The 10 Best Performing ETFs Over the Last 10 Years

Updated as of: December 2, 2025

In 2024, the ETF industry reached a new high with $1.1 trillion in net inflows, reshuffling market share leaders across various asset classes and peer groups.

Notably, several strategies that captured increased market share benefited significantly from robust long-term performance. Below, we explore some of the top-performing ETFs across different timeframes.

Sign up for our free monthly Fund Flow Report to stay updated on how assets are moving in and out of these strategies:

For advisors incorporating these strategies into their portfolios, YCharts offers multiple tools to enhance client communication around your decision-making process.

Start with Quick Extract to import screenshots or Excel files for a clear view of what a prospect currently holds. Use Transition Analysis to evaluate the tax impact of proposed changes. Then, with Risk Profiles and Talking Points, you can create personalized, compliance-ready proposals that help clients visualize the why, empowering you to win new business with confidence. Start a Free Trial to incorporate these tools into your workflow.

Now, let’s dive into the best-performing ETFs of the past decade.

To create this list, we analyzed the entire ETF universe using the YCharts Fund Screener to find the best-performing ETFs on a 1-year, 3-year, 5-year, 10-year basis (excluding leveraged and inverse ETFs). We also observed funds with the lowest max drawdowns during this period, as well.

Click to jump to a section:

- Best-Performing ETFs in the Last Year

- Best-Performing ETFs in the Last 3 Years

- Best-Performing ETFs in the Last 5 Years

- Best-Performing ETFs in the Last 10 Years

- What Was the Growth of $10,000 Over the Last 10 Years?

Looking for lists of the best performing mutual funds? Check out our analysis on the Best Performing Mutual Funds here.

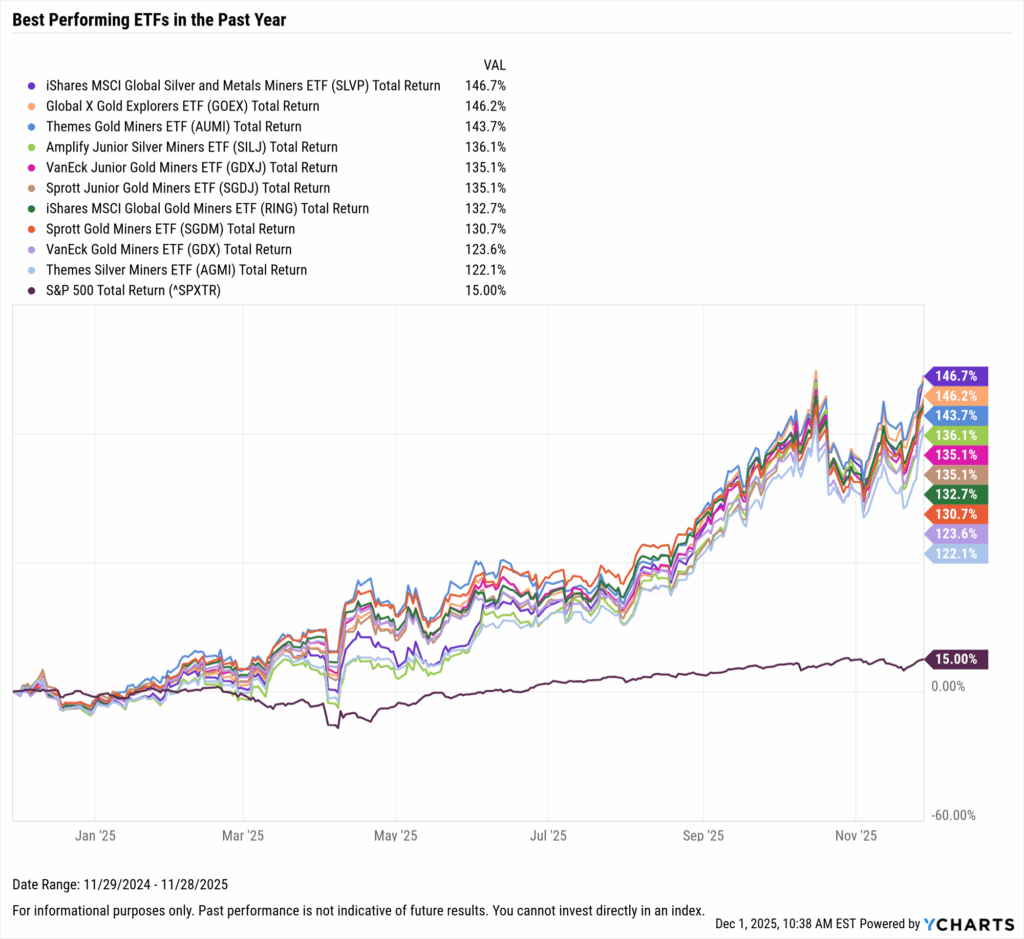

Best Performing ETFs in the Last Year

These are the top-performing ETFs over the past year as of November 30, 2025.

