The Magnificent Seven Stocks: Post-Q2 Earnings Recap

After a surge in their stock prices throughout 2023, investors’ eyes were glued to the Q2 earnings reports for NVIDIA (NVDA), Tesla (TSLA), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL, GOOG), Meta (META), and Amazon (AMZN).

Before earnings season, we did a mid-year status update on the ‘Magnificent Seven’ stocks. Now, with earnings in the rearview, here’s how those companies stand.

Enter Your Email to Recieve a Post-Earnings Season UpdateNVIDIA After Q2 Earnings

After soaring all 2023, it felt like all of Wall Street’s eyes were on NVIDIA on August 23rd – and it delivered. (Click here to see how NVIDIA was doing before earnings)

The chipmaker registered a staggering $13.51B in revenue, marking a 101% YoY surge. EPS stood tall at $2.70, surpassing the forecasted $2.14 by a considerable margin, reflecting a colossal 429% YoY uptick.

Download Visual | Modify in YCharts

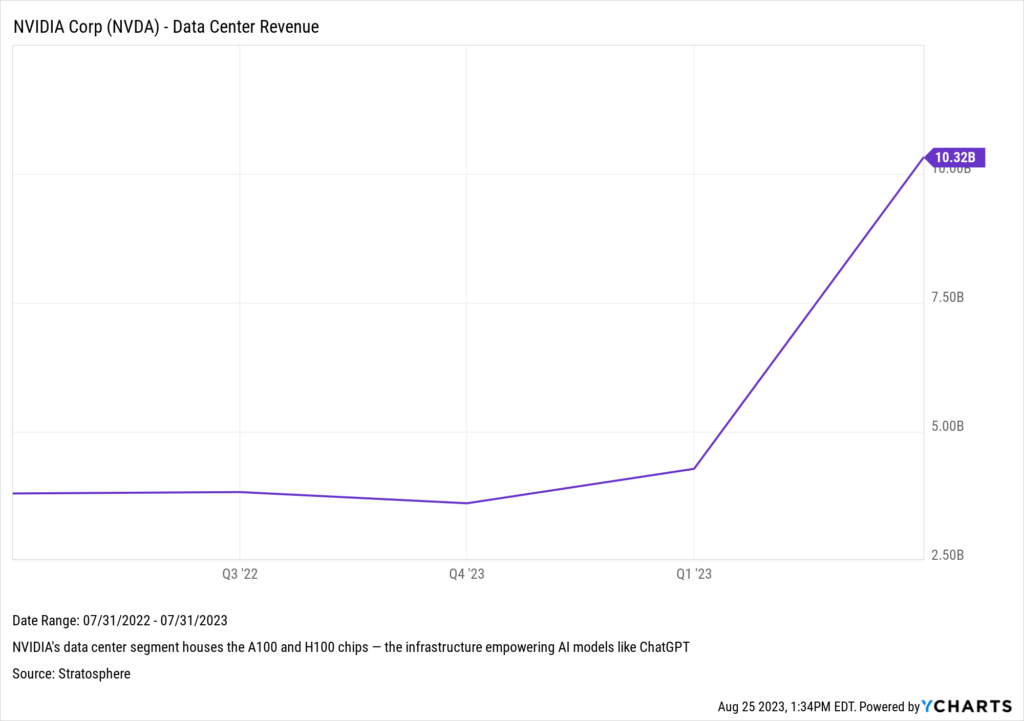

As expected, the linchpin behind NVIDIA’s impressive growth was its data center segment, home to the powerhouse A100 and H100 AI chips — the very infrastructure powering AI models like ChatGPT. This segment alone raked in a whopping $10.32 billion in revenue, showcasing an impressive 171% annual growth.

Download Visual | Modify in YCharts

NVIDIA’s achievements were not confined to the AI realm. Its gaming business, which the company was historically known for, burgeoned by 22% YoY. The company continues to capitalize on the “trillion dollar opportunity” it laid out, reporting 15% YoY growth from the automotive sector, translating to $253 million in revenue.

Download Visual | Modify in YCharts

Per the earnings press release, CEO Jensen Huang said, “A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

Echoing this bullish sentiment, NVIDIA issued an optimistic revenue guidance for the next quarter, targeting $16 billion, suggesting that its sales will grow 170% annually.

