Monthly Canada Market Wrap: May 2022

Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Looking for the US Market Wrap? Click here.

Canada Market Summary for May 2022

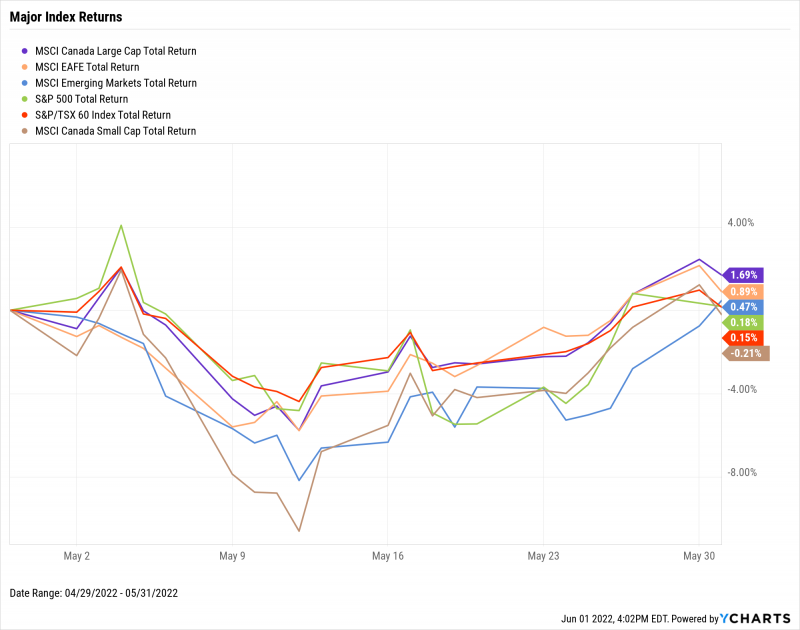

Canadian equities were a mixed bag in May, with Canadian Large Caps leading the charge, up 1.7%. The S&P/TSX 60 index inched up (for you true Canadian readers, “centimetered up”) 0.2%, while Canadian Small Caps dipped 0.2%. South of the border, the S&P 500 rose by that 0.2% as well.

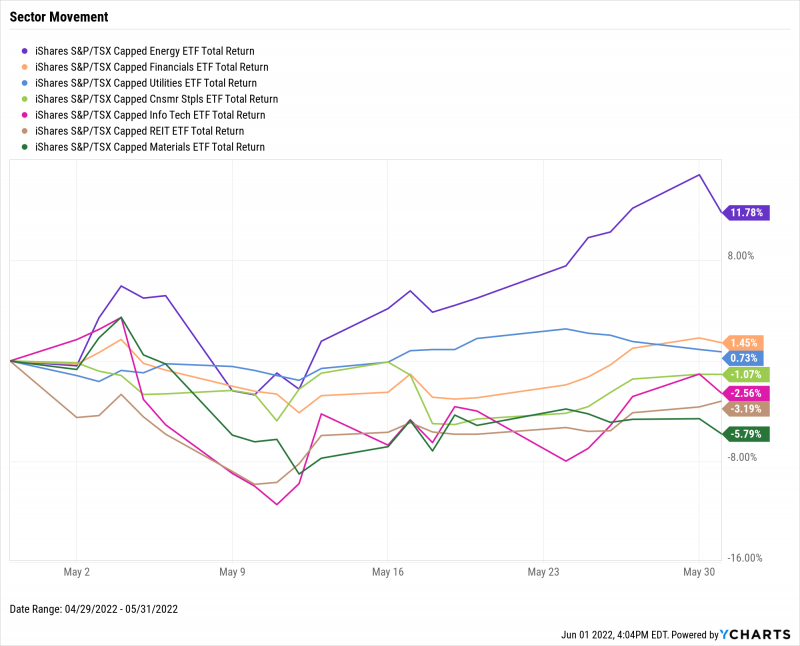

Once again, Energy led all sectors, closing May up 11.8%. Financials and Utilities were the other two sectors to finish May in the black, posting increases of 1.5% and 0.7% respectively. Consumer Staples, Info Tech, REIT, and Materials all ended May in the red, with Materials logging the worst decline of 5.8%.

Prior month employment data was strong. Most notably, the Canadian unemployment rate fell to an all-time low of 5.2%. However, manufacturing slowed according to the Canada Ivey PMI, which fell 10.7% month-over-month from its all-time high in March. The Canada Inflation Rate rose for a tenth straight month to 6.77%, further closing in on a 31-year high. Finally, Canadian gas stations have been filling up their cash registers as of late—according to March data, record high gas prices have helped Canadian Gasoline Stations’ Retail Sales skyrocket to all-time highs.