| Symbol | Name | 1 Year Total Returns (Monthly) | Total Returns Since Inception (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|---|

| SLVP | iShares MSCI Global Silver and Metals Miners ETF | 146.69% | 49.65% | 0.39% | $662,857,573 | Precious Metals Equity Funds |

| GOEX | Global X Gold Explorers ETF | 146.17% | 10.07% | 0.65% | $124,675,368 | Precious Metals Equity Funds |

| AUMI | Themes Gold Miners ETF | 143.66% | 247.88% | 0.35% | $25,089,171 | Precious Metals Equity Funds |

| SILJ | Amplify Junior Silver Miners ETF | 136.14% | 48.96% | 0.69% | $3,151,086,605 | Precious Metals Equity Funds |

| GDXJ | VanEck Junior Gold Miners ETF | 135.07% | 447.04% | 0.51% | $9,091,278,972 | Precious Metals Equity Funds |

| SGDJ | Sprott Junior Gold Miners ETF | 135.05% | 331.75% | 0.50% | $304,609,816 | Precious Metals Equity Funds |

| RING | iShares MSCI Global Gold Miners ETF | 132.66% | 64.41% | 0.39% | $2,739,070,600 | Precious Metals Equity Funds |

| SGDM | Sprott Gold Miners ETF | 130.69% | 203.67% | 0.50% | $639,478,876 | Precious Metals Equity Funds |

| GDX | VanEck Gold Miners ETF | 123.59% | 161.41% | 0.51% | $24,371,933,661 | Precious Metals Equity Funds |

| AGMI | Themes Silver Miners ETF | 122.14% | 143.76% | 0.35% | $7,191,756 | Precious Metals Equity Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

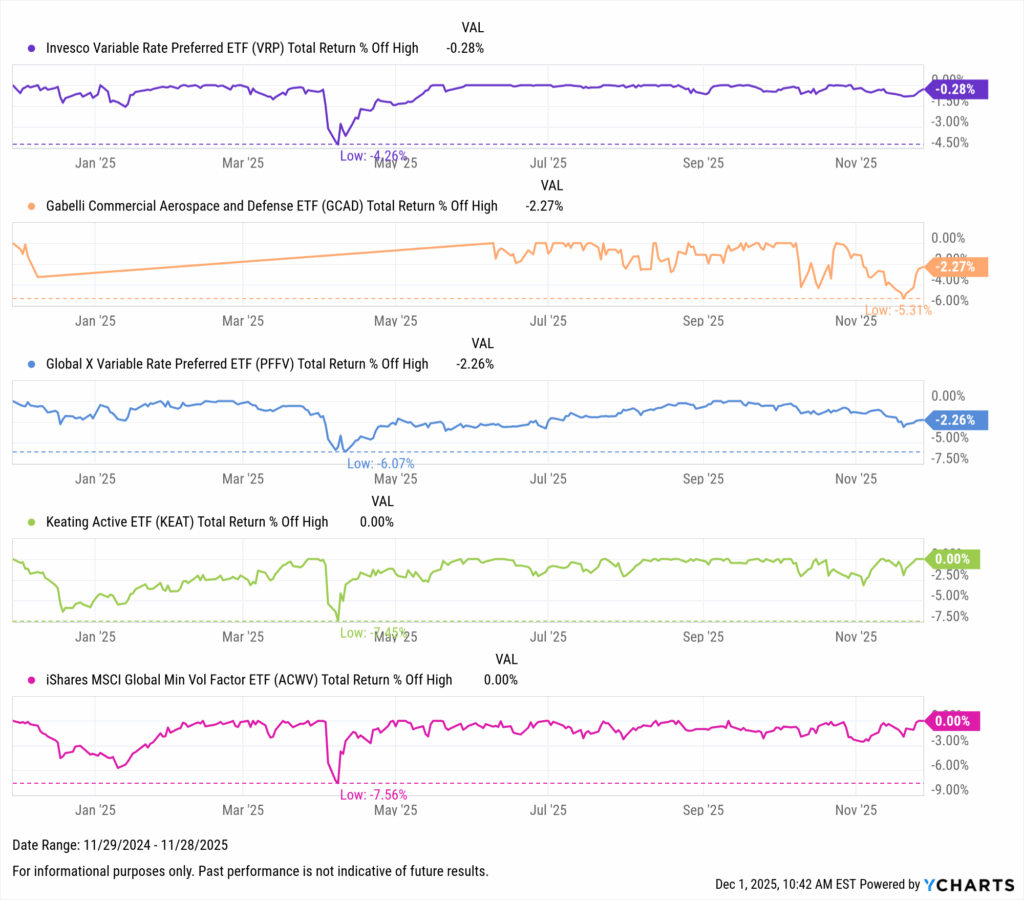

Equity ETFs with the Lowest Drawdown in the Last Year

As of November 30, 2025, these equity ETFs had the lowest drawdown over the last year. The chart below can be expanded to comprehensively depict the peak-to-trough performance of the observed funds.

| Symbol | Name | Max Drawdown (1Y) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|

| VRP | Invesco Variable Rate Preferred ETF | 4.26% | 0.50% | $2,305,611,922 | Equity Income Funds |

| GCAD | Gabelli Commercial Aerospace and Defense ETF | 5.31% | 0.00% | $14,096,752 | Industrials Funds |

| PFFV | Global X Variable Rate Preferred ETF | 6.07% | 0.25% | $307,387,707 | Equity Income Funds |

| KEAT | Keating Active ETF | 7.45% | 0.85% | $103,695,514 | Multi-Cap Value Funds |

| ACWV | iShares MSCI Global Min Vol Factor ETF | 7.56% | 0.20% | $3,374,330,806 | Global Multi-Cap Value |

| DWMF | WisdomTree International Multifactor Fund | 7.74% | 0.38% | $35,847,330 | International Multi-Cap Value |

| EDGH | 3EDGE Dynamic Hard Assets ETF | 7.86% | 1.01% | $134,239,645 | Basic Materials Funds |

| FPWR | First Trust EIP Power Solutions ETF | 8.49% | 0.96% | $18,976,182 | Alternative Energy Funds |

| XLP | Consumer Staples Select Sector SPDR Fund | 8.53% | 0.08% | $15,474,956,279 | Consumer Goods Funds |

| EFAV | iShares MSCI EAFE Min Vol Factor ETF | 8.65% | 0.20% | $5,173,042,251 | International Multi-Cap Core |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