Tesla After Q2 Earnings

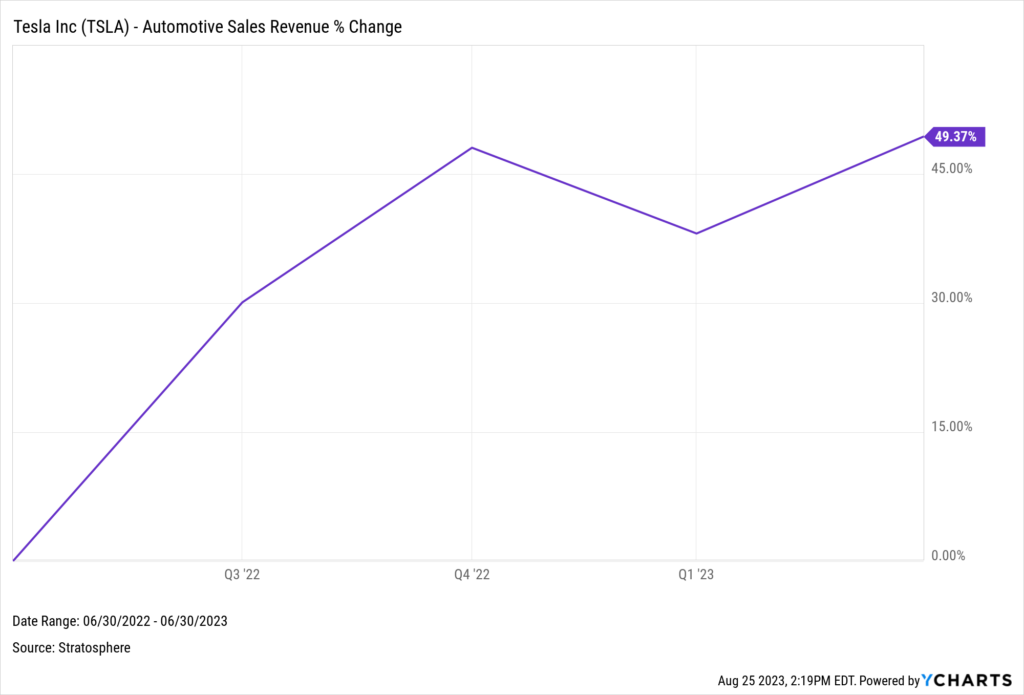

Tesla reported a solid second quarter on July 19th. The electric vehicle maker beat analyst expectations with an EPS of $0.91, surpassing the projected EPS of $0.82 and a notable 20.21% jump from the same period last year. Furthermore, the automaker’s car sales revenue experienced a remarkable 49.37% YoY growth, raking $20.42B in revenues. (Click here to see how Tesla was doing before earnings)

Download Visual | Modify in YCharts

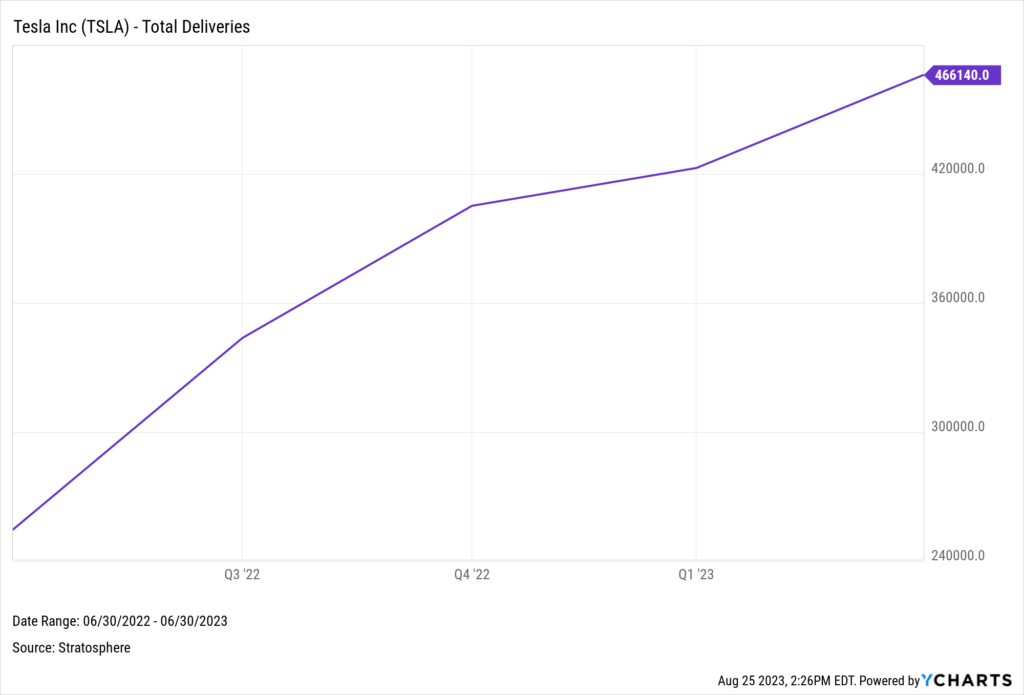

The robust revenue figures align with Tesla’s delivery of 466,140 vehicles this quarter, marking an 83% rise from the same timeframe in the previous year.

