Monthly Canada Market Wrap: February 2022

Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Looking for the US Market Wrap? Click here.

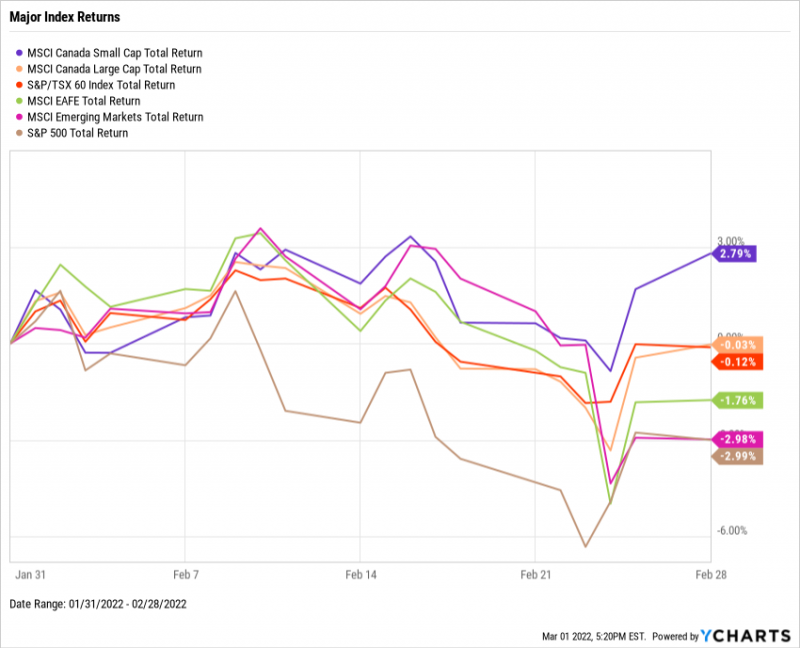

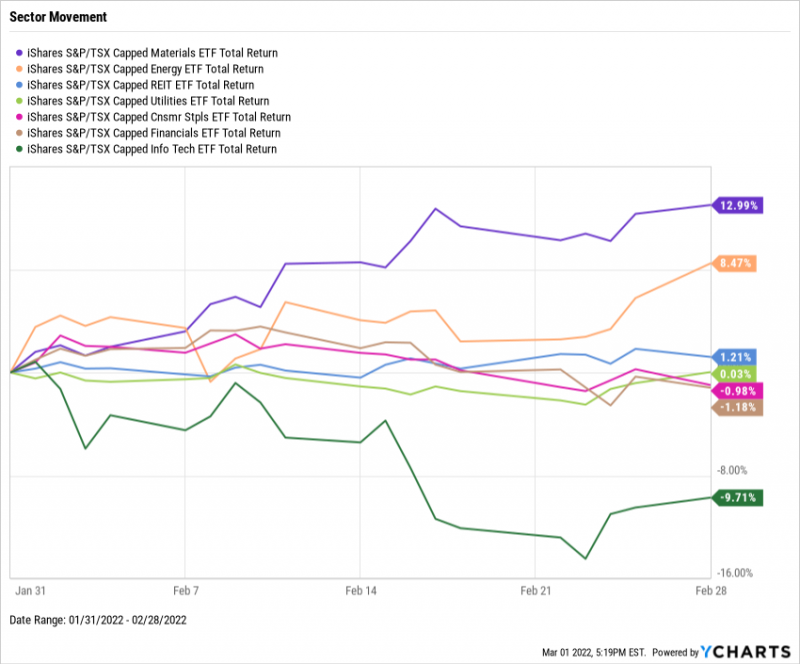

In what was another ugly month for equities worldwide, Canada served as a relative safe haven in February. The S&P/TSX 60 finished the month just 0.1% lower, whereas its US counterpart, the S&P 500, slipped another 3%. Investors favoured precious metal and commodity companies in light of Russia’s invasion into Ukraine, which sent both the Materials and Energy sectors surging in February. The Materials sector is 9.1% higher year-to-date, while the Energy sector is up 27.7%. In fixed income, the Canada 10-Year Benchmark Bond rate increased by 12 basis points in February, and as of month’s end is yielding 0.07% more than the US 10-Year. Finally, Canadian inflation breached 5% for the first time in over 30 years, but one of Canada’s leading manufacturing indexes, the Ivey PMI, rebounded back into expansion territory.