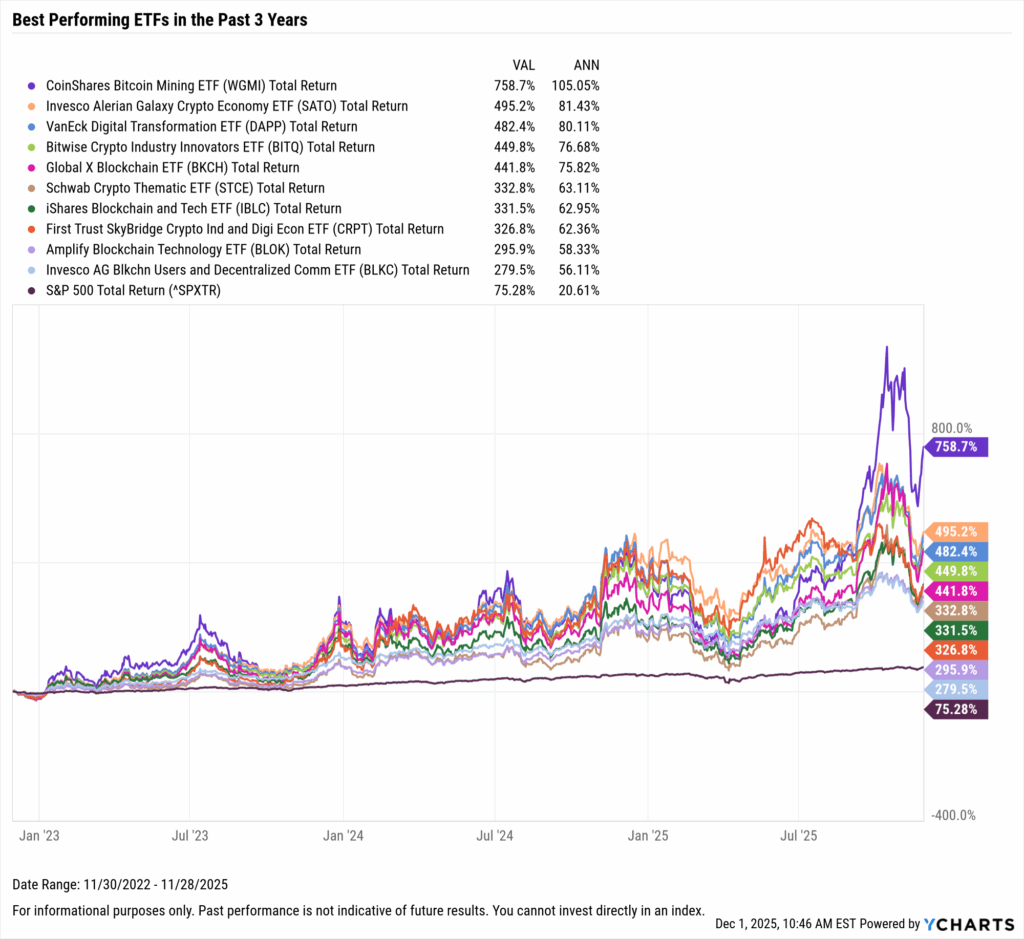

Best Performing ETFs in the Last 3 Years

These are the top-performing ETFs on an annualized basis between December 1st, 2022 and November 30, 2025.

| Symbol | Name | 3 Year Total Returns (Monthly) | Annualized 3 Year Total Returns (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|---|

| WGMI | CoinShares Bitcoin Mining ETF | 758.74% | 104.78% | 0.75% | $293,770,013 | Specialty/Miscellaneous Funds |

| SATO | Invesco Alerian Galaxy Crypto Economy ETF | 495.24% | 81.23% | 0.60% | $11,235,482 | Global Science/Technology Funds |

| DAPP | VanEck Digital Transformation ETF | 482.36% | 79.91% | 0.51% | $320,205,332 | Global Science/Technology Funds |

| BITQ | Bitwise Crypto Industry Innovators ETF | 449.80% | 76.50% | 0.85% | $415,576,837 | Specialty/Miscellaneous Funds |

| BKCH | Global X Blockchain ETF | 441.80% | 75.64% | 0.50% | $359,703,875 | Global Science/Technology Funds |

| STCE | Schwab Crypto Thematic ETF | 332.76% | 62.96% | 0.30% | $303,203,062 | Specialty/Miscellaneous Funds |

| IBLC | iShares Blockchain and Tech ETF | 331.54% | 62.81% | 0.47% | $90,458,013 | Global Science/Technology Funds |

| CRPT | First Trust SkyBridge Crypto Ind and Digi Econ ETF | 326.83% | 62.21% | 0.85% | $123,315,968 | Science & Technology Funds |

| BLOK | Amplify Blockchain Technology ETF | 295.94% | 58.20% | 0.73% | $1,204,173,807 | Science & Technology Funds |

| BLKC | Invesco AG Blkchn Users and Decentralized Comm ETF | 279.54% | 55.99% | 0.60% | $6,664,193 | Global Science/Technology Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

