Bridging the Generational Gap Between Advisors and Investors

- Can advisors close the generational gap before the next major transfer of wealth?

- What’s truly driving younger investors to think, communicate, and invest differently?

- How can advisors build trust with clients who value access, transparency, and meaning?

Interested in testing out YCharts for free?

Start 7-Day Free TrialA growing disconnect exists between advisors and the next generation of investors. Younger clients think, communicate, and invest differently, yet many still feel misunderstood by the financial professionals who hope to serve them.

While Baby Boomers and Gen X often prioritize performance, Millennials and Gen Z value transparency, relevance, and digital access. For advisors, closing that gap may require rethinking your approach.

Advisors who can meet this generation with personalized insights and visuals, rather than traditional performance reviews, will stand out.

Table of Contents

Investing Is More Accessible Than Ever

The investment process looks different than it once did. Brokerage platforms have made investing possible in seconds for anyone with a phone and the barrier between financial curiosity and participation has all but disappeared.

Online communities have accelerated that shift.

- WallStreetBets, now home to over 20 million Reddit users, has turned idea sharing into a collective search for the next opportunity.

- Social platforms continue to shape behavior, with 72 percent of Gen Z and 57 percent of Millennials seeking financial advice through those channels (Inc, 2025).

YCharts chart featured on the homepage of r/WallStreetBets with over 50,000 upvotes and 1,000 comments, making it the subreddit’s eighth most popular post of 2025.

What Is Driving the Shift?

This generation has grown up through rapid technological change, rising costs of living, and constant market noise. They value the ability to act quickly when opportunity appears, and they want their investments to mean something.

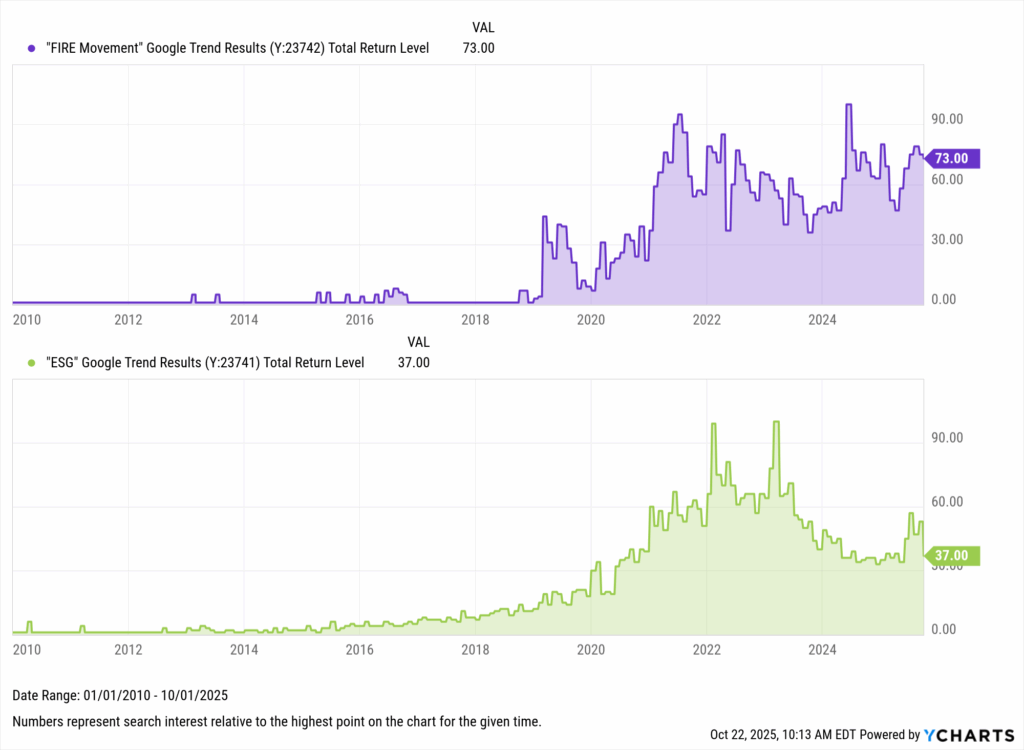

Search trends reveal this balance between independence and purpose. Interest in “FIRE Movement” and “ESG” has climbed sharply in recent years, showing how younger investors blend financial freedom with personal conviction.

FIRE, short for “Financial Independence, Retire Early,” focuses on aggressive saving and investing to gain freedom from traditional work decades earlier than average.

Advisors who understand these ideals can build stronger relationships. By recognizing what drives these generations and reflecting those priorities in their approach, advisors can turn awareness into meaningful engagement.

