Simplifying Multitasking in Financial Advisory: Integrative Tools for Success

The ability to efficiently juggle multiple tasks is paramount in the fast-paced world of financial advisory. Financial advisors often find themselves overwhelmed by the demands of client management, portfolio analysis, compliance, and market research. Effective time management becomes not just a skill but a necessity for success.

Integrative tools have emerged as game-changers, simplifying complex tasks and significantly enhancing productivity. This post explores the critical role of these tools, with a particular focus on the efficiencies offered by YCharts, and provides practical insights into optimizing their use in financial advisory practices.

The Need for Efficiency in Financial Advisory

Financial advisors wear many hats. Their roles have expanded beyond providing investment advice to include comprehensive financial planning, regulatory compliance, proposal generation, and client relationship management. This increasing complexity often leads to multitasking, which, while necessary, can adversely impact efficiency and client satisfaction.

Multitasking can dilute focus, leading to errors, overlooked details, and suboptimal client interactions. In a profession where precision and personalized service are critical, these inefficiencies can harm an advisor’s reputation and client trust. Therefore, the need for streamlined processes and tools that aid in effective multitasking is more pressing than ever.

Overview of Integrative Tools

Integrative tools are software solutions designed to consolidate various functions into a single platform, thereby enhancing productivity. These tools help consolidate a financial advisor’s tech stack by managing client information, conducting detailed portfolio analysis, ensuring compliance, and more, all in a single interface. They reduce the need for switching between different applications, thus saving time and minimizing errors.

Examples of Integrative Tools in Financial Advisory

- CRM Systems: These tools help manage client relationships and track interactions, ensuring that advisors can provide personalized service and follow up on client needs effectively.

- Portfolio Management Software: These platforms offer detailed analysis and reporting capabilities, helping advisors track investment performance and make informed decisions.

- Compliance Software: Ensures that all advisory practices are in line with regulatory requirements, thus reducing the risk of non-compliance.

Finding an Integrative Advisor Tool

YCharts is a powerful integrative tool designed specifically for financial advisors that combines portfolio management and compliance software into one. It offers a suite of features that support multitasking and integration, making it an invaluable asset for any advisory practice.

Key Features of YCharts

- Dashboard Capabilities: YCharts’ dashboards allow advisors to monitor various financial metrics and client portfolios in real-time. Customizable alerts can be set up to notify advisors of significant changes, ensuring they stay informed and can act promptly.

- Stock and Fund Screeners: These screeners enable efficient security research and idea generation. Advisors can create and save customized screens to their accounts, making future research quicker and more targeted.

- Interactive Fundamental Charts: These charts are useful for illustrating investment stories during client meetings. Advisors can save, share, print, and embed these charts in reports, making data presentation seamless and professional. Firm logos can also be automatically added to charts, ensuring a consistent branding experience.

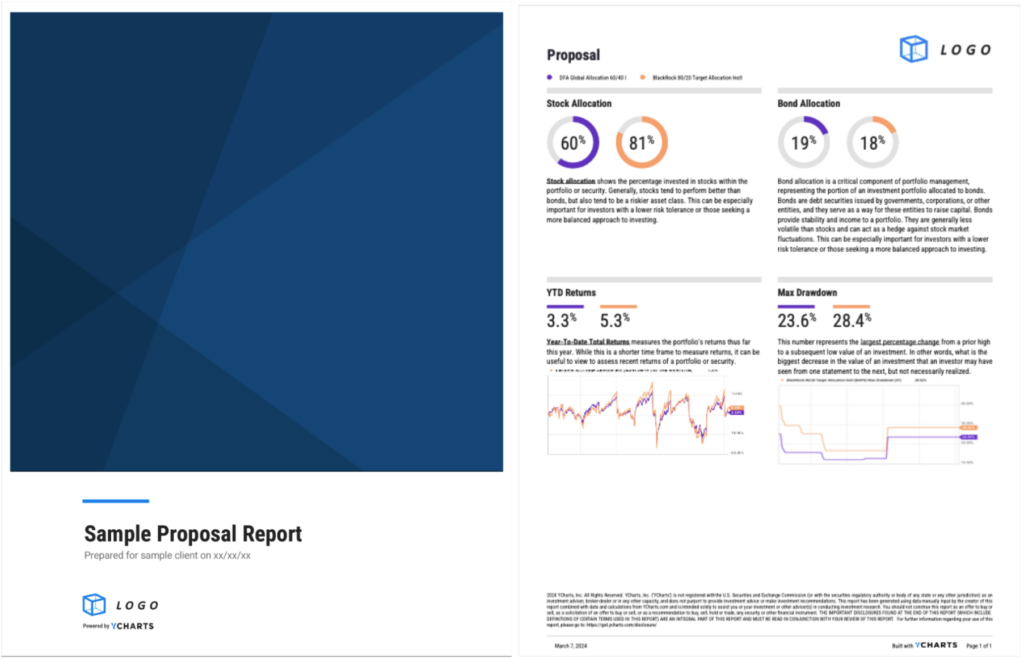

- Automated Proposal and Report Generation: YCharts can generate detailed reports and proposals automatically. This feature saves significant time and ensures consistency and accuracy in documentation. There is also the option to create reports with a custom logo and colors, bringing uniform branding to more touchpoints along the client journey.