Download Visual | Modify in YCharts

However, it wasn’t all smooth sailing. The amplified delivery count was linked to price-cutting measures, denting the company’s operating margin to a five-year low of 9.6%. Additionally, the anticipated announcement of the official Cybertruck delivery date remained absent, leaving analysts unsatisfied. Yet, in a positive spin, CEO Elon Musk assured high-volume production next year and confirmed deliveries to commence this year.

Diving deeper, Tesla is significantly ramping up its R&D expenditures to $943 million, a substantial rise from $667 million last year.

Download Visual | Modify in YCharts

The primary focus of these investments? You guessed it: Artificial Intelligence.

For Tesla, that means investing in the development of ‘Dojo’, its supercomputer geared for AI machine learning and computer vision training. With data collected from customers and company vehicles, Tesla aims to enhance its software while introducing innovative features for its driver assistance systems.

Apple After Q2 Earnings

Apple navigated its third consecutive quarter of declining revenue for the first time since 2016, which is attributable mainly to waning iPhone demand. (Click here to see how Apple was doing before earnings)

Download Visual | Modify in YCharts

Breaking down the numbers: YoY, iPhone sales took a 2.5% hit, landing at $39.7 billion, and iPads witnessed the sharpest decline. However, not everything was gloomy. Apple’s services unit, which Chief Financial Officer Luca Maestri called the company’s “leading indicator of the strength and health of [Apple’s] ecosystem,” reported a record $21 billion in revenue, spurred by the company acquiring more than a billion paid subscribers across various platforms.

Download Visual | Modify in YCharts

China, Apple’s third-largest market, saw a 7.9% revenue uptick, clocking in at $15.8 billion. Elsewhere in Asia, India was one of 8 countries CEO Tim Cook mentioned as posting a record for total revenue.

“[India] is the second largest smartphone market in the world. So we ought to be doing really well there,” Cook said. “We still have a very, very modest and low share in the smartphone market. And so I think that it’s a huge opportunity for us.”

Alphabet After Q2 Earnings

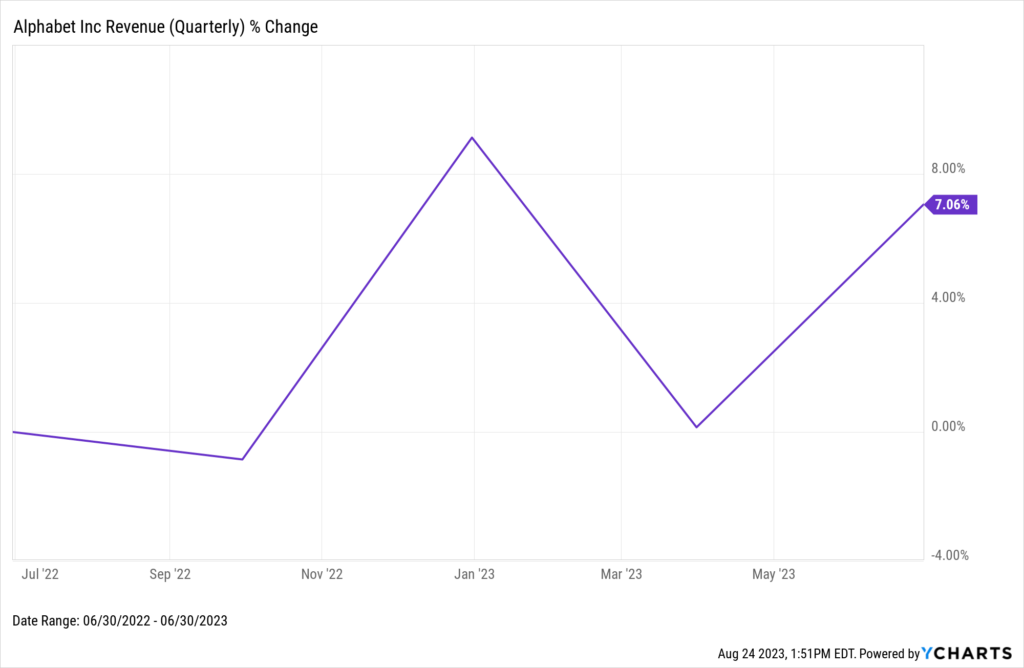

Alphabet posted second-quarter earnings of $1.44 per share, exceeding the expected $1.33. Revenue surged by 7% YoY, reaching $74.6 billion, up from $69.7 billion recorded in the same period the previous year. (Click here to see how Alphabet was doing before earnings)