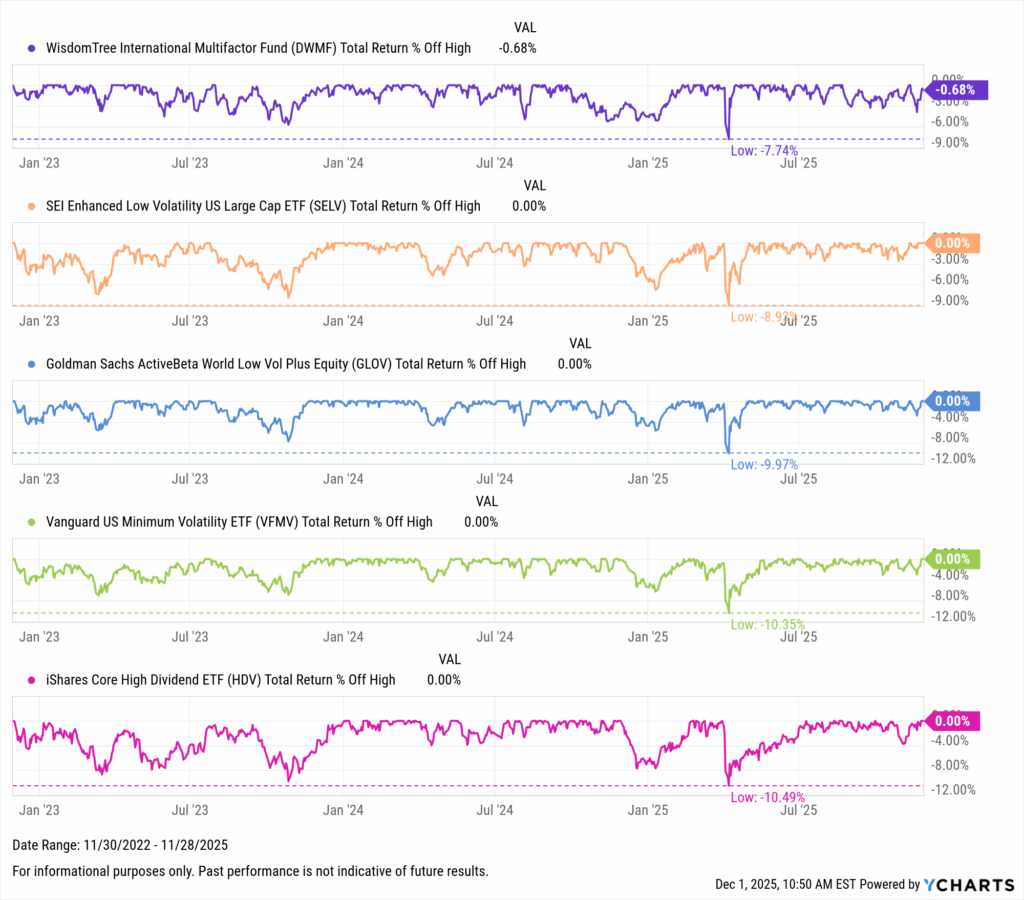

Equity ETFs with the Lowest Drawdown in the Last 3 Years

As of November 30, 2025, these equity ETFs had the lowest drawdown over the last three years. The chart below can be expanded to comprehensively depict the peak-to-trough performance of the observed funds.

| Symbol | Name | Max Drawdown (3Y) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|

| DWMF | WisdomTree International Multifactor Fund | 8.56% | 0.38% | $35,847,330 | International Multi-Cap Value |

| SELV | SEI Enhanced Low Volatility US Large Cap ETF | 8.93% | 0.15% | $195,794,556 | Multi-Cap Value Funds |

| GLOV | Goldman Sachs ActiveBeta World Low Vol Plus Equity | 10.04% | 0.25% | $1,538,683,060 | Global Multi-Cap Value |

| VFMV | Vanguard US Minimum Volatility ETF | 10.35% | 0.13% | $304,254,689 | Multi-Cap Value Funds |

| HDV | iShares Core High Dividend ETF | 10.49% | 0.08% | $11,820,991,608 | Equity Income Funds |

| HDEF | Xtrackers MSCI EAFE Hi Dv Yld Eq ETF | 11.15% | 0.09% | $2,174,899,354 | International Equity Income Funds |

| LGLV | State Street SPDR SSGA US Lg Cap Low Vol Index ETF | 11.31% | 0.12% | $1,126,157,932 | Multi-Cap Value Funds |

| EMLP | First Trust North American Energy Infrastructure | 11.47% | 0.95% | $3,489,535,137 | Energy MLP Funds |

| DEW | WisdomTree Global High Dividend Fund | 11.80% | 0.58% | $126,175,730 | Global Equity Income Funds |

| SIXA | ETC 6 Meridian Mega Cap Equity ETF | 11.92% | 0.47% | $408,893,751 | Large-Cap Value Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