Connecting Priorities With Portfolios

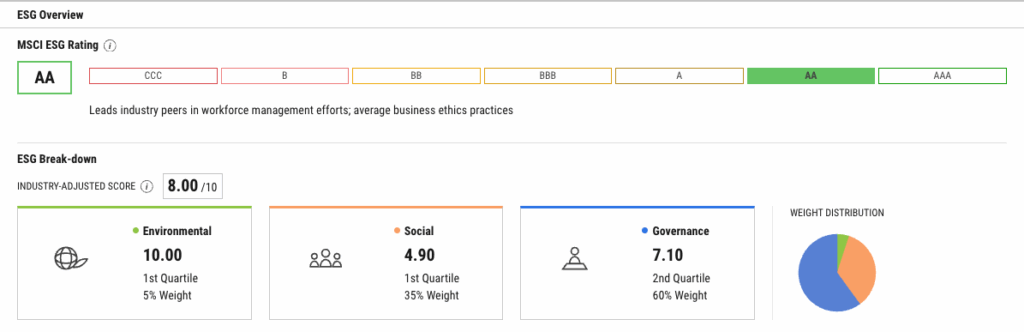

Bridging the gap begins with understanding what younger investors care about and using the right tools to find opportunities that align with those priorities.

Every company page includes a dedicated ESG tab that breaks down performance across environmental, social, and governance pillars. Advisors can see the metrics behind each score, review peer comparisons, and identify the factors that shape a company’s rating.

This removes the uncertainty surrounding ESG investing, providing the clarity that builds trust and understanding for clients who want their portfolios to reflect their values.

Explore in YCharts → Company level ESG tab

Find Investments That Reflect Client Priorities

Fund Screener allows advisors to identify investments that match each client’s interests and preferences. Filters make it easy to uncover funds that combine performance with purpose.

Advisors can:

- Identify funds with strong long-term returns.

- Target exposure to sectors such as technology, automation, or renewable energy.

- Search by category, theme, or risk profile to refine opportunities

This level of flexibility helps advisors personalize recommendations and show clients that their priorities matter. By connecting goals to measurable opportunities, advisors strengthen both understanding and trust.

A screen of ESG-recognized funds with a five-year annualized return above 8 percent and an MSCI ESG rating within the top ten percentile. Click to view in YCharts.

AI Chat simplifies the discovery process further by turning research into conversation. Advisors can ask questions and receive instant, data-backed charts or visuals that uncover similar opportunities in seconds.

Visualizing Insights That Build Trust

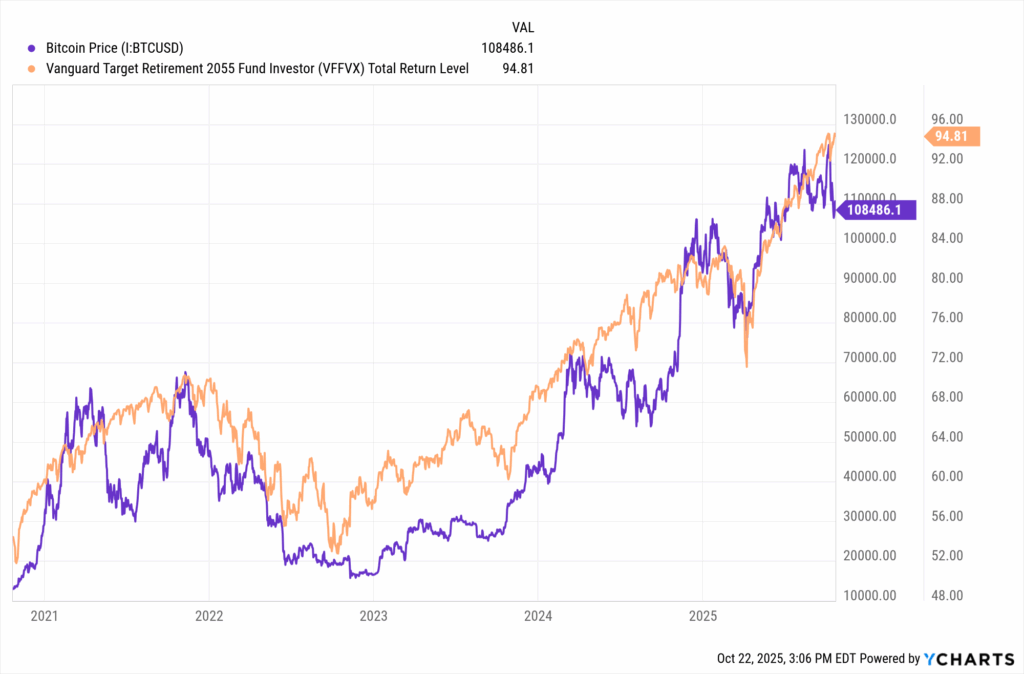

Investors want to see their portfolios, not just hear about them. YCharts helps advisors turn data into visuals that make performance clear, engaging, and understandable.

With Fundamental Charts, advisors can compare performance metrics side by side to illustrate how each decision supports client goals.