Equity Performance

Major Indexes

Download Visual | Modify in YCharts

Canadian Sector Movement

Download Visual | Modify in YCharts

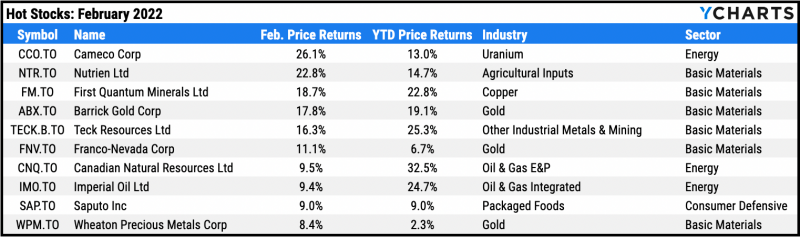

Hot Stocks: February’s Top 10 TSX 60 Performers

Download Visual | Modify in YCharts

Cameco (CCO.TO): 26.1% gain in February 2022

Nutrien (NTR.TO): 22.8%

First Quantum Minerals (FM.TO): 18.7%

Barrick Gold (ABX.TO): 17.8%

Teck Resources (TECK.B.TO): 16.3%

Franco-Nevada (FNV.TO): 11.1%

Canadian Natural Resources (CNQ.TO): 9.5%

Imperial Oil (IMO.TO): 9.4%

Saputo (SAP.TO): 9.0%

Wheaton Precious Metals (WPM.TO): 8.4%

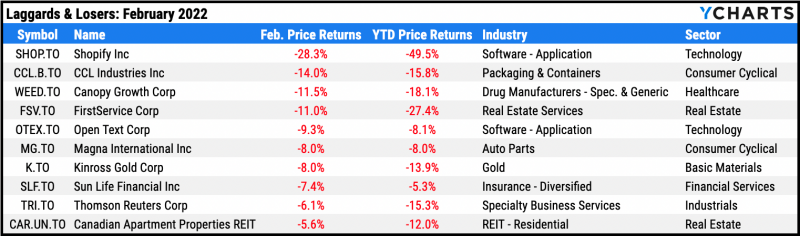

Laggards & Losers: February’s 10 Worst TSX 60 Performers

Download Visual | Modify in YCharts

Shopify (SHOP.TO): -28.3% decline in February 2022

CCL Industries (CCL.B.TO): -14.0%

Canopy Growth (WEED.TO): -11.5%

FirstService (FSV.TO): -11.0%

Open Text (OTEX.TO): -9.3%

Magna International (MG.TO): -8.0%

Kinross Gold (K.TO): -8.0%

Sun Life Financial (SLF.TO): -7.4%

Thomson Reuters (TRI.TO): -6.1%

Canadian Apartment Properties Real Estate Investment Trust (CAR.UN.TO): -5.6%

Fixed Income Performance

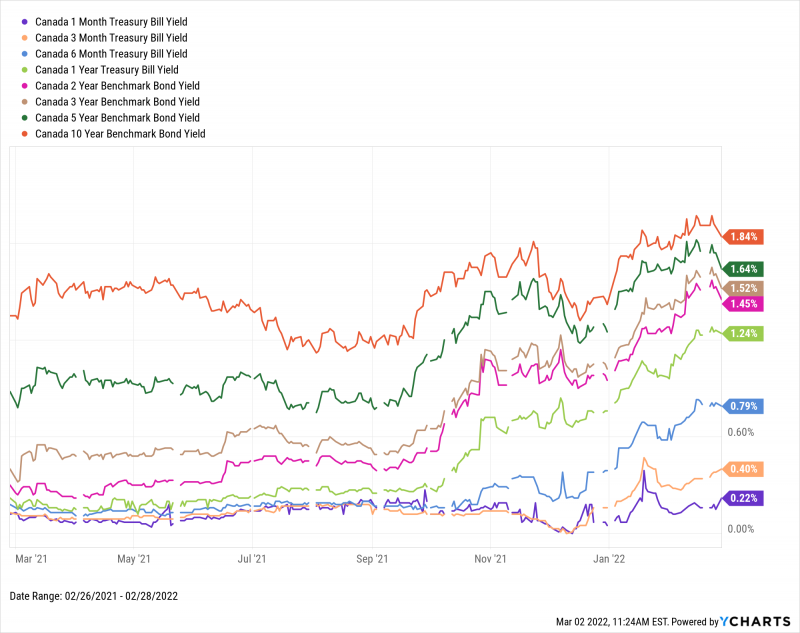

Canadian Treasury Yield Curve

Download Visual | Modify in YCharts

Canada 1 Month Treasury Bill Yield: 0.22%

Canada 3 Month Treasury Bill Yield: 0.40%

Canada 6 Month Treasury Bill Yield: 0.79%

Canada 1 Year Treasury Bill Yield: 1.24%

Canada 2 Year Benchmark Bond Yield: 1.45%

Canada 3 Year Benchmark Bond Yield: 1.52%

Canada 5 Year Benchmark Bond Yield: 1.64%

Canada 10 Year Benchmark Bond Yield: 1.84%

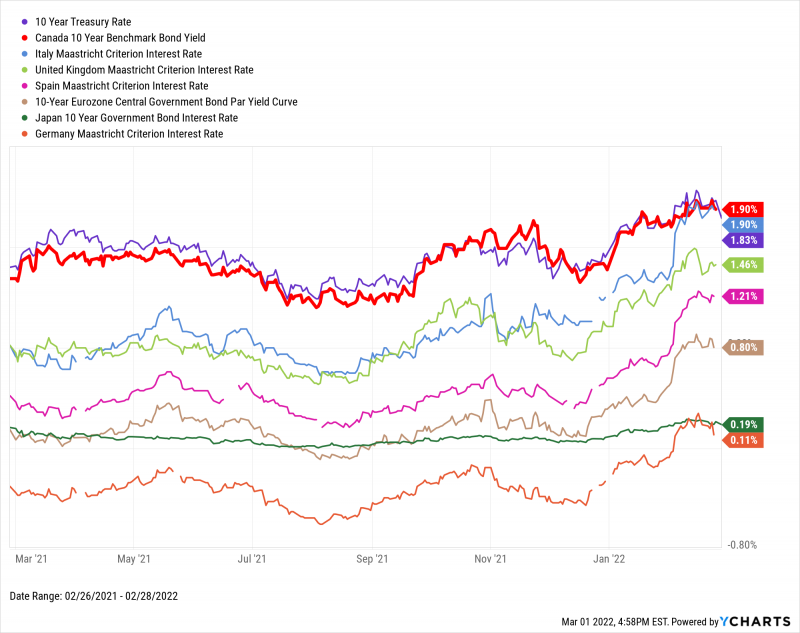

Global Bonds

Download Visual | Modify in YCharts

10 Year Treasury Rate: 1.90%

Canada 10 Year Benchmark Bond Yield: 1.90%

Italy Long Term Bond Interest Rate: 1.83%

United Kingdom Long Term Bond Interest Rate: 1.46%

Spain Long Term Bond Interest Rate: 1.21%

10-Year Eurozone Central Government Bond Par Yield: 0.80%

Japan 10 Year Government Bond Interest Rate: 0.19%

Germany Long Term Bond Interest Rate: 0.11%

Featured Market & Advisor News

Bank of Canada expected to kickstart rate-hiking cycle (BNN)

