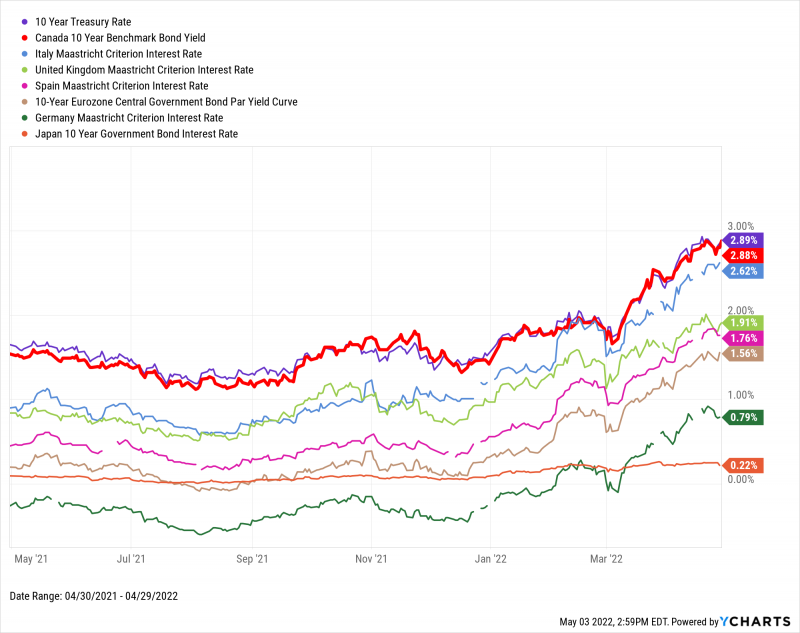

Finally, Canadian fixed income yields continued increasing, with the Canada 10-Year ending April at 2.80%. Shorter-term instruments posted the largest monthly increases. Yields on both the 1-Month Treasury Bill and 3-Month Treasury Bill more than doubled, from 0.34% to 0.86% and 0.60% to 1.34%, respectively. The Bank of Canada raised its target overnight interest rate by 50 basis points in April to 1.00%, with more hikes expected in the near term. One Reuters poll of economists has forecasted rates will reach 2.25% by Q2 of next year.