Streamlining Client Interactions with YCharts

Utilizing YCharts During Client Meetings

YCharts’ dashboard and dynamic charting capabilities are invaluable during client meetings. Advisors can present real-time data, enhancing transparency and trust. The interactive nature of the charts helps clients understand investment strategies better, leading to more informed decision-making and limiting friction in the sales process.

Automated Updates and Alerts

YCharts provides automated updates and alerts, keeping both the advisor and the client informed about portfolio changes and new opportunities. This proactive approach ensures that clients feel engaged and valued.

Report Generation Software

The report generation software in YCharts is particularly useful for creating detailed proposals. Advisors can easily compare a client’s existing portfolio with their recommended strategies, highlighting potential benefits and reinforcing their advice with data-driven findings.

Take a free test drive of YCharts Proposals

Case Studies: YCharts as an Integrative Advisory Tool

Financial advisors and firms across the country have used YCharts as an all-in-one tool to simplify their tech stacks and tackle multitasking with ease. Examples include:

- Ryan Miller, RICP, financial advisor at Cetera Investors: Cetera’s advisors strive to educate their clients in an easy-to-understand manner and empower them to be involved in pursuing their financial aspirations. Two of Cetera’s other research tools that Ryan was using at the time met most of his needs, but there were some growing pains. With Ryan heavily leveraging Separate Accounts (SMAs) in his client portfolios, the reporting frequencies available oftentimes came up short.

With YCharts, Ryan was able to create a custom report template that highlighted performance and risk metrics he discusses most often, including annualized return, drawdown, standard deviation, and beta. From there, it took just a couple of clicks to generate a report before each client or prospect meeting. “What used to take me 2-3 minutes to prepare previously is now down to around 15 seconds,” says Ryan. “That might look like just an incremental amount of time back in my day-to-day, but it adds up” - Michael Minnoch, owner of Vantage Point Management: YCharts’ comprehensive datasets and tools to gather the information for his needs were a game-changer. Mike now had full control over his model strategies and an efficient means for educating other advisors on their merits, which was crucial in his decision to switch to YCharts. Mike has built on his success by further streamlining his portfolio construction and reporting processes. “It takes me just ten minutes after receiving an advisor’s holdings to put them in Model Portfolios, review, and send over a complete report output,” says Mike. “After that, all they have to do is go and win the business. It doesn’t get much better than that.”

Tips for Maximizing the Use of Integrative Tools

Practical Tips for Financial Advisors

- Start with the Dashboard: Familiarize yourself with YCharts’ dashboard and customize it according to your needs. This will help you monitor portfolios, securities, market trends, and key metrics efficiently.

- Leverage Alerts: Set up alerts for critical portfolio changes. This proactive approach will keep you ahead of the curve and ready to address client concerns promptly.

- Use Interactive Charts: During client meetings, use YCharts’ Fundamental Charts and Scenarios to explain investment strategies clearly. A visual aid can significantly enhance client understanding and trust.

- Automate Reports: Utilize automated report generation features such as the drag-and-drop Report Builder tool and saved report templates to create professional and accurate collateral. This will save time and ensure brand consistency.

Combining YCharts with Other Tools

While YCharts is a comprehensive tool, integrating it with other software solutions such as one of YCharts’ many integration partners can create a robust yet simplified tech stack. YCharts seamlessly integrates with Orion, Redtail, iRebal, Addepar and more. This dynamic combination will cover additional aspects of your advisory practice, including the importation of client portfolio holdings and cost basis data.

Conclusion

Integrative tools like YCharts play a crucial role in simplifying multitasking in financial advisory. By consolidating various functions into a single platform, these tools enhance efficiency, improve service delivery, and boost operational productivity. Advisors who leverage such tools can expect not only time savings but also enhanced client engagement and satisfaction.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for one tool that accomplishes many workflows?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. See YCharts’ multitasking capabilities in action:

Schedule a personalized information session.

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Ensure Compliance Across Your Firm with YCharts’ Customizable SolutionsRead More →