Download Visual | Modify in YCharts

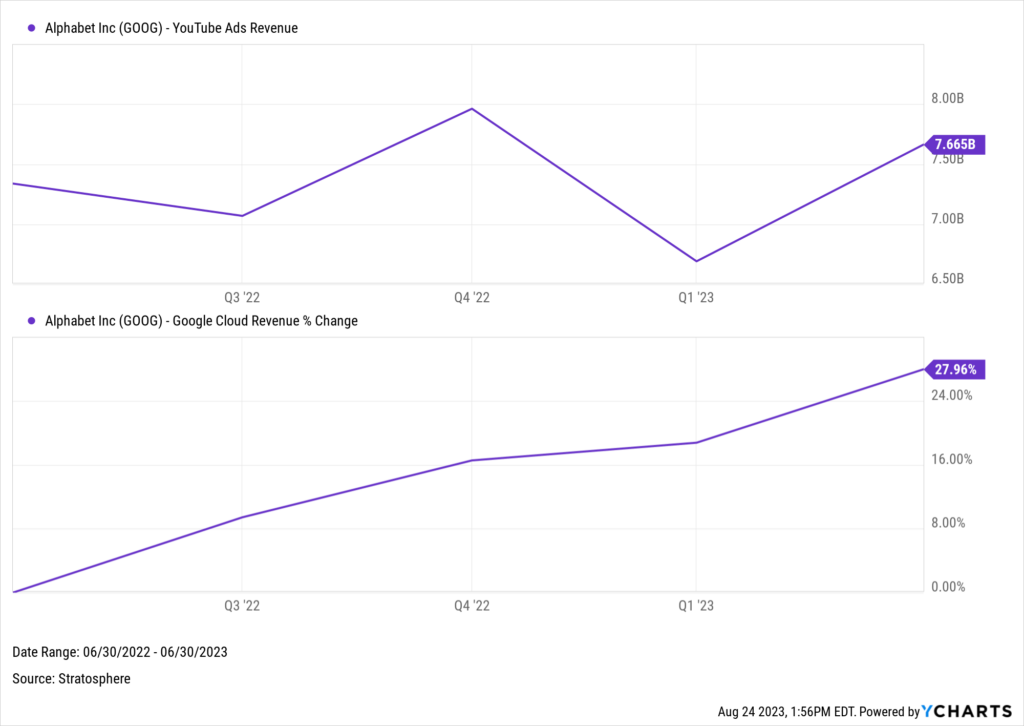

Google’s cloud division saw a promising 28% YoY growth, highlighting the company’s intensified focus and success in cloud computing. Ad revenue, the backbone of Alphabet’s earnings, grew by 3.3%, with a total revenue of $58.14 billion, a slight uptick from last year’s $56.29 billion. Moreover, YouTube’s advertising revenue stood at $7.67 billion despite wrestling with fierce competition, notably from TikTok, in the short video segment.