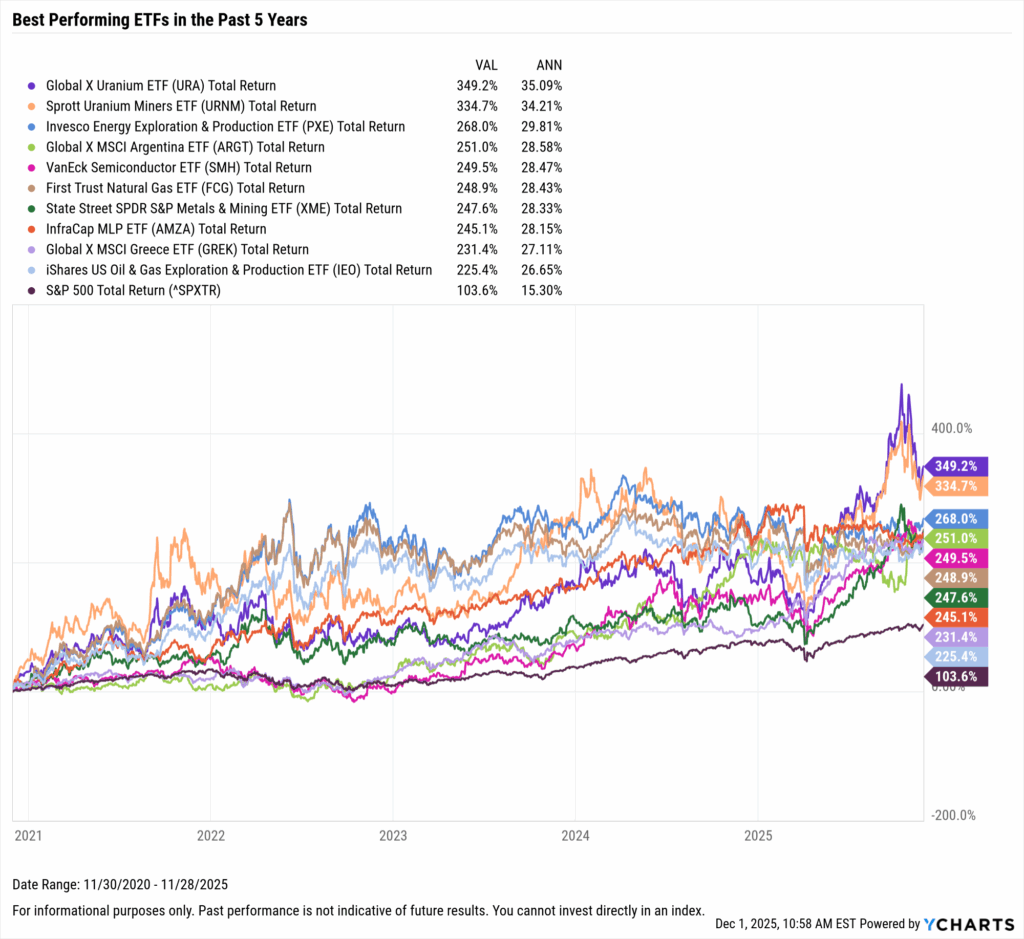

Best Performing ETFs in the Last 5 Years

These are the top-performing ETFs on an annualized basis between December 1, 2020 and November 30, 2025.

| Symbol | Name | 5 Year Total Returns (Monthly) | Annualized 5 Year Total Returns (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|---|

| URA | Global X Uranium ETF | 349.15% | 35.05% | 0.69% | $5,209,355,520 | Basic Materials Funds |

| URNM | Sprott Uranium Miners ETF | 334.66% | 34.16% | 0.75% | $1,715,589,171 | Precious Metals Equity Funds |

| PXE | Invesco Energy Exploration & Production ETF | 268.01% | 29.77% | 0.61% | $70,918,926 | Natural Resources Funds |

| ARGT | Global X MSCI Argentina ETF | 251.02% | 28.55% | 0.59% | $791,225,806 | Latin American Funds |

| SMH | VanEck Semiconductor ETF | 249.45% | 28.43% | 0.35% | $35,601,859,399 | Science & Technology Funds |

| FCG | First Trust Natural Gas ETF | 248.93% | 28.40% | 0.57% | $436,157,487 | Natural Resources Funds |

| XME | State Street SPDR S&P Metals & Mining ETF | 247.57% | 28.29% | 0.35% | $2,673,302,464 | Basic Materials Funds |

| AMZA | InfraCap MLP ETF | 245.15% | 28.12% | 2.75% | $387,421,287 | Energy MLP Funds |

| GREK | Global X MSCI Greece ETF | 231.38% | 27.08% | 0.57% | $284,717,938 | Emerging Markets Funds |

| IEO | iShares US Oil & Gas Exploration & Production ETF | 225.39% | 26.61% | 0.38% | $445,788,314 | Natural Resources Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