Lastly, some flattening appeared across the Canadian yield curve, most notably between the 2-Year and 3-Year Benchmark Bond yields. Both bonds were paying 2.67% in interest as of the end of May, which was also just 5 basis points less than the 5-Year Benchmark Bond yield. Reports of forthcoming “jumbo” rate hikes by Bank of Canada caused the 1-Month Treasury Bill’s interest rate to near 1% and the 6-Month Treasury Bill to surpass 2% for the first time since October 2008.

Jump to Fixed Income Performance

Equity Performance

Major Indexes

Download Visual | Modify in YCharts

Canadian Sector Movement

Download Visual | Modify in YCharts

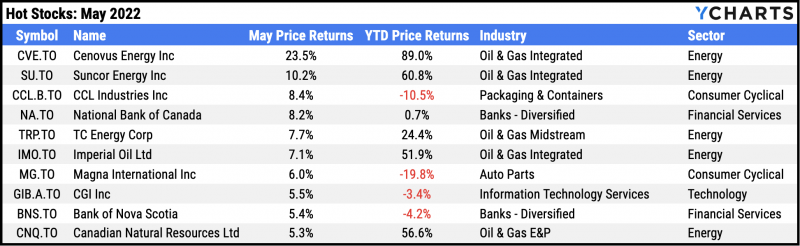

Hot Stocks: Top 10 TSX 60 Performers of May 2022

Cenovus Energy (CVE.TO): 23.5% gain in May 2022

Suncor Energy (SU.TO): 10.2%

CCL Industries (CCL.B.TO): 8.4%

National Bank of Canada (NA.TO): 8.2%

TC Energy (TRP.TO): 7.7%

Imperial Oil (IMO.TO): 7.1%

Magna International (MG.TO): 6.0%

CGI Inc (GIB.A.TO): 5.5%

Bank of Nova Scotia (BNS.TO): 5.4%

Canadian Natural Resources (CNQ.TO): 5.3%

Download Visual | Modify in YCharts

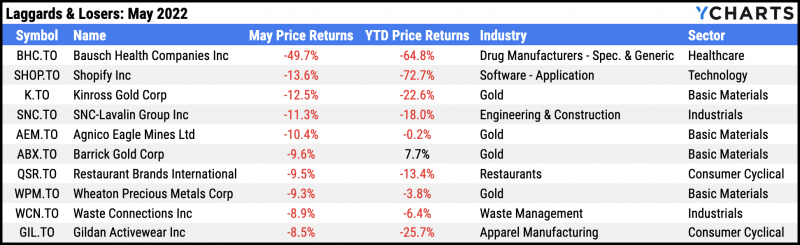

Laggards & Losers: 10 Worst TSX 60 Performers of May 2022

Bausch Health Companies (BHC.TO): -49.7% decline in May 2022

Shopify (SHOP.TO): -13.6%

Kinross Gold (K.TO): -12.5%

SNC-Lavalin Group (SNC.TO): -11.3%

Agnico Eagle Mines (AEM.TO): -10.4%

Barrick Gold (ABX.TO): -9.6%

Restaurant Brands International (QSR.TO): -9.5%

Wheaton Precious Metals (WPM.TO): -9.3%

Waste Connections (WCN.TO): -8.9%

Gildan Activewear (GIL.TO): -8.5%

Download Visual | Modify in YCharts

Economic Data

Employment

Last month was a strong one for Canadian employment. The Canadian unemployment rate reached an all-time low of 5.2% in April and the Canada Ivey Employment index rose 2.6 points to 65.1. In addition, the Canadian Part-time Employment figure recorded an increase of 47,000 part-time workers in April.

Production and Sales

The Canada Ivey PMI fell to 66.30 in April, down 10.7% from its all-time high of 74.20 set just two months ago in March. However, the Canadian economy continued its rebound from the COVID-19 pandemic, with Canada Real GDP increasing 0.7% in March.

Housing

The Canada New Housing Price Index rose 0.32% in April, a significant retracement from March’s 1.22% surge, but still clocked in above its all-time monthly average of 0.24%.

Consumers and Inflation

Unlike in the US, where inflation declined for the first time in over half a year, the Canada Inflation Rate increased for a tenth consecutive month to 6.77%. April’s inflation print is Canada’s highest since January 1991, when it was 6.91%. Canada’s Consumer Price Index marched upward with inflation, rising 0.67% in April.