Download Visual | Modify in YCharts

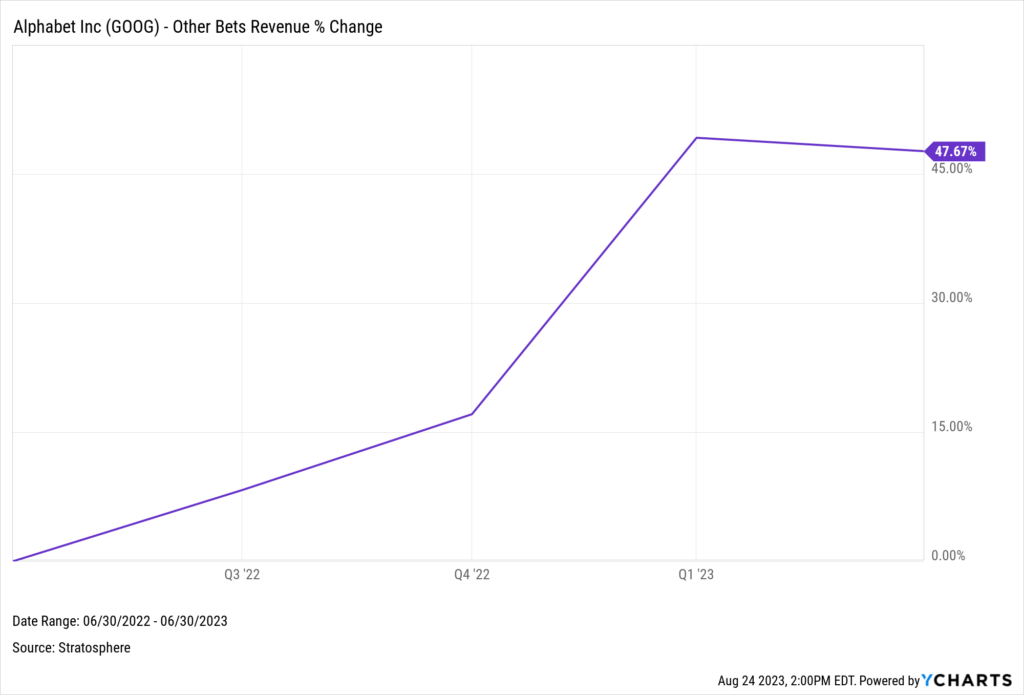

Alphabet’s ‘Other Bets‘ segment, which encompasses the autonomous driving venture Waymo, saw a significant 48% YoY revenue rise, amounting to $285 million.

Download Visual | Modify in YCharts

Speaking of the ‘Other Bets’ segment, the company announced that Ruth Porat, Alphabet’s CFO for the past eight years, is set to transition to a newly forged role as the president and chief investment officer. Porat will oversee the ‘Other Bets’ portfolio, hinting at the company’s future strategic direction.

META Platforms After Q2 Earnings

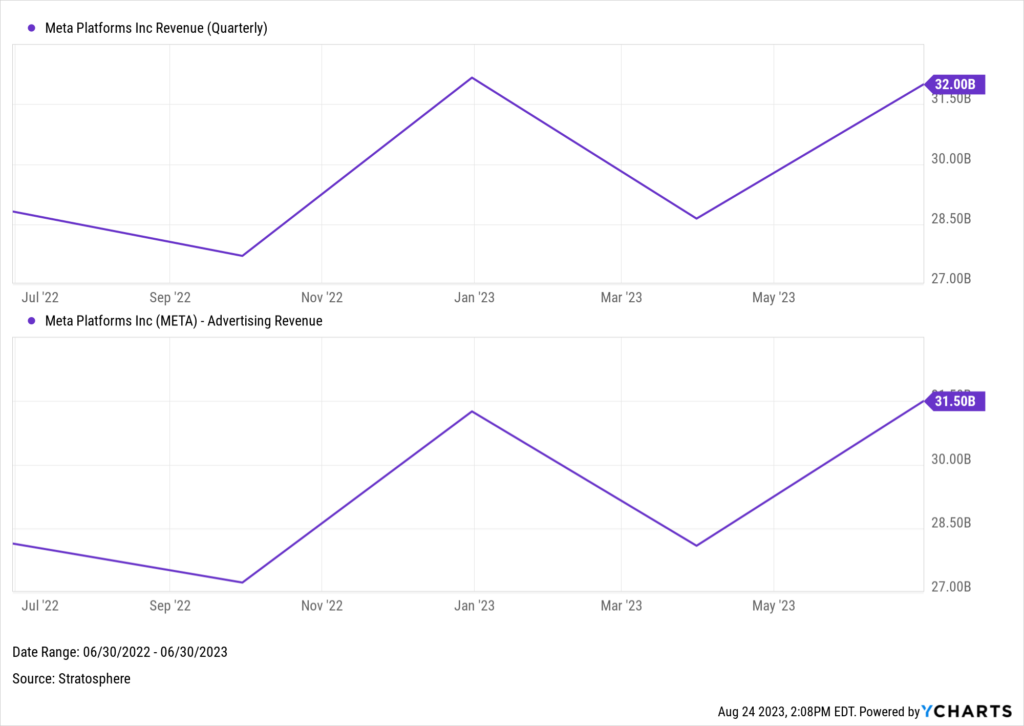

Meta Platforms, previously known as Facebook, delivered an impressive financial performance, reporting double-digit revenue growth for the first time since Q4 of 2021. The company’s Q2 earnings clocked in at $2.98 per share, surpassing the anticipated $2.88. (Click here to see how Meta was doing before earnings)

This fiscal momentum was underscored by an 11% YoY revenue increase, charged by the 12% YoY uptick in advertising revenue. Moreover, the net income swelled to $7.79 billion, up from the previous year’s $6.69 billion.