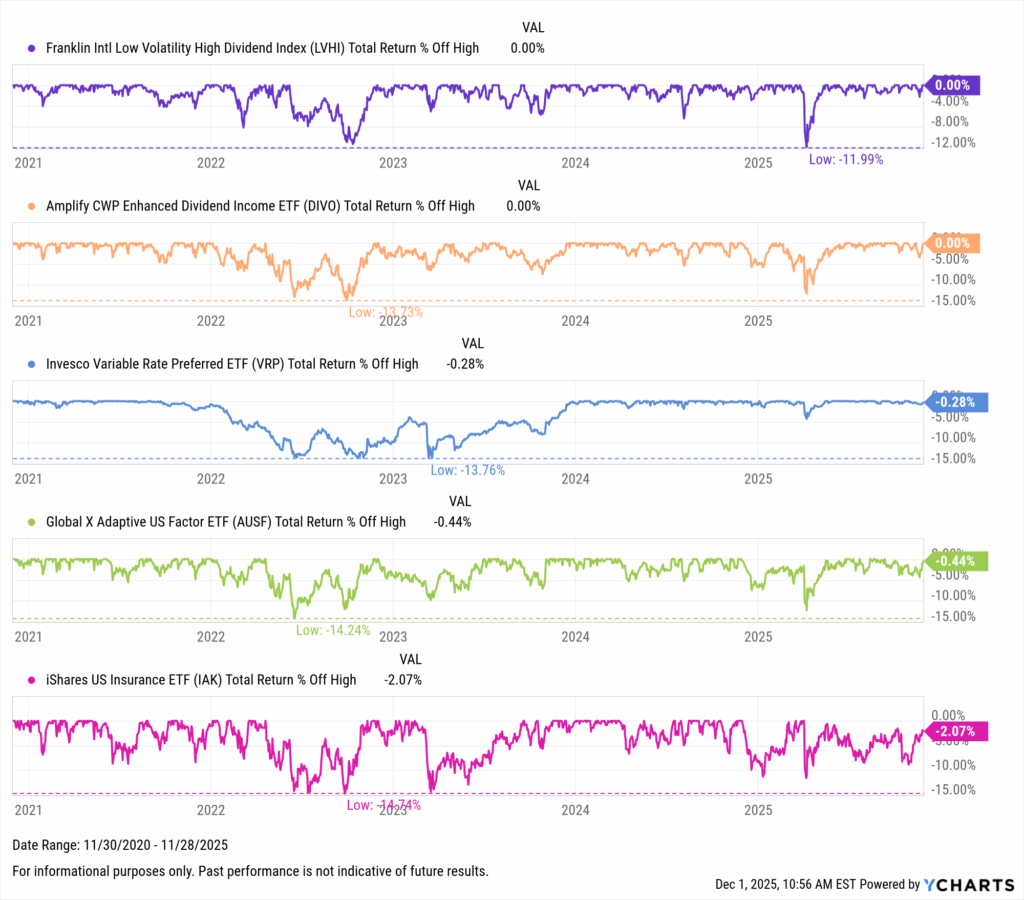

Equity ETFs with the Lowest Drawdown in the Last 5 Years

As of November 30, 2025, these equity ETFs had the lowest drawdown over the last five years. The chart below can be expanded to comprehensively depict the peak-to-trough performance of the observed funds.

| Symbol | Name | Max Drawdown (5Y) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|

| LVHI | Franklin Intl Low Volatility High Dividend Index | 13.09% | 0.40% | $3,665,249,091 | International Large-Cap Value |

| DIVO | Amplify CWP Enhanced Dividend Income ETF | 13.73% | 0.56% | $5,679,625,267 | Equity Income Funds |

| VRP | Invesco Variable Rate Preferred ETF | 13.76% | 0.50% | $2,305,611,922 | Equity Income Funds |

| AUSF | Global X Adaptive US Factor ETF | 14.24% | 0.27% | $739,457,862 | Multi-Cap Value Funds |

| IAK | iShares US Insurance ETF | 14.74% | 0.38% | $512,010,886 | Financial Services Funds |

| HEFA | iShares Currency Hedged MSCI EAFE ETF | 14.77% | 0.03% | $6,600,302,486 | International Large-Cap Core |

| DDWM | WisdomTree Dynamic International Equity Fund | 14.82% | 0.40% | $1,029,620,054 | International Multi-Cap Value |

| DBEF | Xtrackers MSCI EAFE Hedged Equity ETF | 14.99% | 0.35% | $8,435,236,437 | International Large-Cap Core |

| IYK | iShares US Consumer Staples ETF | 15.04% | 0.38% | $1,326,372,287 | Consumer Goods Funds |

| FLV | American Century Focused Large Cap Value ETF | 15.07% | 0.42% | $284,023,912 | Large-Cap Value Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