Gold

The price of gold was $2,362.80 CAD per ounce as of May 27th, a monthly decrease of 3.3%, while the iShares S&P/TSX Global Gold ETF (XGD.TO) tumbled 10.9% and is now up just 1.1% year to date.

Oil

Oil continued climbing in May, with the per barrel daily spot prices of WTI and Brent Crude rising to $110.32 USD and $115.13 USD, respectively. The surges in oil prices sent Canadian gas prices to all-time highs in turn. Further downstream, Retail Sales among Canadian Gasoline Stations hit an all-time high of $6.73B CAD in the month of March, up 32.1% from a year ago.

Cryptocurrencies

Major cryptocurrencies suffered another month of significantly lower price action in May. One Bitcoin was worth $31,741 USD as of May 31st, a decline of 20.1% which came on the heels of a 17.9% drop in the month of April. Ethereum fell below $2,000 USD for the first time in ten months, to $1,996 USD at the end of May, while Cardano tumbled another 32.3% in May to 57 cents USD per coin. Year to date, Bitcoin is down 32.7%, Ethereum is off 46.3%, and Cardano is 58% lower.

Featured Market & Advisor News

Consumers prop up economy despite drag from oil exports (BNN)

Inverted Yield Curve: What It Means and How to Navigate It (YCharts)

Truth in labelling comes for Ontario advisors (Advisor’s Edge)

Do You Know Your Exposure To Mega Cap Stocks? (YCharts)

‘Extremely bearish’ investors are hoarding cash at the highest level in two decades (Financial Post)

Is the 60/40 Portfolio Drowning? (YCharts)

Fixed Income Performance

Canadian Treasury Yield Curve

Canada 1 Month Treasury Bill Yield: 0.99%

Canada 3 Month Treasury Bill Yield: 1.47%

Canada 6 Month Treasury Bill Yield: 2.02%

Canada 1 Year Treasury Bill Yield: 2.48%

Canada 2 Year Benchmark Bond Yield: 2.67%

Canada 3 Year Benchmark Bond Yield: 2.67%

Canada 5 Year Benchmark Bond Yield: 2.72%

Canada 10 Year Benchmark Bond Yield: 2.90%

Download Visual | Modify in YCharts

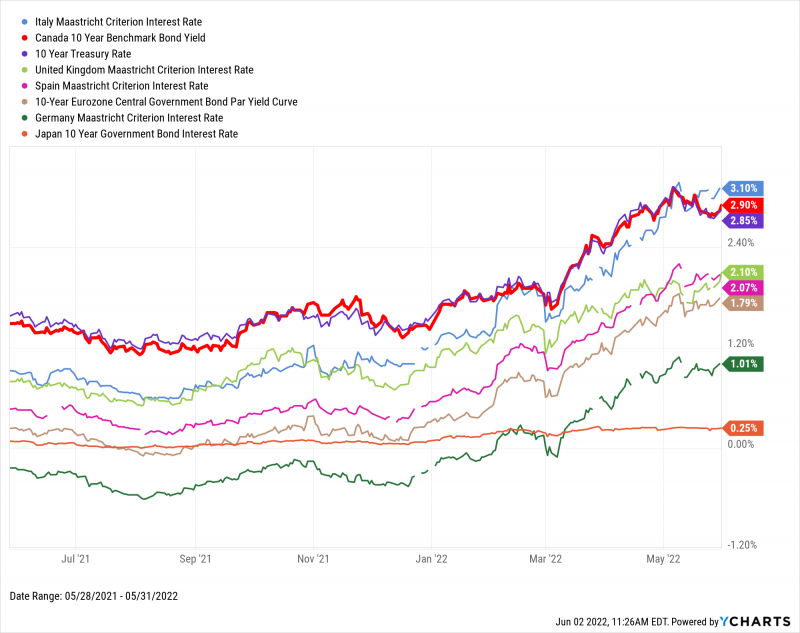

Global Bonds

Italy Long Term Bond Interest Rate: 3.10%

Canada 10 Year Benchmark Bond Yield: 2.90%

10 Year Treasury Rate: 2.85%

United Kingdom Long Term Bond Interest Rate: 2.10%

Spain Long Term Bond Interest Rate: 2.07%

10-Year Eurozone Central Government Bond Par Yield: 1.79%

Germany Long Term Bond Interest Rate: 1.01%

Japan 10 Year Government Bond Interest Rate: 0.25%

Download Visual | Modify in YCharts

Have a great June! 📈

Next Article

Do You Know Your Exposure To Mega Cap Stocks?Read More →