Monthly Canada Market Wrap: December 2021

Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Looking for the US Market Wrap? Click here.

And just like that, 2021 is in the books. Whether this is your first Canada Market Wrap or you’ve been reading since we launched this Canadian version last February, thanks for joining us as we recap the prior month’s events. We love having you here!

Now, on to the fun stuff. How did markets do in 2021?

The S&P/TSX 60 logged a gain of 28.1%, higher than the US’s Dow Jones Industrial Average rise of 21% and the NASDAQ’s of 22.2%. The Canadian benchmark S&P index led its US counterpart, the S&P 500, for most of the year and finished just 66 basis points behind it.

Download Visual | Modify in YCharts

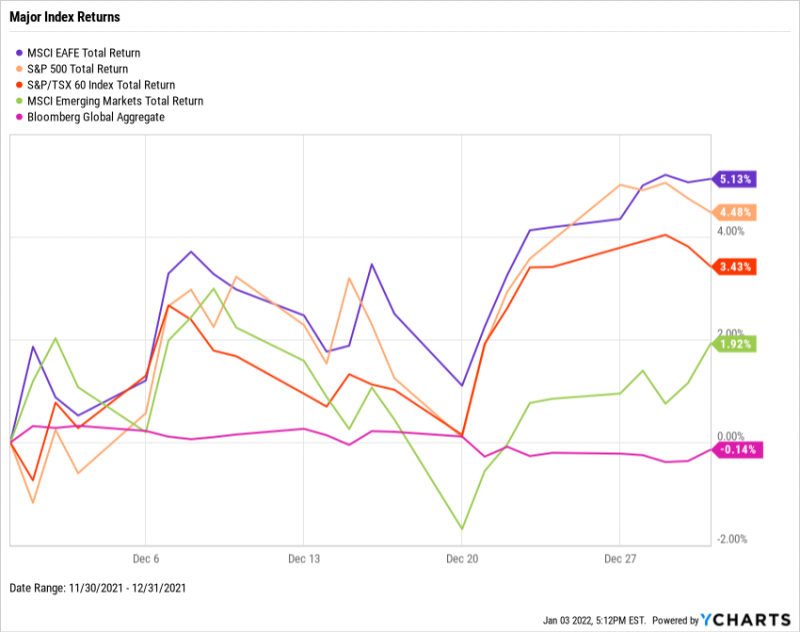

2021 was definitely more positive than negative, as the three indices had only a few minor drawdowns during the year. The S&P 500’s largest drawdown was 5.1%, while the TSX 60’s was 5.3%. For comparison’s sake, the Dow’s largest drawdown was 6.3% while the NASDAQ’s was 10.5%, the latter of which narrowly qualified as correction territory. Finally, among global indices, MSCI’s International Developed Markets index rose 11.8% in 2021, while the Emerging Markets index finished down 2.2%.

That’s a wrap on 2021. But before you eagerly—or sadly—flip that calendar, take a look at these key developments from the last month of the year:

• Major Index Returns: Equities Shrug Off Omicron Worries

• Sector Movement: 6 of 7 Positive, Defensive Sectors Rise

• Hot Stocks of the Month: Healthcare, Essential Businesses Attract

• Laggards & Losers: Welcome Back, Canopy Growth

• Economic Data: All-Time High for Canada Housing Starts

Major Index Returns: Equities Shrug Off Omicron Worries

Download Visual | Modify in YCharts

After the TSX 60 gave up November gains to finish last month down 1.1%, the benchmark Canadian index propelled 3.4% higher in December. This happened despite skyrocketing cases per day attributed to the Omicron variant. Elsewhere, the US’s S&P 500 rose 4.5% while International Developed Markets added 5.1%. The latter’s rise can largely be attributed to strong performances in the Swiss, French, United Kingdom, and German markets, countries that make up 45% of the index. MSCI Emerging Markets finished December up 1.9%, and the Global Aggregate Bond Index slipped 0.1%.

Sector Movement: 6 of 7 Positive, Defensive Sectors Rise

Download Visual | Modify in YCharts

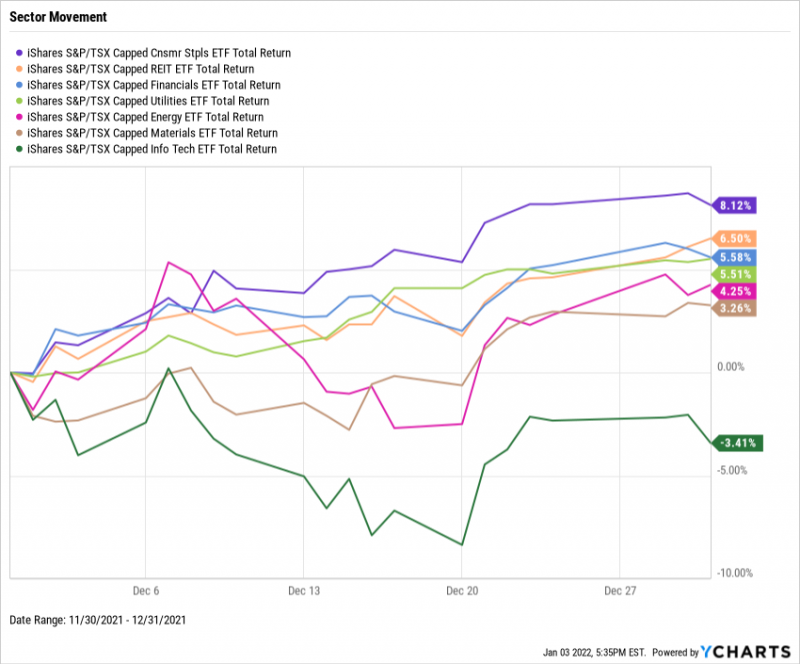

After 6 of the 7 TSX sectors went negative in November, the opposite occurred in December. Consumer Staples, REITs, Financials, and Utilities were the best performing sectors as wage and inflation growth prompted the Bank of Canada to accelerate the timing of potential rate hikes. The moves follow a similar trend in the US, where the Federal Reserve’s accelerated rate hike plan spurred investors to flee cyclical sectors in favor of defensive ones. As such, Info Tech was the TSX’s lone losing sector, falling 3.4%.