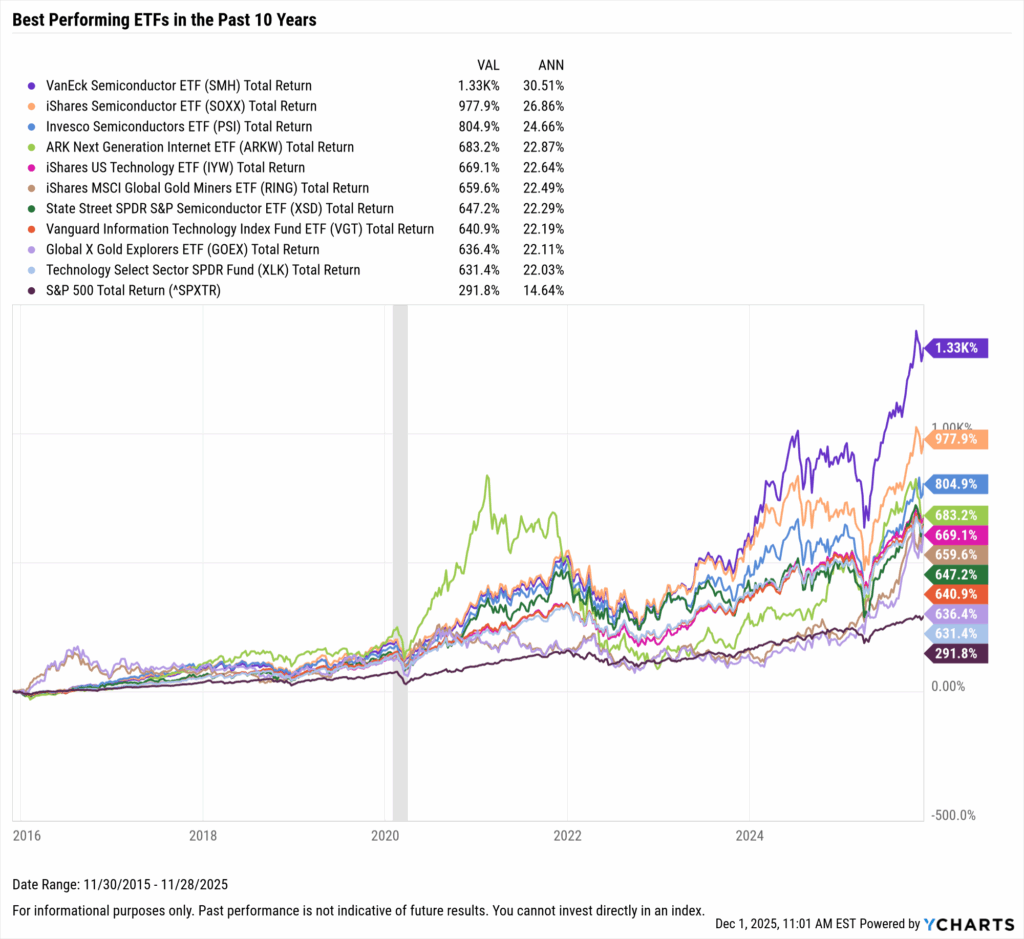

Best Performing ETFs in the Last 10 Years

These are the top-performing ETFs on an annualized basis between December 1, 2015 and November 30, 2025.

| Symbol | Name | 10 Year Total Returns (Monthly) | Annualized 10 Year Total Returns (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|---|

| SMH | VanEck Semiconductor ETF | 1331.68% | 30.49% | 0.35% | $35,601,859,399 | Science & Technology Funds |

| SOXX | iShares Semiconductor ETF | 977.92% | 26.84% | 0.34% | $16,704,412,690 | Science & Technology Funds |

| PSI | Invesco Semiconductors ETF | 804.91% | 24.64% | 0.56% | $963,938,036 | Science & Technology Funds |

| ARKW | ARK Next Generation Internet ETF | 683.17% | 22.85% | 0.82% | $2,184,151,200 | Science & Technology Funds |

| IYW | iShares US Technology ETF | 669.08% | 22.63% | 0.38% | $20,919,527,194 | Science & Technology Funds |

| RING | iShares MSCI Global Gold Miners ETF | 659.59% | 22.48% | 0.39% | $2,739,070,600 | Precious Metals Equity Funds |

| XSD | State Street SPDR S&P Semiconductor ETF | 647.21% | 22.28% | 0.35% | $1,599,332,405 | Science & Technology Funds |

| VGT | Vanguard Information Technology Index Fund ETF | 640.90% | 22.17% | 0.09% | $118,968,804,029 | Science & Technology Funds |

| GOEX | Global X Gold Explorers ETF | 636.36% | 22.10% | 0.65% | $124,675,368 | Precious Metals Equity Funds |

| XLK | Technology Select Sector SPDR Fund | 631.37% | 22.02% | 0.08% | $93,463,550,337 | Science & Technology Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

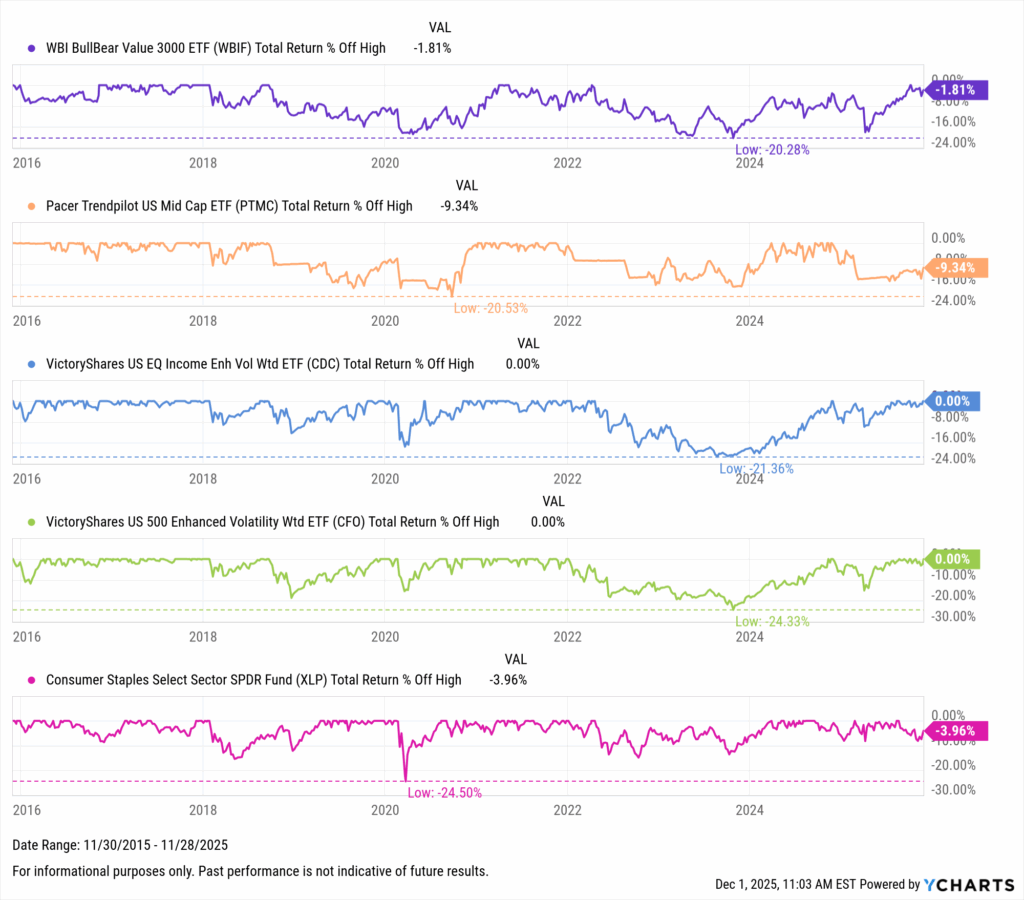

Equity ETFs with the Lowest Drawdown in the Last 10 Years

As of November 30, 2025, these equity ETFs had the lowest drawdown over the last ten years. The chart below can be expanded to comprehensively depict the peak-to-trough performance of the observed funds.