Jump to Fixed Income Performance

Equity Performance

Major Indexes

Download Visual | Modify in YCharts

Canadian Sector Movement

Download Visual | Modify in YCharts

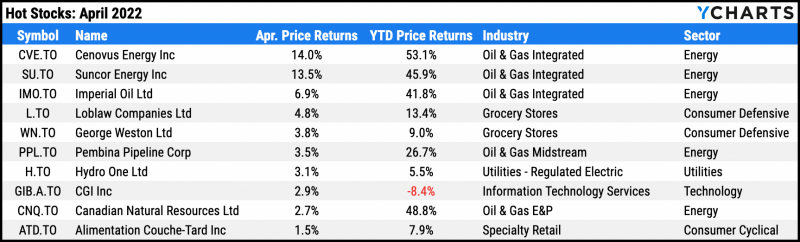

Hot Stocks: Top 10 TSX 60 Performers of April 2022

Cenovus Energy (CVE.TO): 14.0% gain in April 2022

Suncor Energy (SU.TO): 13.5%

Imperial Oil (IMO.TO): 6.9%

Loblaw Companies (L.TO): 4.8%

George Weston (WN.TO): 3.8%

Pembina Pipeline Corp (PPL.TO): 3.5%

Hydro One (H.TO): 3.1%

CGI Inc (GIB.A.TO): 2.9%

Canadian Natural Resources (CNQ.TO): 2.7%

Alimentation Couche-Tard (ATD.TO): 1.5%

Download Visual | Modify in YCharts

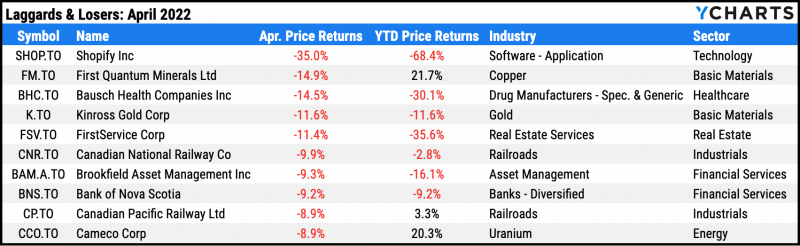

Laggards & Losers: 10 Worst TSX 60 Performers of April 2022

Shopify (SHOP.TO): -35.0% decline in April 2022

First Quantum Materials (FM.TO): -14.9%

Bausch Health Companies (BHC.TO): -14.5%

Kinross Gold (K.TO): -11.6%

FirstService (FSV.TO): -11.4%

Canadian National Railway (CNR.TO): -9.9%

Brookfield Asset Management (BAM.A.TO): -9.3%

Bank of Nova Scotia (BNS.TO): -9.2%

Canadian Pacific Railway (CP.TO): -8.9%

Cameco (CCO.TO): -8.9%

Download Visual | Modify in YCharts

Economic Data

Employment

March’s Canadian unemployment rate tied its record low of 5.3%, last set in October 2007. The Canada Ivey Employment index rose 2.3 points to 62.5, following a February in which the index jumped 11.2 points. Canadian Part-time Employment recorded a slight monthly decrease of 22,000 part-time workers in March.

Production and Sales

The Canada Ivey PMI reading for March vaulted by 22% to 74.2, setting a record in the index’s four-and-a-half year existence. This succeeds a February in which the index went from 50.7 to 60.6, a jump of 20%.

Housing

The Canada New Housing Price Index increased 1.22% month-over-month, almost five times above its all-time monthly average change of 0.24%.

Consumers and Inflation

Canada’s Consumer Price Index rose 0.89% in February, its largest monthly increase since September 2005. The Canada Inflation Rate increased by almost a full percentage point to 6.66%, which is the highest level since January 1991 and its ninth consecutive upward month.

Gold

April marked the second month in a row in which the price of gold in CAD went practically unchanged, ending the month at $2,442.70 CAD per ounce. Even so, the iShares S&P/TSX Global Gold ETF (XGD.TO) tumbled 5.5% in March.

Oil

Oil fell below $100 USD for the first time in 2-3 weeks. The Daily Spot Price of WTI was $99.60 USD per barrel as of April 25th, while Brent sat at $99.27 USD. From their respective highs on March 8th, WTI is currently 19.4% lower, and Brent is down 25.5%.

Cryptocurrencies

As with equities, the prices of major cryptocurrencies fell sharply in April. One Bitcoin cost $38,651 USD on April 30th, representing a monthly decline of 17.9%. Ethereum ended April 16.7% lower, at $2,817 USD. Cardano fared the worst in April, tumbling 32.3% in April to 80 cents USD per coin. It has been six months since Ethereum and Bitcoin logged a new high—they have drawn down 39.1% and 41.2% respectively, while Cardano is 71.6% off of its all-time high.

Featured Market & Advisor News

Canada extends growth streak with 5.6% annualized expansion (BNN)

How Oil and Gas Prices Impact the Economy (YCharts)

Financial planning projections peg long-term inflation at 2.1% (Advisor’s Edge)

Economic Update — Reviewing Q1 2022 (YCharts)

Canada faces record wave of retirements as it grapples with historic labour shortage (Financial Post)

Q1 2022 Fund Flows: March Buyers Bring April Sellers? (YCharts)

Fixed Income Performance

Canadian Treasury Yield Curve

Canada 1 Month Treasury Bill Yield: 0.86%

Canada 3 Month Treasury Bill Yield: 1.39%

Canada 6 Month Treasury Bill Yield: 1.79%

Canada 1 Year Treasury Bill Yield: 2.40%

Canada 2 Year Benchmark Bond Yield: 2.63%

Canada 3 Year Benchmark Bond Yield: 2.67%

Canada 5 Year Benchmark Bond Yield: 2.75%

Canada 10 Year Benchmark Bond Yield: 2.88%

Download Visual | Modify in YCharts

Global Bonds

10 Year Treasury Rate: 2.89%

Canada 10 Year Benchmark Bond Yield: 2.88%

Italy Long Term Bond Interest Rate: 2.62%

United Kingdom Long Term Bond Interest Rate: 1.91%

Spain Long Term Bond Interest Rate: 1.76%

10-Year Eurozone Central Government Bond Par Yield: 1.56%

Germany Long Term Bond Interest Rate: 0.79%

Japan 10 Year Government Bond Interest Rate: 0.22%

Download Visual | Modify in YCharts

Have a great May! 📈

Next Article

The Risks & Rewards of Leaning into Mega CapsRead More →