Download Visual | Modify in YCharts

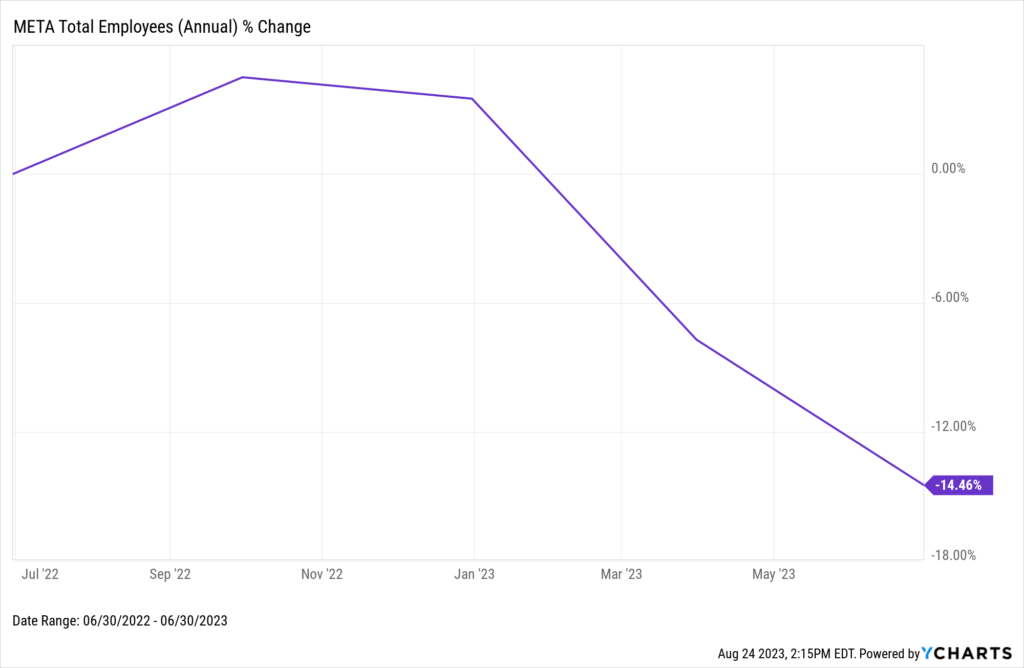

In some ways, Meta’s solid performance can be summed up as addition by subtraction; the company’s overall headcount dipped by 14.5% YoY to 71,469. This reduction is in part attributed to the substantial layoffs in 2023, with half of those affected employees factored into the headcount reported as of June 30, 2023.

Download Visual | Modify in YCharts

Regarding its workforce strategy, Meta has expressed intentions to invest more in payroll. CFO Susan Li stated: “We anticipate growth in our payroll expenses as we evolve our workforce composition toward higher-cost technical roles” on the Q2 earnings call.

This move suggests that employees transitioning into select technical positions might witness an uptick in compensation, reflecting Meta’s emphasis on technical prowess and innovation.

AMZN After Q2 Earnings

Amazon posted double-digit revenue growth after grappling with single-digit expansion in five out of the previous six quarters. The company’s Q2 earnings came in at 65 cents per share, comfortably beating the expected 34 cents. (Click here to see how Amazon was doing before earnings)

Download Visual | Modify in YCharts

Amazon’s CEO, Andy Jassy, who succeeded founder Jeff Bezos in July 2021, highlighted the significant role of AWS in the company’s renewed growth trajectory. Amid earlier signs of clients cutting back on AWS spending due to economic volatility, Jassy observed a stabilization in this trend, stating: “While customers have continued to [cost] optimize during the second quarter, we’ve started seeing more customers shift their focus towards driving innovation and bringing new workloads to the cloud.”

Notably, AWS sales rose 12% to $22.1B, and the segment contributed $5.37B to the company’s total operating profit of $7.7B. Additionally, its advertising segment saw a 22% increase in quarterly revenue, reaching $10.7B.

Download Visual | Modify in YCharts

Enter Your Email to Recieve a Post-Earnings Season UpdateConnect with YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2023 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further inf

Next Article

Betting on Bonds: Capitalizing on Fixed Income After Rising RatesRead More →