Make Summer Work Harder: The Mid-Year Checklist for Advisors

While summer brings out the golf clubs and getaway plans, it also offers a rare stretch of breathing room. Fewer meetings. More headspace. And the perfect time to get strategic.

The “summer slowdown” provides advisors with an opportunity to prepare their practices for success for the rest of 2025.

This post offers tips for advisors to get the most out of summer for the benefit of their practices, including how to efficiently evaluate investment strategies, maintain communication channels with clients, refine marketing strategies, and tackle operational to-dos.

Evaluate Investment Strategies

Market conditions shift. Portfolios should too. Use this slower stretch to reassess models, screen for replacement securities, and test changes before fall comes back around.

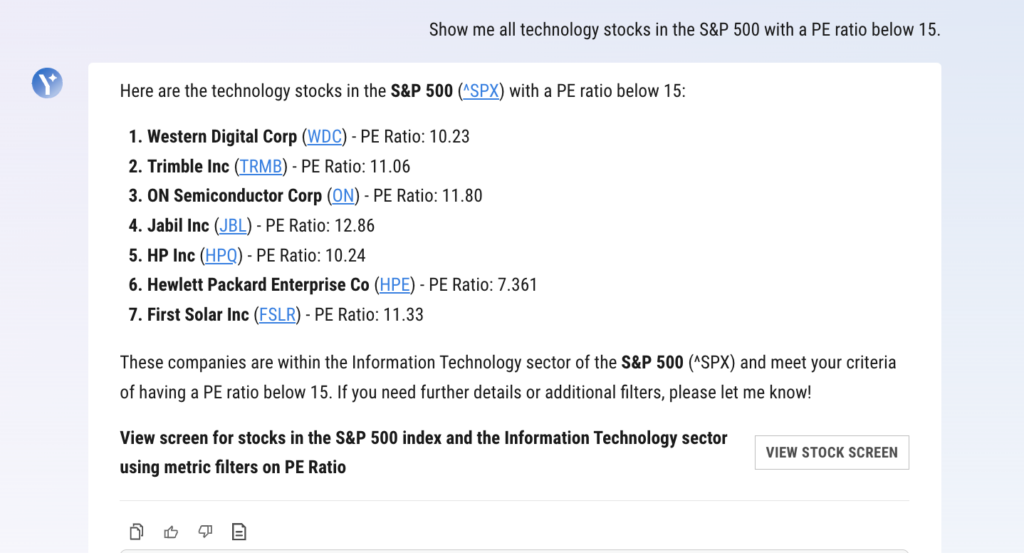

Screeners are efficient tools for searching large stock and fund universes to find securities that meet specific criteria. Alternatively, advisors can save even more time by leveraging artificial intelligence tools such as AI Chat. Simply tell AI Chat what to look for and receive accurate results in a matter of moments, resulting in less time spent at a desk and more time at the beach.

Once new or replacement security candidates have been found, an advisor can easily tweak models to include those security selections and even rebalance clients’ actual allocations based on market movements or life changes to set them up for success in pursuit of their goals.

Conduct Mid-Year Check-ins

For clients who prefer more frequent contact from their advisor – proven to be a major factor in client satisfaction – summertime is a terrific window for scheduling quick, informal meetings with clients. These mid-year touchpoints are a smart opportunity to review portfolio performance, reassess risk tolerance, and confirm that investment goals are still aligned with life changes and market conditions.

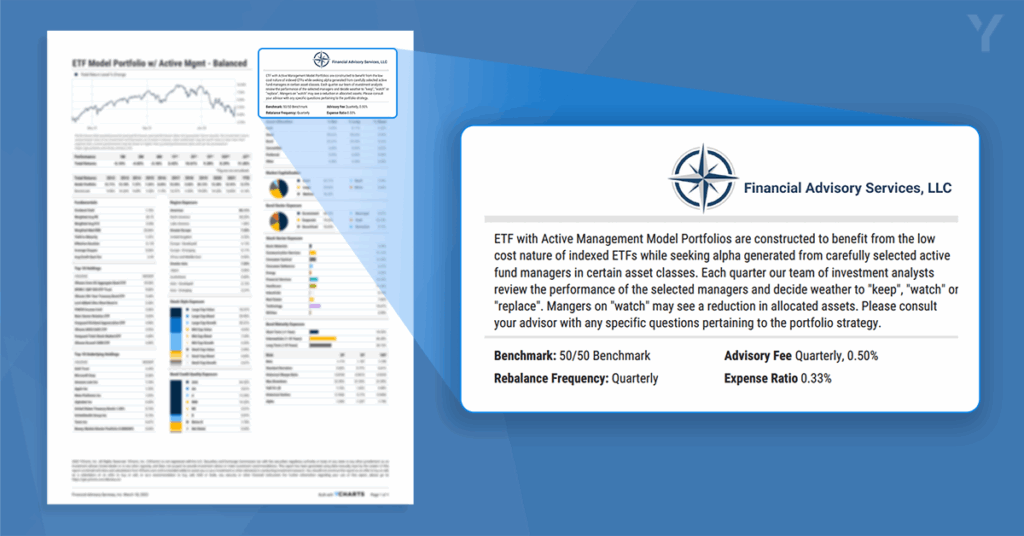

Advisors can also quickly generate take-home collateral such as portfolio performance reports or single-page tearsheets to leave clients with robust, tangible updates on progress toward their goals.

These small, proactive check-ins pay dividends: better retention, increased wallet share, and peace of mind for clients who expect more.

Refine Marketing and Client Outreach

Referrals remain the #1 driver behind new client acquisition, and many of your best leads may already be sitting in your CRM. Summer offers a prime window to re-engage prospects from earlier in the year, especially with inboxes less crowded and schedules more flexible. Revisit referral leads, show up at golf outings or community events, and come prepared with polished leave-behinds powered by YCharts visuals and templates.

It’s also a great time to expand your digital presence. Whether it’s sharing a market update on LinkedIn, publishing a blog post, or sending a mid-year client newsletter, content marketing builds trust even while clients are on vacation. For advisors looking to sharpen their approach, webinars, sample agendas, and email templates can all make outreach faster and more effective heading into Q3.

Tackle Operational Housekeeping

Summer’s slower pace makes it the ideal time to clean up the back office; those tasks that never feel urgent but pay off in efficiency and compliance.

Start with your CRM. Scrubbing outdated contact data can sharpen your outreach and uncover hidden opportunities. Then, revisit compliance procedures to ensure everything’s up to standard before regulatory season ramps up.

Now’s also the time to pressure-test your tech stack. What’s actually driving value? What’s collecting dust? Lighter schedules give you the space to evaluate whether your systems work together or against you. If tools feel scattered or duplicative, consider consolidation. Platforms like YCharts can replace multiple-point solutions to streamline research, model management, and reporting into one intuitive workflow.

Fewer logins. Lower overhead. Higher productivity. That’s a summer win worth checking off.

Summer may be slower, but it doesn’t have to be stagnant. Use this window to fine-tune your strategy, deepen client relationships, and streamline operations so when Q3 hits, you’re not playing catch-up, you’re pulling ahead. Whether it’s optimizing portfolios or consolidating your tech stack, YCharts is built to help advisors work smarter year-round.

Whenever you’re ready, here’s how YCharts can help you:

1. Want to reduce time spent researching stocks, funds, or macro trends?

Explore how AI Chat can accelerate your workflow.

2. Want to know how much time you could save on proposals?

Calculate Your ROI with YCharts and see the impact for your business.

3. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Federal Reserve’s June 2025 Meeting: What Advisors Must KnowRead More →