| Symbol | Name | Max Drawdown (10Y) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|

| WBIF | WBI BullBear Value 3000 ETF | 20.28% | 1.65% | $26,405,103 | Multi-Cap Core Funds |

| PTMC | Pacer Trendpilot US Mid Cap ETF | 20.53% | 0.60% | $396,023,439 | Small-Cap Core Funds |

| CDC | VictoryShares US EQ Income Enh Vol Wtd ETF | 21.36% | 0.35% | $721,816,007 | Multi-Cap Value Funds |

| CFO | VictoryShares US 500 Enhanced Volatility Wtd ETF | 24.33% | 0.35% | $411,055,019 | Multi-Cap Core Funds |

| XLP | Consumer Staples Select Sector SPDR Fund | 24.50% | 0.08% | $15,474,956,279 | Consumer Goods Funds |

| KXI | iShares Global Consumer Staples ETF | 24.59% | 0.39% | $901,193,455 | Consumer Goods Funds |

| RTH | VanEck Retail ETF | 24.99% | 0.35% | $259,552,262 | Consumer Services Funds |

| GMOM | Cambria Global Momentum ETF | 25.02% | 1.01% | $119,632,540 | Global Multi-Cap Core |

| FSTA | Fidelity MSCI Consumer Staples Index ETF | 25.09% | 0.08% | $1,328,913,758 | Consumer Goods Funds |

| WBIL | WBI BullBear Quality 3000 ETF | 25.30% | 1.55% | $31,980,001 | Multi-Cap Core Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

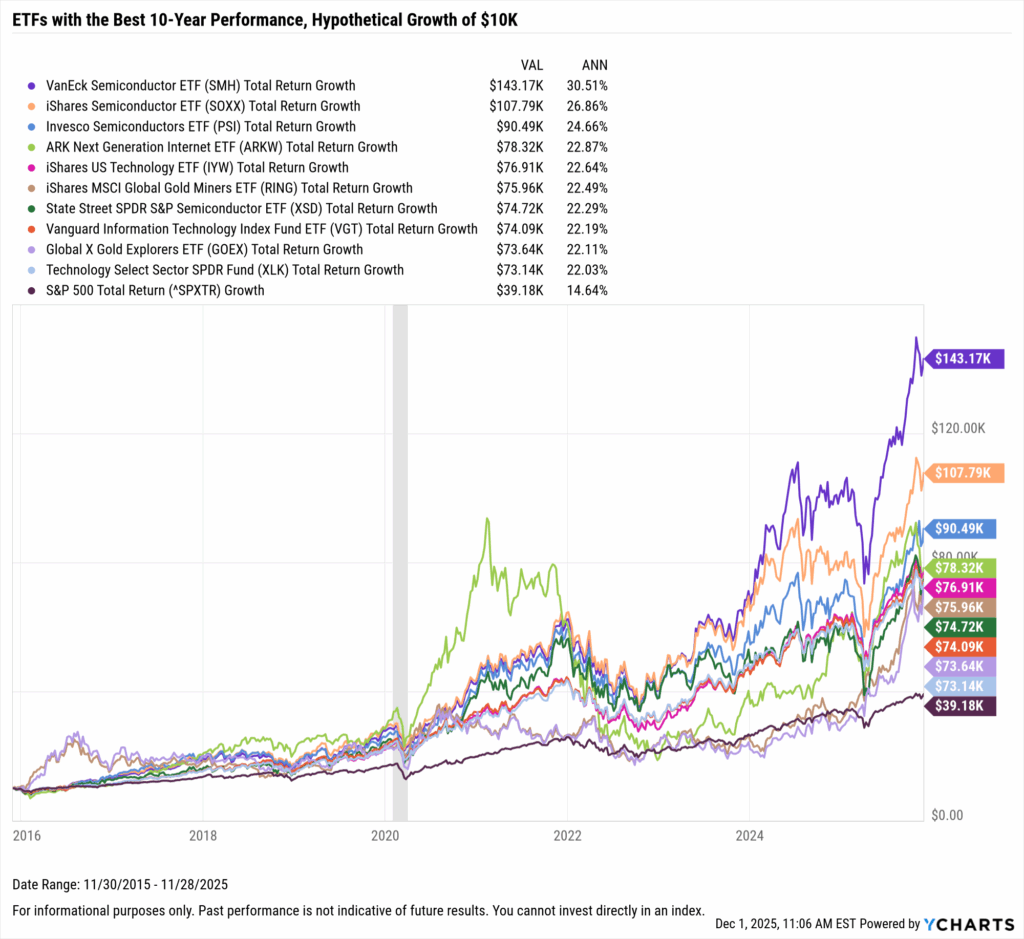

What Was the Growth of $10,000 in the Top ETFs Over the Last 10 Years?

If you invested $10,000 10 years ago into any of the ten best-performing ETFs over the last 10 years, your balance today would be no less than $79K.

The best-performing ETF in the last 10 years was VanEck Semiconductor ETF (SMH). A $10,000 investment into SMH 10 years ago would be worth over $143,000 today. Right behind it was the iShares Semiconductor ETF (SOXX); investing $10,000 into SOXX back in 2015 would’ve turned into $108K.

Download Visual | Modify in YCharts

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of ETF trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Monthly Market Wrap: November 2025Read More →