Effective Federal Funds Rate Monthly Update: Key Insights & Analysis

The Effective Federal Funds Rate is a crucial benchmark interest rate that influences the cost of borrowing and the overall financial landscape in the United States. Set by the Federal Reserve, changes in the Effective Federal Funds Rate can significantly impact economic activity, inflation, and market sentiment. For more detailed information, you can visit the New York Fed Effective Federal Funds Rate page.

Latest Data Release

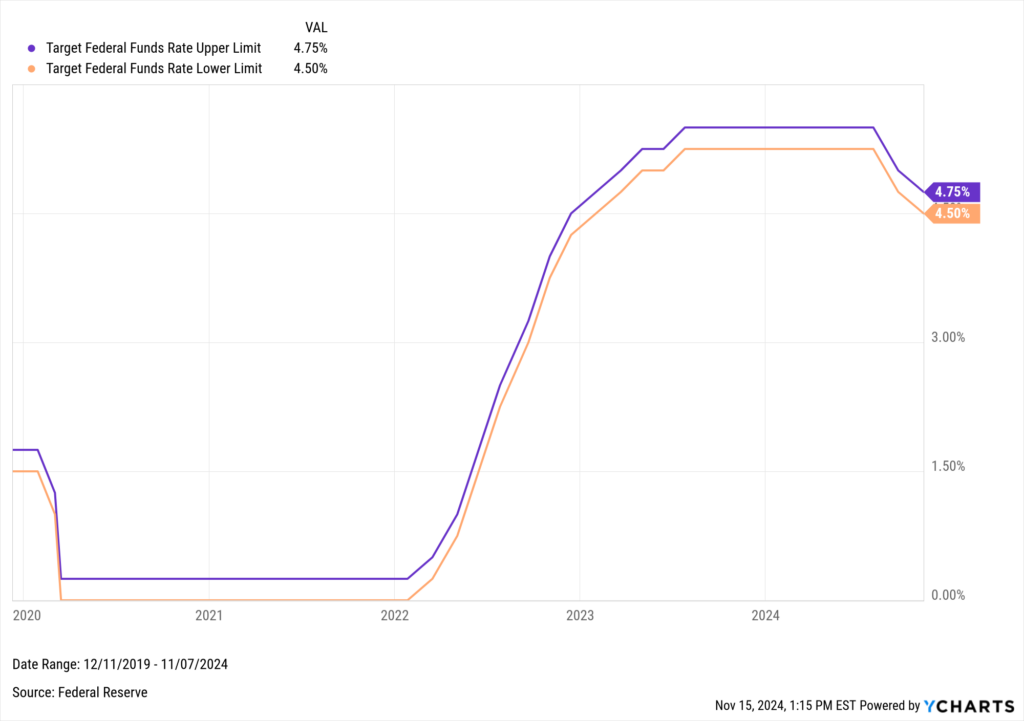

On November 7th, the Federal Open Market Committee voted to cut interest rates by an additional 25 basis points, following a 50 basis point cut in September. This recent adjustment brings the upper limit of the Federal Funds Rate down from 5% to 4.75%. In September’s Summary of Economic Projections, the FOMC’s dot plot indicates that the majority of FOMC participants expect the interest rate to be cut further this year.

This chart from YCharts visualizes the Federal Funds Rate’s upper and lower limit over the past three years.

Download Visual | Modify in YCharts

Analysis and Insights

The recent data indicates there’s been a 50bp rate cut applied to the Federal Funds Rate, and many investors are expecting further loosening from the Federal Reserve moving forward. This shift can have broad implications:

Banking Sector: Higher rates can lead to increased borrowing costs, potentially reducing loan demand but increasing interest margins for banks.

Real Estate: Mortgage rates are closely tied to the Federal Funds Rate, so changes can impact housing affordability and market activity.

Investment Strategies: Investors might adjust their portfolios, shifting from bonds to equities or vice versa, depending on rate expectations.

Accessing Effective Federal Funds Rate data on YCharts is straightforward. Follow these simple steps:

- Log on to ycharts.com.

- From anywhere on the platform, type “Effective Federal Funds Rate” into the search bar and click on the result.

- Once on the indicator page, users can toggle the navigation bar to browse historical data on a month-by-month or daily basis or view data in an interactive chart.

Clicking “View Full Chart” will open data in an interactive Fundamental Chart to compare against other economic indicators, such as inflation rates or the US Unemployment Rate. Export historical data to a CSV file for offline analysis by clicking the “Export” button.

Related Financial Indicators

Understanding the Federal Funds Rate in conjunction with other indicators can provide a holistic view of the economic landscape:

- US ISM Services PMI (click here to see how to use this indicator in YCharts)

- Consumer Price Index (click here to see how to use this indicator in YCharts)

- US Unemployment Rate (click here to see how to use this indicator in YCharts)

Implications for Investors

Changes in the Federal Funds Rate can influence various investment strategies. For instance:

- Fixed Income: Rising rates typically decrease bond prices but increase yields, affecting fixed-income investments.

- Equities: Higher rates can lead to lower stock prices as borrowing costs increase, but certain sectors like financials may benefit.

- Real Estate: As mentioned, mortgage rates tied to the Federal Funds Rate can impact real estate investments.

Historical examples show how previous rate adjustments have led to shifts in market dynamics. Investors should consider diversifying their portfolios and staying informed about rate trends.

YCharts Feature Highlights

YCharts offers powerful tools that enhance financial analysis and decision-making. Here’s a look at how you can leverage YCharts features for monitoring and analyzing economic data, including the Effective Federal Funds Rate.

Model Portfolios

YCharts’ Model Portfolios allow you to build, backtest, and compare investment strategies. This feature enables advisors to simulate different economic scenarios, including changes in the Federal Funds Rate, and automate comprehensive portfolio performance reports.

Fundamental Charts

Fundamental Charts in YCharts help visualize and analyze data. Create and customize charts to compare multiple metrics, such as the Federal Funds Rate with inflation rates or GDP growth, to identify trends and correlations that can inform investment strategies.

Dashboards

YCharts Dashboards consolidate various charts and data points into one view. Monitor performance, track key indicators like the Federal Funds Rate in real-time, and easily share insights with clients or colleagues.

Custom Alerts

Stay updated with YCharts’ Custom Alerts. Set alerts for specific economic indicators, including changes in the Federal Funds Rate, and receive notifications to ensure you never miss critical updates.

Economic Indicator Calendar

Gain a comprehensive overview of recent and upcoming economic data releases worldwide with YCharts’ Economic Indicator Calendar. Seamlessly integrate any specific indicator’s release schedule into your personal or professional calendar for streamlined planning and timely updates.

For tutorials on these features, check our YCharts tutorial page.

Conclusion

The latest Federal Funds Rate report provides critical insights into the Federal Reserve’s monetary policy and its potential market impacts. Regularly checking for updates and utilizing YCharts can enhance your analysis and investment decisions.

To arm yourself with YCharts’ extensive library of economic indicators, charting software, and analysis tools, get in touch for a personalized information session or start a free trial.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Download the Economic Summary Deck:Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

US ISM Services PMI Monthly UpdateRead More →