YCharts comparison of Bitcoin and the Vanguard Target Retirement 2055 Fund Investor (VFFX). Advisors can use this view to help clients understand the trade-offs between speculative enthusiasm and steady, long-term growth. Click to view in YCharts.

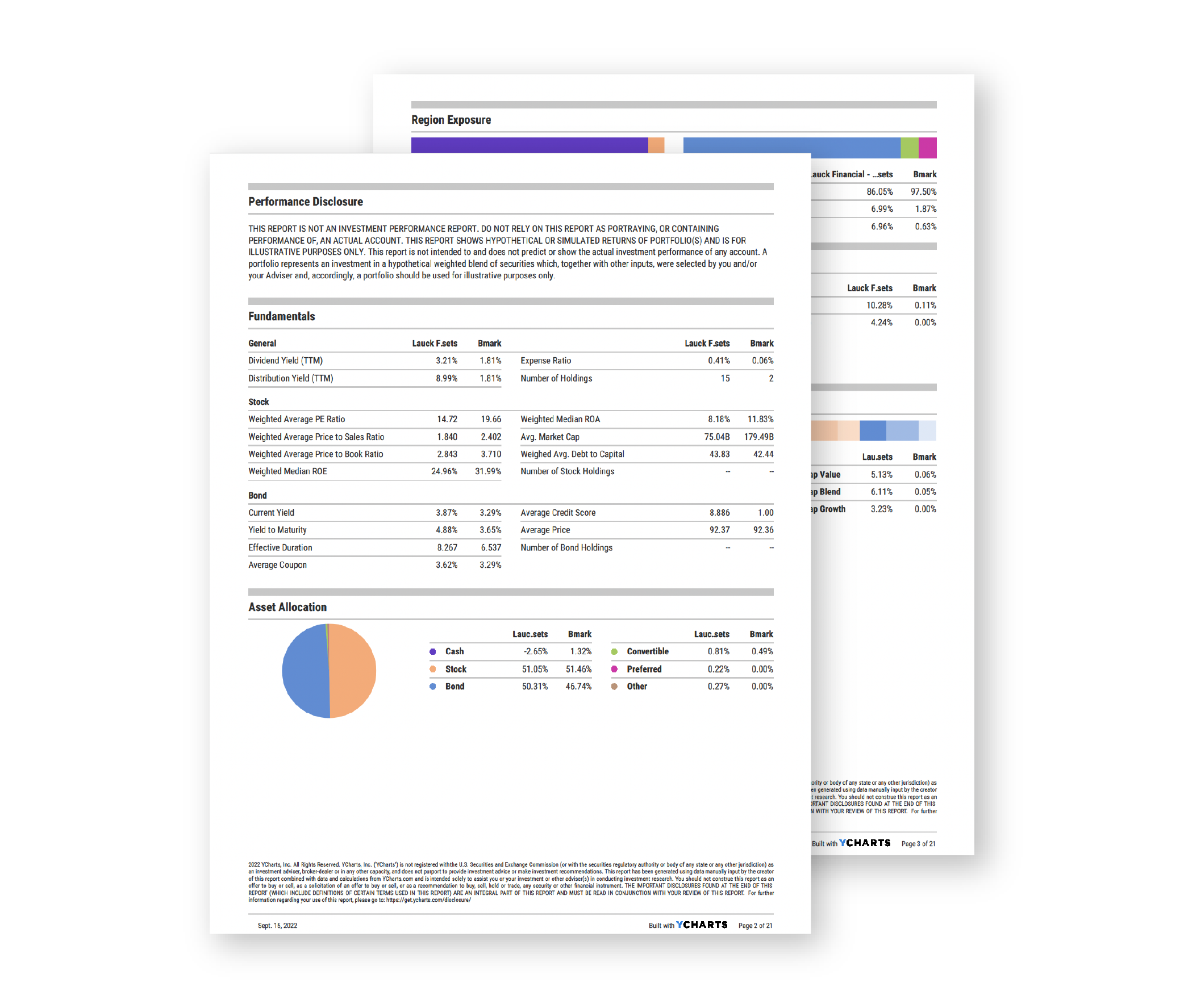

Report Builder brings those insights together in professional, branded formats that make complex strategies approachable and personal.

YCharts helps advisors bridge generations by making investing personal again. Every visualization, report, and conversation starts with understanding, and ends with trust.

For deeper insights into how advisors can engage the next generation of clients, explore Fired at Inheritance: Why 80% of Heirs Leave Their Parents’ Advisor, YCharts’ latest research on facilitating multigenerational relationships.

Bridge the generational investing gap with YCharts → start a free trial today.

Ready to Move On From Your Investment Research and Analytics Platform?

Follow YCharts Social Media to Unlock More Content!

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Gold Glitters Again: Inside Q3’s Commodity and Alternative Fund FlowsRead More →