How to Use YCharts to Win New Business and Grow AUM

In today’s competitive advisory landscape, leveraging proposal tools like YCharts is essential for attracting new clients and increasing Assets Under Management (AUM). YCharts enhances an advisor’s ability to present data-driven investment strategies, build client trust, and effectively manage portfolios, which can drive significant business growth. By integrating YCharts into a tech stack, advisors can differentiate themselves in the market, offer unmatched service quality, and ultimately secure a superior competitive position.

YCharts Overview and Its Benefits for Advisors

What is YCharts?

YCharts is a premier portfolio and proposal platform that offers comprehensive market data, analytical model portfolio tools, and presentation solutions. Designed specifically for financial advisors, asset managers, and investment strategists, YCharts provides a rich suite of capabilities to streamline the report generation process, enhance portfolio insights, improve client satisfaction and win new business.

Key Benefits of YCharts

Using YCharts, advisors can speed up the process of building model portfolios, support data-driven decision-making, and improve client communication. The platform is pivotal in differentiating advisory services through simplified workflows, customizable reporting capabilities, and real-time data access, setting the stage for elevated advisory performance and client satisfaction.

Leveraging YCharts for Client Acquisition

Creating Impressive Client Presentations

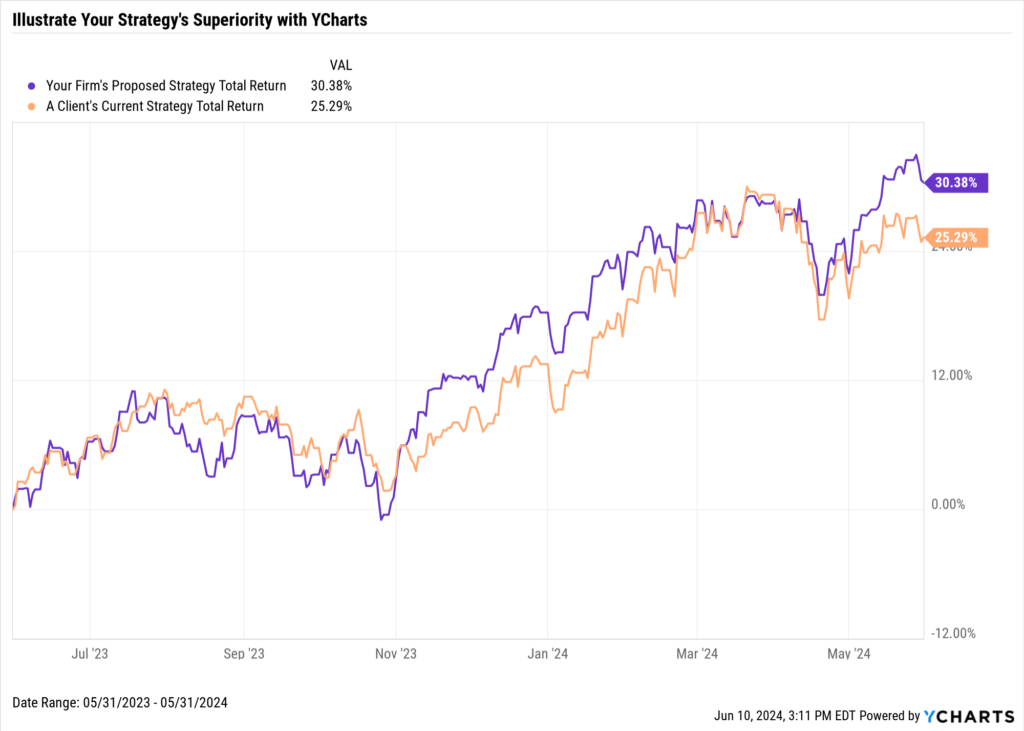

With tools like Fundamental Charts and Report Builder, YCharts enables the creation of compelling presentations that demonstrate the value of your investment strategies compared to others in the marketplace. For example, advisors can build dynamic presentations that underscore the strengths of their approaches compared to competitors, effectively showcasing their knowledge and expertise.

Connect With our Team to Create Visuals Like These

Enhancing Client Proposals

YCharts aids in developing detailed, personalized client proposals. By customizing proposals with visual data that align with client objectives and risk profiles, advisors can make a strong, persuasive case for their services. This process enhances proposal quality and increases the likelihood of winning new business.