7 Best Asset Classes to Hedge Against Inflation (YCharts)

Broker-dealers sell record $10.5 billion USD in alts in January (InvestmentNews)

Victors of Today’s Market Volatility with Beth Kindig (YCharts)

Buying a home costs up to 50% more than Canadians can afford in many big cities, says PBO (Financial Post)

How Long Does it Take Tech Stocks to Recover From a Crash? (YCharts)

Economic Data

Employment

The Canadian unemployment rate checked in at 6.5% in January—rising 0.5 points after December’s dip below 6%—for the first month since February 2020. As such, the Canada Ivey Employment index slipped another 0.9 points to 49.1, and Canadian Part-time Employment recorded a decrease of 117,000 part-time workers in December.

Production and Sales

The Canada Ivey PMI bounced out of contraction territory in February, now reading 50.7. Readings above 50 indicate expansion in the manufacturing sector.

Housing

Canada Housing Starts continued to cool down from a record November, logging 13,220 new starts in January. Interestingly, the Canada New Housing Price Index was up 0.91% month-over-month, well above its historical, monthly average rise of 0.24%.

Consumers and Inflation

The Canada Consumer Price Index rose 0.55% in January, while the Canada Inflation Rate topped 5% for the first time since September 1991. February’s 5.1% print represents the inflation rate’s seventh straight monthly increase.

Gold

The price of gold in CAD was $2,401.10 per ounce at February’s end, representing a monthly price increase of 5%. Gold’s uptick in price provided a 4% lift to the iShares S&P/TSX Global Gold ETF (XGD.TO) in February.

Oil

Oil prices continued their rapid climb in February. As of February 28th, the WTI Daily Spot Price was $96.13 USD per barrel, and Brent surpassed $100 USD, sitting at $103.08 USD/barrel.

Cryptocurrencies

Despite surging in the first half of the month, Bitcoin and Ethereum ended February flat. The price of Bitcoin was $37,804 USD as of February 28th, still 36.1% off its all- time high. Ethereum stood at $2,629 USD, representing a 39.4% retracement. Cardano had a losing month, dipping 17.2% in February to $0.86 USD.