Hot Stocks of the Month: Healthcare, Essential Businesses Attract

Download Visual | Modify in YCharts

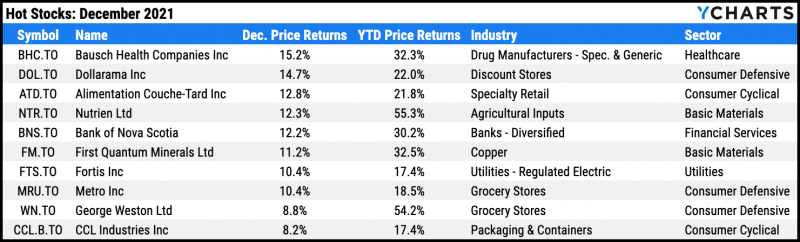

Many defensive names made December’s Hot Stocks list, including Bausch Health Companies (BHC.TO), Dollarama (DOL.TO), Fortis (FTS.TO), Metro (MRU.TO), and George Weston (WN.TO). Despite the provinces of Ontario and Quebec reimposing many lockdown measures, the latter three companies have been classified as essential businesses, lessening the impacts to their operations. Though classified as a cyclical stock, convenience store chain Alimentation Couche-Tard (ATD.TO) surged 12.8% in December in part on news that its locations will be exempt from Quebec’s mandate that stores be closed on Sundays in January.

Nutrien (NTR.TO), Bank of Nova Scotia (BNS.TO), First Quantum Materials (FM.TO), and CCL Industries (CCL.B.TO) also made the cut for December’s ten best performers.

Laggards & Losers: Welcome Back, Canopy Growth

Download Visual | Modify in YCharts

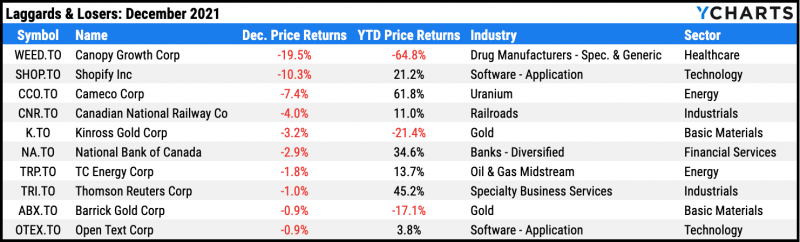

To close out a disappointing year in which it lost nearly two-thirds of its value, Canopy Growth (WEED.TO) fell back on the Laggards & Losers list for the sixth consecutive month. The specialty drugmaker plummeted another 20% in December, despite announcing a divestment of its Cannabinoid Compound subsidiary that will aim to reduce both operational complexities and short-term capital requirements. The cyclical names that investors fled the most were e-commerce giant Shopify (SHOP.TO), Caneco (CCO.TO), and Canadian National Railway (CNR.TO).

In what was an overall positive December that didn’t contain many significant Laggards and Losers, rounding out December’s list is Kinross Gold (K.TO), National Bank of Canada (NA.TO), TC Energy (TRP.TO), Thomson Reuters (TRI.TO), Barrick Gold (ABX.TO), and Open Text (OTEX.TO).

Featured Market & Advisor News

Analysts Are Not Raising Quarterly S&P 500 EPS Estimates for First Time Since Q2 2020 (FactSet)

The 14 Charts that Defined 2021 with Josh Brown and Friends (YCharts)

Canadian stocks close out best year since 2009, led by energy (BNN)

The Best Performing Bond ETFs and How to Find Them (YCharts)

Wage growth outpaces inflation as job vacancies surge to record (Financial Post)

Bear Market Mania with Charlie Bilello (YCharts)

Economic Data: All-time High for Canada Housing Starts

Unemployment: November marked the sixth consecutive month in which the Canadian unemployment rate declined, falling to 6.0% and now just 0.3% away from its February 2020 level. However, full-time employment was adversely affected. The Canada Ivey Employment index tumbled 7.5 points to 54.5, and the Canada Part-time Employment figure recorded an increase of 74,000 part-time workers in November.

Housing: Canada Housing Starts set an all-time record in November of 24,905. With that, housing prices rose at a healthy pace as the Canada New Housing Price Index ticked up 0.9%

Consumers: The Canada Consumer Price Index rose 0.35% in November, while the Canada Inflation Rate increased for the fifth straight month to 4.72%, a level not reached since 1991.

Manufacturing: After falling 11.1 points in October, the Canada Ivey PMI edged up 1.9 points in November to 61.20, which is still well into expansion territory for the manufacturing sector.

Have a great January and 2022! 📈

Next Article

Scatter Plot: Dynamic Storytelling for Funds, ETFs & PortfoliosRead More →