Connect With our Team to Generate a Proposal

Using YCharts to Grow AUM

Identifying New Opportunities

YCharts’ Screeners and Dashboards are instrumental in helping advisors identify new investment opportunities and trends. For instance, an advisor might discover a high-potential value strategy through YCharts and successfully integrate it into client portfolios, enhancing portfolio diversity and potential returns.

Enhancing Portfolio Management

The platform supports effective portfolio management through tools like Scenarios, Holdings Overlap, and Model Portfolios. These tools allow advisors to optimize client portfolios and enhance performance, increasing client satisfaction and retention—a critical factor in sustained AUM growth.

YCharts Features for Winning New Business

Data Visualization and Reporting

Ryan Miller, RICP, from Cetera Investors highlights how YCharts’ reporting functionalities provide clear, client-friendly outputs, which are crucial during client meetings. Miller mentioned that YCharts’ ability to export data seamlessly to Excel has enhanced efficiency, reducing preparation time significantly from minutes to mere seconds. This transformation in data handling and presentation allows financial advisors to effectively communicate complex data in an engaging manner that resonates with clients.

Connect With our Team to Generate a Report

In addition to insights from Cetera Investors, Balasa Dinverno Foltz LLC (BDF) also exemplifies how YCharts’ data visualization tools are instrumental. BDF leverages YCharts to provide personalized, visually engaging client presentations that showcase data and metrics in an easily digestible format. This ability to customize content significantly enhances client communications, making complex data more accessible and understandable.

Comparative Analysis Tools

YCharts exemplifies its strength in offering direct comparisons between a client’s current portfolio and proposed investment strategies. This capability enables advisors like Ryan to articulate potential improvements and align strategies directly with client goals, solidifying client trust and facilitating more informed decision-making.

The YCharts Transition Analysis Tool further enhances the portfolio transition process by streamlining portfolio transitions and ensuring that any transition plan accounts for your client’s tax budget and financial goals. It automates and customizes transition strategies, efficiently managing tax impacts to align with financial goals, which is crucial for high-net-worth clients.

This tool allows you to make real-time adjustments and comprehensive proposals, which include detailed reports outlining the target allocation and required transactions. By providing full transparency and facilitating client involvement during meetings, YCharts saves advisors time and deepens client engagement and trust. Check out the video below to preview how the Transition Analysis tool will benefit your practice.

Case Studies and Success Stories

Real-world Applications

Ryan’s use of YCharts has led to remarkable efficiency gains, reducing his monthly research time from up to 10 hours to just 1-2 hours. The ability to quickly adjust and present financial data using YCharts has been instrumental in converting direct investment accounts to Cetera’s advisory platform, thus driving AUM growth.

Wealth managers at BDF also experience significant time savings thanks to YCharts’ streamlined research processes, saving approximately 3-4 hours per week. These efficiencies translate into more time for client engagement and personalized advice.

Best Practices

Ryan’s experience underscores the importance of leveraging YCharts for the depth of its financial data and client-facing tools. By creating custom report templates highlighting key performance and risk metrics, advisors can streamline their workflow and provide consistent updates that keep clients informed and engaged.

Implementing YCharts in Your Advisory Practice

Getting Started

Following BDF’s example, new YCharts users benefit from a structured and helpful onboarding process. Firms can quickly set up their teams with customized dashboards and watchlists, as YCharts offers personalized setup assistance to ensure a smooth transition.

Training and Support

The success stories from both Cetera and BDF emphasize the comprehensive support and training provided by YCharts. Direct support from dedicated account managers in addition to webinars and tutorials ensures that all team members, regardless of their technical proficiency, can maximize the benefits offered by YCharts.

These insights from BDF and Cetera Investors are just two examples that illustrate the transformative impact YCharts has had on thousands of financial advisory practices. YCharts helps enhance client interactions, optimize research processes, and facilitate a cohesive strategic approach across teams.

Conclusion

YCharts is an invaluable tool for advisors aiming to win new business and grow AUM. Its comprehensive features support effortless report generation, portfolio management, and effective client engagement. We encourage advisors to explore YCharts’ capabilities to boost client acquisition by getting in touch for a personalized information session or starting a free trial.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Top 10 Visuals for Client and Prospect Meetings slide deck:

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Simplifying Portfolio Transitions with YCharts' New Transition Analysis ToolRead More →